a.

Determine the typical seasonal patterns for the production data using the ratio-to-moving-average method.

a.

Answer to Problem 26CE

The typical seasonal patterns for sales are 0.7549, 0.9913, 1.4043 and 0.8495, respectively.

Explanation of Solution

Calculation:

Four-Year moving average:

Centered Moving Average:

Specific seasonal index:

| Year | Quarter | Board ft Millions |

Four-quarter moving average |

Centered Moving average | Specific seasonal |

| 2012 | Winter | 7.8 | |||

| Spring | 10.2 | ||||

| Summer | 14.7 | 10.3875 | 1.41516 | ||

| Fall | 9.3 | 10.5 | 10.45 | 0.88995 | |

| 2013 | Winter | 6.9 | 10.275 | 10.975 | 0.6287 |

| Spring | 11.6 | 10.625 | 11.325 | 1.02428 | |

| Summer | 17.5 | 11.325 | 11.575 | 1.51188 | |

| Fall | 9.3 | 11.325 | 11.5875 | 0.80259 | |

| 2014 | Winter | 8.9 | 11.825 | 11.075 | 0.80361 |

| Spring | 9.7 | 11.35 | 10.9 | 0.88991 | |

| Summer | 15.3 | 10.8 | 11.225 | 1.36303 | |

| Fall | 10.1 | 11 | 11.7875 | 0.85684 | |

| 2015 | Winter | 10.7 | 11.45 | 12.3125 | 0.86904 |

| Spring | 12.4 | 12.125 | 12.575 | 0.98608 | |

| Summer | 16.8 | 12.5 | 12.4625 | 1.34804 | |

| Fall | 10.7 | 12.65 | 12.425 | 0.86117 | |

| 2016 | Winter | 9.2 | 12.275 | 12.6125 | 0.72944 |

| Spring | 13.6 | 12.575 | 12.6 | 1.07937 | |

| Summer | 17.1 | 12.65 | |||

| Fall | 10.3 | 12.55 |

The Quarterly indexes are,

| Winter | Spring | Summer | Fall | |

| 2012 | 1.415162 | 0.889952 | ||

| 2013 | 0.628702 | 1.024283 | 1.511879 | 0.802589 |

| 2014 | 0.803612 | 0.889908 | 1.363029 | 0.85684 |

| 2015 | 0.869036 | 0.986083 | 1.348044 | 0.861167 |

| 2016 | 0.729435 | 1.079365 | ||

| Mean | 0.757696 | 0.99491 | 1.409529 | 0.852637 |

Typical Seasonal index:

Here,

Therefore,

The typical seasonal indexes are,

| Winter | Spring | Summer | Fall | |

| 2012 | 1.415162 | 0.889952 | ||

| 2013 | 0.628702 | 1.024283 | 1.511879 | 0.802589 |

| 2014 | 0.803612 | 0.889908 | 1.363029 | 0.85684 |

| 2015 | 0.869036 | 0.986083 | 1.348044 | 0.861167 |

| 2016 | 0.729435 | 1.079365 | ||

| Mean | 0.757696 | 0.99491 | 1.409529 | 0.852637 |

| Typical Index | 0.7549 | 0.9913 | 1.4043 | 0.8495 |

b.

Interpret the typical seasonal pattern.

b.

Explanation of Solution

The typical seasonal index for the Summer quarter is 1.4043, which is largest compared with other three quarters. That is, the production is largest in the third quarter and moreover, it represent above the average quarters because seasonal index is greater than 1. The Winter, Spring and Fall quarters represent below the average quarters because seasonal indexes for the three quarters are less than 1.

c.

Determine the trend equation.

c.

Answer to Problem 26CE

The trend equation is

Explanation of Solution

Calculation:

Deseasonalization:

| Board ft Millions | Typical Seasonal Index | Deseasonalized production |

| 7.8 | 0.7549 | 10.33249437 |

| 10.2 | 0.9913 | 10.28951881 |

| 14.7 | 1.4043 | 10.46784875 |

| 9.3 | 0.8495 | 10.94761624 |

| 6.9 | 0.7549 | 9.140283481 |

| 11.6 | 0.9913 | 11.70180571 |

| 17.5 | 1.4043 | 12.4617247 |

| 9.3 | 0.8495 | 10.94761624 |

| 8.9 | 0.7549 | 11.78964101 |

| 9.7 | 0.9913 | 9.785130637 |

| 15.3 | 1.4043 | 10.89510788 |

| 10.1 | 0.8495 | 11.88934667 |

| 10.7 | 0.7549 | 14.17406279 |

| 12.4 | 0.9913 | 12.50882679 |

| 16.8 | 1.4043 | 11.96325571 |

| 10.7 | 0.8495 | 12.5956445 |

| 9.2 | 0.7549 | 12.18704464 |

| 13.6 | 0.9913 | 13.71935842 |

| 17.1 | 1.4043 | 12.17688528 |

| 10.3 | 0.8495 | 12.12477928 |

Assign t value as 1 for first quarter of 2012, 2 for the second quarter of 2012 and so on.

Step-by-step procedure to obtain the regression using the Excel:

- Enter the data for Deseasonalized production and t in Excel sheet.

- Go to Data Menu.

- Click on Data Analysis.

- Select ‘Regression’ and click on ‘OK’

- Select the column of Deseasonalized production under ‘Input Y

Range ’. - Select the column of t under ‘Input X Range’.

- Click on ‘OK’.

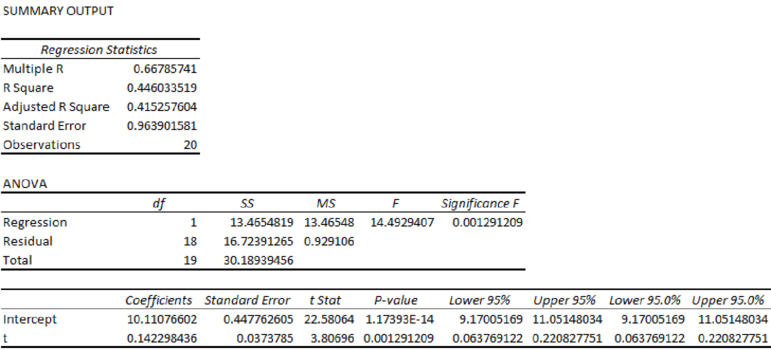

Output for the Regression obtained using the Excel is as follows:

From the Excel output, the regression equation is

d.

Find the seasonally adjusted production for four quarters of 2017.

d.

Answer to Problem 26CE

The seasonally adjusted production for four quarters of 2017 are 9.8884, 13.1261, 18.7946 and 11.4903, respectively.

Explanation of Solution

Calculation:

From the output, the regression equation is

The t value for first quarter of 2017 is 21.

The t value for second quarter of 2017 is 22.

The t value for third quarter of 2017 is 23.

The t value for fourth quarter of 2017 is 24.

Seasonally Adjusted Forecast:

| Estimated Visitors | Seasonal Index | |

| 13.0990 | 0.7549 | 9.8884 |

| 13.2413 | 0.9913 | 13.1261 |

| 13.3836 | 1.4043 | 18.7946 |

| 13.5259 | 0.8495 | 11.4903 |

Want to see more full solutions like this?

Chapter 18 Solutions

STATISTICAL TECHNIQUES FOR BUSINESS AND

- Question 1. Your manager asks you to explain why the Black-Scholes model may be inappro- priate for pricing options in practice. Give one reason that would substantiate this claim? Question 2. We consider stock #1 and stock #2 in the model of Problem 2. Your manager asks you to pick only one of them to invest in based on the model provided. Which one do you choose and why ? Question 3. Let (St) to be an asset modeled by the Black-Scholes SDE. Let Ft be the price at time t of a European put with maturity T and strike price K. Then, the discounted option price process (ert Ft) t20 is a martingale. True or False? (Explain your answer.) Question 4. You are considering pricing an American put option using a Black-Scholes model for the underlying stock. An explicit formula for the price doesn't exist. In just a few words (no more than 2 sentences), explain how you would proceed to price it. Question 5. We model a short rate with a Ho-Lee model drt = ln(1+t) dt +2dWt. Then the interest rate…arrow_forwardIn this problem, we consider a Brownian motion (W+) t≥0. We consider a stock model (St)t>0 given (under the measure P) by d.St 0.03 St dt + 0.2 St dwt, with So 2. We assume that the interest rate is r = 0.06. The purpose of this problem is to price an option on this stock (which we name cubic put). This option is European-type, with maturity 3 months (i.e. T = 0.25 years), and payoff given by F = (8-5)+ (a) Write the Stochastic Differential Equation satisfied by (St) under the risk-neutral measure Q. (You don't need to prove it, simply give the answer.) (b) Give the price of a regular European put on (St) with maturity 3 months and strike K = 2. (c) Let X = S. Find the Stochastic Differential Equation satisfied by the process (Xt) under the measure Q. (d) Find an explicit expression for X₁ = S3 under measure Q. (e) Using the results above, find the price of the cubic put option mentioned above. (f) Is the price in (e) the same as in question (b)? (Explain why.)arrow_forwardThe managing director of a consulting group has the accompanying monthly data on total overhead costs and professional labor hours to bill to clients. Complete parts a through c. Question content area bottom Part 1 a. Develop a simple linear regression model between billable hours and overhead costs. Overhead Costsequals=212495.2212495.2plus+left parenthesis 42.4857 right parenthesis42.485742.4857times×Billable Hours (Round the constant to one decimal place as needed. Round the coefficient to four decimal places as needed. Do not include the $ symbol in your answers.) Part 2 b. Interpret the coefficients of your regression model. Specifically, what does the fixed component of the model mean to the consulting firm? Interpret the fixed term, b 0b0, if appropriate. Choose the correct answer below. A. The value of b 0b0 is the predicted billable hours for an overhead cost of 0 dollars. B. It is not appropriate to interpret b 0b0, because its value…arrow_forward

- Using the accompanying Home Market Value data and associated regression line, Market ValueMarket Valueequals=$28,416+$37.066×Square Feet, compute the errors associated with each observation using the formula e Subscript ieiequals=Upper Y Subscript iYiminus−ModifyingAbove Upper Y with caret Subscript iYi and construct a frequency distribution and histogram. LOADING... Click the icon to view the Home Market Value data. Question content area bottom Part 1 Construct a frequency distribution of the errors, e Subscript iei. (Type whole numbers.) Error Frequency minus−15 comma 00015,000less than< e Subscript iei less than or equals≤minus−10 comma 00010,000 0 minus−10 comma 00010,000less than< e Subscript iei less than or equals≤minus−50005000 5 minus−50005000less than< e Subscript iei less than or equals≤0 21 0less than< e Subscript iei less than or equals≤50005000 9…arrow_forwardThe managing director of a consulting group has the accompanying monthly data on total overhead costs and professional labor hours to bill to clients. Complete parts a through c Overhead Costs Billable Hours345000 3000385000 4000410000 5000462000 6000530000 7000545000 8000arrow_forwardUsing the accompanying Home Market Value data and associated regression line, Market ValueMarket Valueequals=$28,416plus+$37.066×Square Feet, compute the errors associated with each observation using the formula e Subscript ieiequals=Upper Y Subscript iYiminus−ModifyingAbove Upper Y with caret Subscript iYi and construct a frequency distribution and histogram. Square Feet Market Value1813 911001916 1043001842 934001814 909001836 1020002030 1085001731 877001852 960001793 893001665 884001852 1009001619 967001690 876002370 1139002373 1131001666 875002122 1161001619 946001729 863001667 871001522 833001484 798001589 814001600 871001484 825001483 787001522 877001703 942001485 820001468 881001519 882001518 885001483 765001522 844001668 909001587 810001782 912001483 812001519 1007001522 872001684 966001581 86200arrow_forward

- For a binary asymmetric channel with Py|X(0|1) = 0.1 and Py|X(1|0) = 0.2; PX(0) = 0.4 isthe probability of a bit of “0” being transmitted. X is the transmitted digit, and Y is the received digit.a. Find the values of Py(0) and Py(1).b. What is the probability that only 0s will be received for a sequence of 10 digits transmitted?c. What is the probability that 8 1s and 2 0s will be received for the same sequence of 10 digits?d. What is the probability that at least 5 0s will be received for the same sequence of 10 digits?arrow_forwardV2 360 Step down + I₁ = I2 10KVA 120V 10KVA 1₂ = 360-120 or 2nd Ratio's V₂ m 120 Ratio= 360 √2 H I2 I, + I2 120arrow_forwardQ2. [20 points] An amplitude X of a Gaussian signal x(t) has a mean value of 2 and an RMS value of √(10), i.e. square root of 10. Determine the PDF of x(t).arrow_forward

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL Trigonometry (MindTap Course List)TrigonometryISBN:9781305652224Author:Charles P. McKeague, Mark D. TurnerPublisher:Cengage Learning

Trigonometry (MindTap Course List)TrigonometryISBN:9781305652224Author:Charles P. McKeague, Mark D. TurnerPublisher:Cengage Learning College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning

College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning