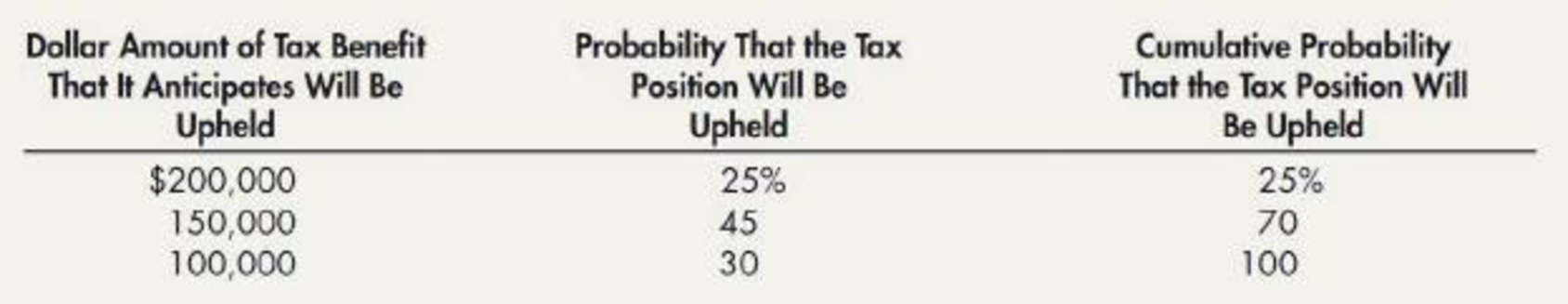

Uncertain Tax Position At the end of the current year, Boyd Company claims a $200,000 tax credit on its income tax return. Boyd is uncertain whether the IRS will accept this credit. It studies the IRS regulations and determines that it is more likely than not that the IRS will accept all or some of this tax credit. Based on this research, Boyd estimates the following probability distribution of possible outcomes:

Required:

For the current year, determine (1) the amount that Boyd will recognize as a current tax benefit and (2) the amount that it will record as the unrecognized tax benefit.

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

EBK INTERMEDIATE ACCOUNTING: REPORTING

Additional Business Textbook Solutions

Business Essentials (12th Edition) (What's New in Intro to Business)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Marketing: An Introduction (13th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT