(a):

(a):

Explanation of Solution

The opportunity cost of producing a commodity can be calculated by dividing the total quantity of Pearls lost with the Diamonds gained for the country. Country A produces either 150 tons of Diamonds or 75 ton of Pearls. Thus, the opportunity cost can be calculated as follows:

Therefore, the opportunity cost of producing a ton of Diamond is

Thus, the opportunity cost of producing a ton of Diamond for Country B is equal to 2 tons of Pearls.

Opportunity cost: Opportunity cost is the cost of the next best alternatives that is foregone while making the choices. When the resources are used for the production of Commodity A, Commodity B that could be made with that same quantity of resource will be the opportunity cost.

(b):

Opportunity cost of producing Pearls.

(b):

Explanation of Solution

The opportunity cost of producing Pearl can be calculated by dividing the total quantity of Diamonds lost with the Pearls gained for the country. Country A produces either 150 tons of Diamonds or 75 ton of Pearl. Thus, the opportunity cost can be calculated as follows:

Therefore, the opportunity cost of producing a ton of Pearl is 2 tons of Pearls in Country A. Similarly, Country B can produce either 90 tons of Diamonds or 180 tons of Pearls. Thus, the opportunity cost of producing Pearl for B can be calculated as follows:

Thus, the opportunity cost of producing a ton of Pearl for Country B is equal to

(c):

Commodity in which A has a

(c):

Explanation of Solution

The

In the case of Country A, the opportunity cost of producing a ton of Diamond is

(d):

Commodity in which Country B has a comparative advantage.

(d):

Explanation of Solution

In the case of Country A, the opportunity cost of producing a ton of Diamond is

From this, it can be identified that Country B could produce Pearls at a lower opportunity cost than Country A. This indicates that Country B has comparative advantage in the production of Pearls.

(e):

Benefit of specialization.

(e):

Explanation of Solution

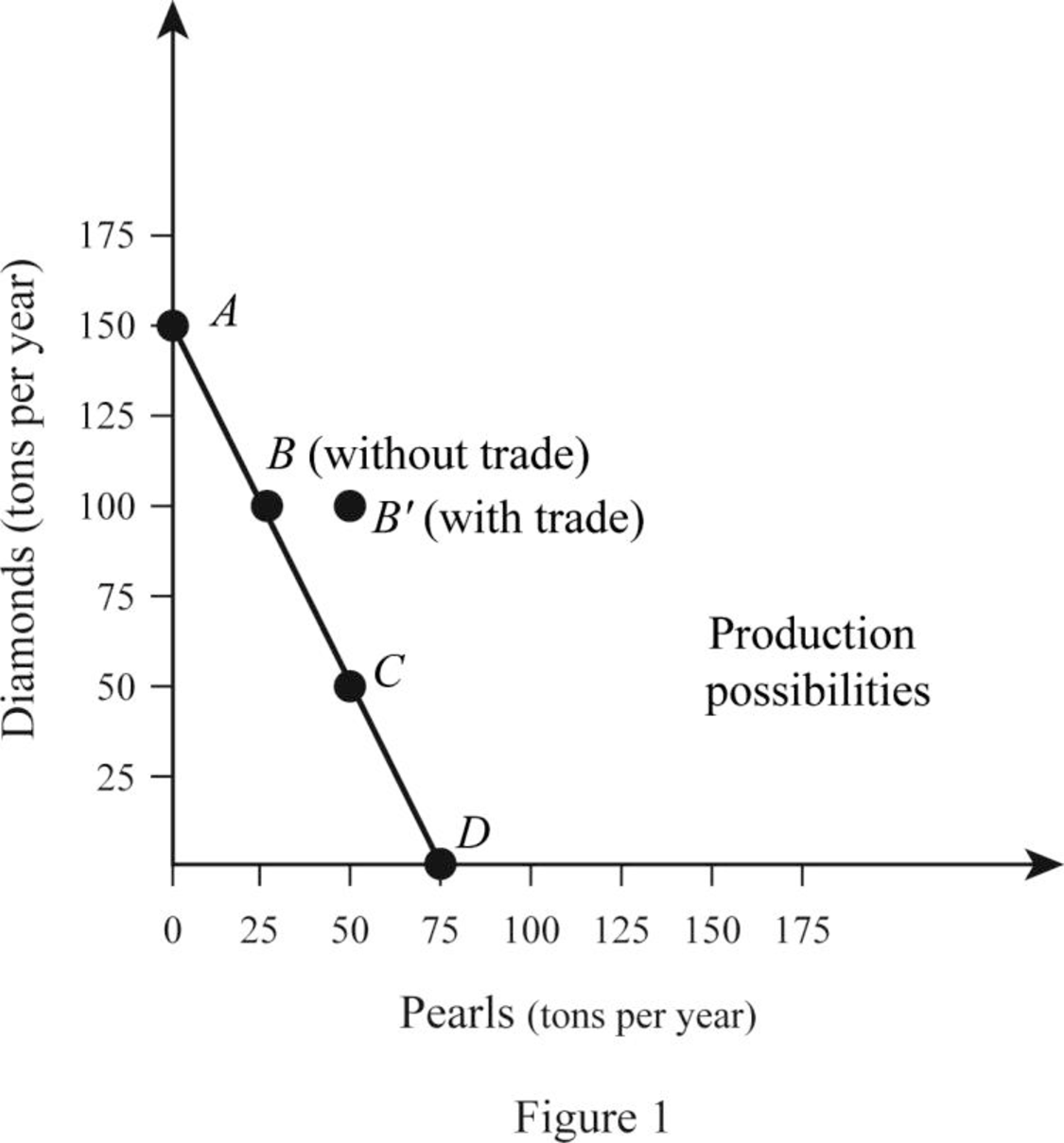

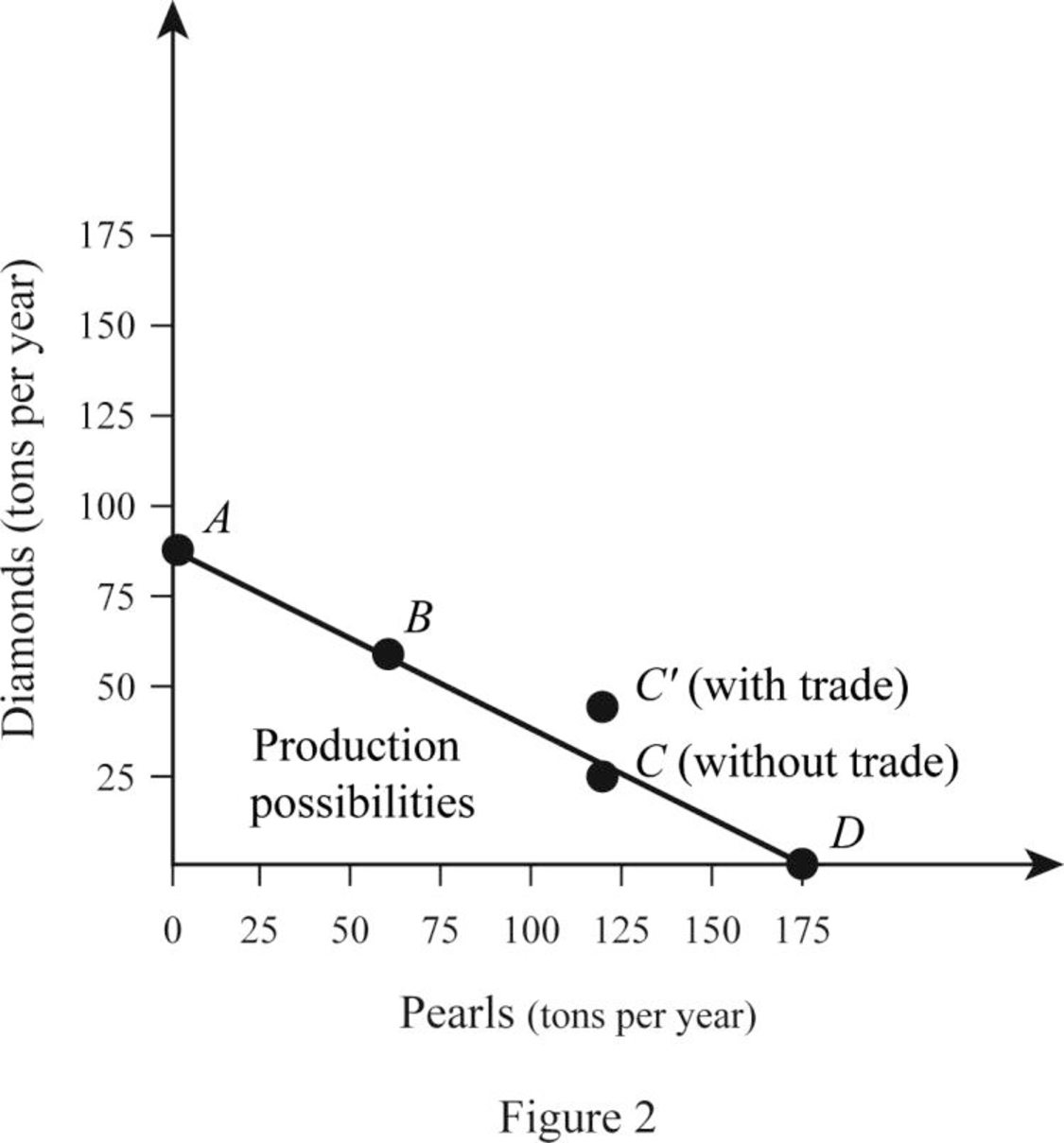

Country A is in its PPC Curve B where it produces 100 tons of Diamonds and 25 tons of Pearls. Country B is on its PPC curve C where it produces 30 tons of Diamonds and 120 tons of Pearls. Thus, the total output is 130 tons of Diamonds and 145 tons of Pearls. When the country specializes, Country A produces only Diamonds, which is 150 tons and B produces only Pearls, which is 180 tons. Thus, the total output increases due to specialization by 20 tons of Diamonds and 35 tons of Pearls. This can be illustrated in a table as follows:

| Diamonds (in tons per year) | Pearls (In tons per year) | |

| Before Specialization | ||

| A (PPC point at B) | 100 | 25 |

| B (PP C point at C) | 30 | 120 |

| Total Output | 130 | 145 |

| After Specialization | ||

| A (PPC point at A) | 150 | 0 |

| B (PP C point at D) | 0 | 180 |

| Total Output | 150 | 180 |

Thus, the total output of Diamonds and Pearls increases as the economy specializes in the production of commodities in which they have comparative advantages.

(f):

Graphical representation of specialization and trade benefit for the countries.

(f):

Explanation of Solution

When there is no specialization and trade between A and B, Country A operates at PPC point B where it produces and consumes 100 tons of Diamonds and 25 tons of Pearls. The case with Country B is different and it operates at Point C of the PPC where it produces and consumes 30 tons of Diamonds and 120 tons of Pearls. When the country specializes, Country A produces 150 tons of Diamonds and Country B produces 180 tons of pearls.

When the trade takes place, Country A trades 50 tons of Diamonds in exchange for 50 tons of Pearls with Country B. This means that Country A is able to consume 100 tons of Diamonds and 50 tons of Pearl whereas Country B is able to consume 50 tons of Diamonds and 130 tons of Pearls. Thus, both countries are able to achieve a consumption point beyond their PPC which can be illustrated as follows:

Want to see more full solutions like this?

Chapter 18 Solutions

MACROECONOMICS FOR TODAY-W/LMS MINDTAP

- not use aiarrow_forwardConsider the following statements: a. Fewer people are employed in Freedonia now than at any time in the past 75 years. b. The unemployment rate in Freedonia is lower now than it has been in 75 years.Can both of these statements be true at the same time? A. Yes, these statements can be correct if more people are classified as "discouraged workers."B. No, these statements cannot be true since unemployment must increase as employment decreases.C. Yes, if the number of unemployed decreases more than the number of employed.D. Yes, both of these statements can be correct if labor productivity increases.arrow_forwardAsap please and quality answerarrow_forward

- 1) Use the supply and demand schedules to graph the supply and demand functions. Find and show on the graph the equilibrium price and quantity, label it (A). P Q demanded P Q supplied 0 75 0 0 5 65 5 0 10 55 10 0 15 45 15 10 20 35 20 20 25 25 25 30 30 15 30 40 35 40 5 0 35 40 50 60 2) Find graphically and numerically the consumers and producers' surplus 3) The government introduced a tax of 10$, Label the price buyers pay and suppliers receive. Label the new equilibrium for buyers (B) and Sellers (S). How the surpluses have changed? Give the numerical answer and show on the graph. 4) Calculate using midpoint method the elasticity of demand curve from point (A) to (B) and elasticity of the supply curve from point (A) to (C).arrow_forwardFour heirs (A, B, C, and D) must divide fairly an estate consisting of three items — a house, a cabin and a boat — using the method of sealed bids. The players' bids (in dollars) are: In the initial allocation, player D Group of answer choices gets no items and gets $62,500 from the estate. gets the house and pays the estate $122,500. gets the cabin and gets $7,500 from the estate. gets the boat and and gets $55,500 from the estate. none of thesearrow_forwardJack and Jill are getting a divorce. Except for the house, they own very little of value so they agree to divide the house fairly using the method of sealed bids. Jack bids 140,000 and Jill bids 160,000. After all is said and done, the final outcome is Group of answer choices Jill gets the house and pays Jack $80,000. Jill gets the house and pays Jack $75,000. Jill gets the house and pays Jack $70,000. Jill gets the house and pays Jack $65,000. none of thesearrow_forward

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning