Introduction:

Managerial accounting refers to the system that helps the managers with relevant information to develop strategies and make policies and plans that are useful in decision making for the effective operation of the business. On the other hand financial accounting refers to the system that focuses mainly on presenting the true and fair financial statement and reports to the stakeholders of the company.

Managerial accounting is concerned only with internal management and does not comply with any specific standards while there are various accounting standards established to be adhered by finance managers in preparing financial statements and reports.

To state:

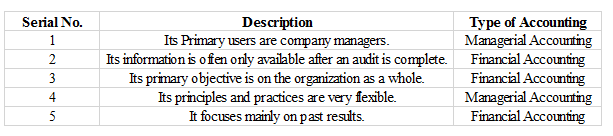

The type of accounting whether it relates to managerial accounting or financial accounting based on their description.

Answer to Problem 1QS

Solution:

Explanation of Solution

1. Managerial accounting contains economic information related to the company that are useful in decision making process for the managers and internal users within the company.

2. Financial accounting deals with financial statements and reports and are used by external users of the company for which accuracy is to be important. Hence the audit team will deeply analyse and verify the accuracy of the information presented after which it is available to the users.

3. Financial accounting is most concerned with the needs of the business as a whole where it represents statements and reports,

4. Managerial accounting has no specific standard or rules for the preparation of reports and statements and it is not a mandatory requirement by any law. Thus managerial accounting principles and practices are very simple.

5. Financial accounting has its focus on past results and the financial statements which are already distributed to the external users. It is the comparison of current reports with the past reports to analyse the improvements made by the business.

Each description is analysed based on the characteristic features of accounting to identify the type of accounting.

Want to see more full solutions like this?

Chapter 18 Solutions

FUND.ACCT.PRIN.(LOOSELEAF)-W/CONNECT

- I am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education