Concept explainers

Various stock transactions; correction of

• LO18–4

IFRS

Part A

During its first year of operations, the McCollum Corporation entered into the following transactions relating to shareholders’ equity. The corporation was authorized to issue 100 million common shares, $1 par per share.

Required:

Prepare the appropriate journal entries to record each transaction.

| Jan. 9 | Issued 40 million common shares for $20 per share. |

| Mar. 11 | Issued 5,000 shares in exchange for custom-made equipment. McCollum’s shares have traded recently on the stock exchange at $20 per share. |

Part B

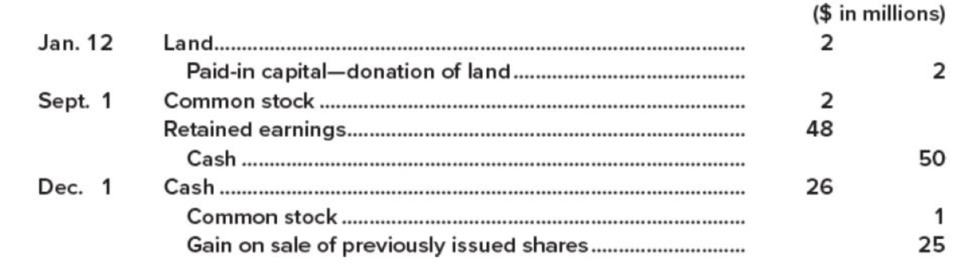

A new staff accountant for the McCollum Corporation recorded the following journal entries during the second year of operations. McCollum retires shares that it reacquires (restores their status to that of authorized but unissued shares).

Required:

Prepare the journal entries that should have been recorded for each of the transactions.

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

INTERMEDIATE ACCOUNTING <CUSTOM LL>

Additional Business Textbook Solutions

Accounting Information Systems (14th Edition)

Essentials of MIS (13th Edition)

Management (14th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

- Financial Accounting please provide solutionarrow_forward! Required information Problem 6-10 (Algo) Long-term contract; revenue recognition over time [LO6-8, 6-9] [The following information applies to the questions displayed below.] In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: 2024 2025 $ 2026 $ Cost incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year 2,016,000 2,808,000 2,613,600 5,184,000 2,376,000 0 2,180,000 2,644,000 5,176,000 1,890,000 2,500,000 5,610,000 Westgate recognizes revenue over time according to percentage of completion. Problem 6-10 (Algo) Part 5 5. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years, assuming the following costs incurred and costs to complete information. Note: Do not round intermediate calculations and round your final…arrow_forwardAnswer this Accounting questionarrow_forward

- choose best answerarrow_forwardHow much are total assets at the end of the year on these financial accounting question?arrow_forwardCrane Company sponsors a defined benefit pension plan. The corporation's actuary provides the following information about t January 1, 2025 December 31, 2025 Vested benefit obligation $1,560 $2,010 Accumulated benefit obligation 2,010 2,820 Projected benefit obligation 2,260 3,630 Plan assets (fair value) 1,540 2,560 Settlement rate and expect rate of return 10% Pension asset/liability 720 ? Service cost for the year 2025 $400 Contributions (funding in 2025) 730 Benefits paid in 2025 200 (a)Compute the actual return on the plan assets in…arrow_forward

- A firm had fixed assets of $16,000 at the beginning of the year and $19,000 at the end of the year. You also know that the firm sold $7,000 in fixed assets over the year. How much in fixed assets must they have purchased?arrow_forwardWhat is the total amount of manufacturing overhead costs for the month?arrow_forwardStatus of manufacturing overhead ar year endarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning