Concept explainers

Matching Items Involving the Statement of

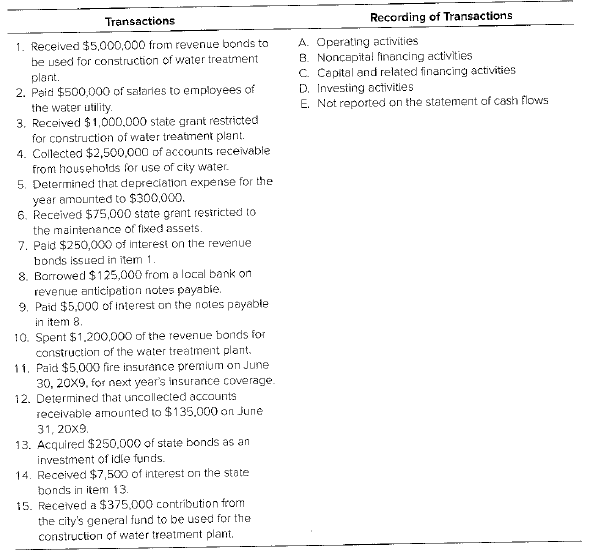

The numbered items on the left consist of a variety of transactions that occurred in Jeffersen City’s water utility enterprise fund for the year ended June 30, 20X9. Item A, B, C, and D on the right represent the four categories of cash flows that are reported on the statement of cash flows for proprietary funds. Item E is for transactions that are not reported on the statement of cash flows. Assume that the direct method is used for disclosing cash flows from operating activities. Select the appropriate letter to indicate where cadi transaction should be disclosed on the statement of cash flows or whether that item would not be reported on the statement of cash flows.

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

ADV.FIN.ACCT.LL W/CONNECT+PROCTORIO PLUS

Additional Business Textbook Solutions

Business Essentials (12th Edition) (What's New in Intro to Business)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Marketing: An Introduction (13th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

MARKETING:REAL PEOPLE,REAL CHOICES

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

- I am looking for help with this general accounting question using proper accounting standards.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forwardPlease show me the correct approach to solving this financial accounting question with proper techniques.arrow_forward

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardPlease explain the solution to this financial accounting problem using the correct financial principles.arrow_forward

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease provide the correct answer to this financial accounting problem using valid calculations.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forward

- Can you solve this financial accounting problem using appropriate financial principles?arrow_forwardI am looking for the correct answer to this financial accounting problem using valid accounting standards.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning