FUNDAMENTALS OF COST ACCOUNTING W/CONNE

6th Edition

ISBN: 9781264199617

Author: LANEN/ANDERSON

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 17, Problem 45P

Analyze Performance for a Restaurant

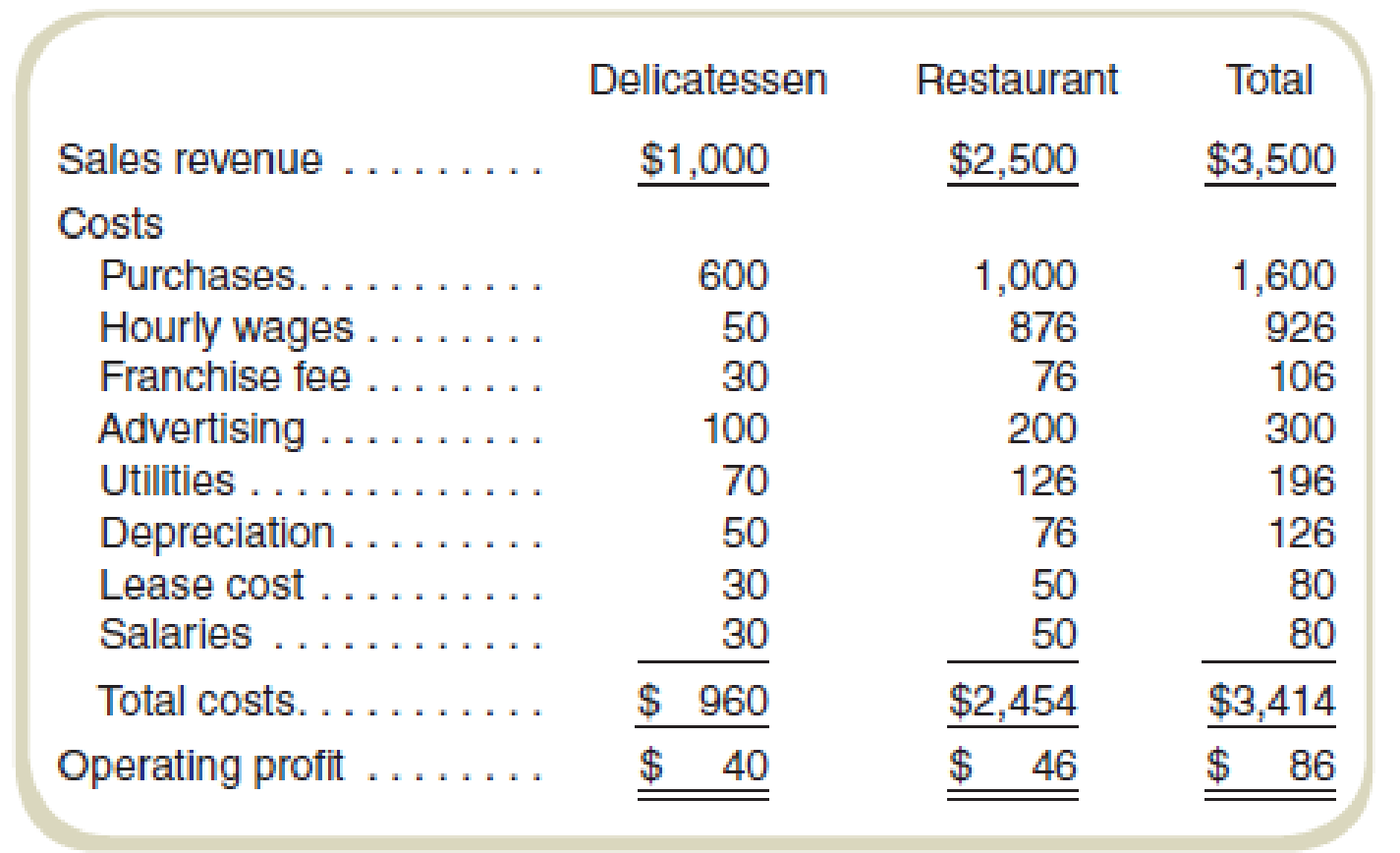

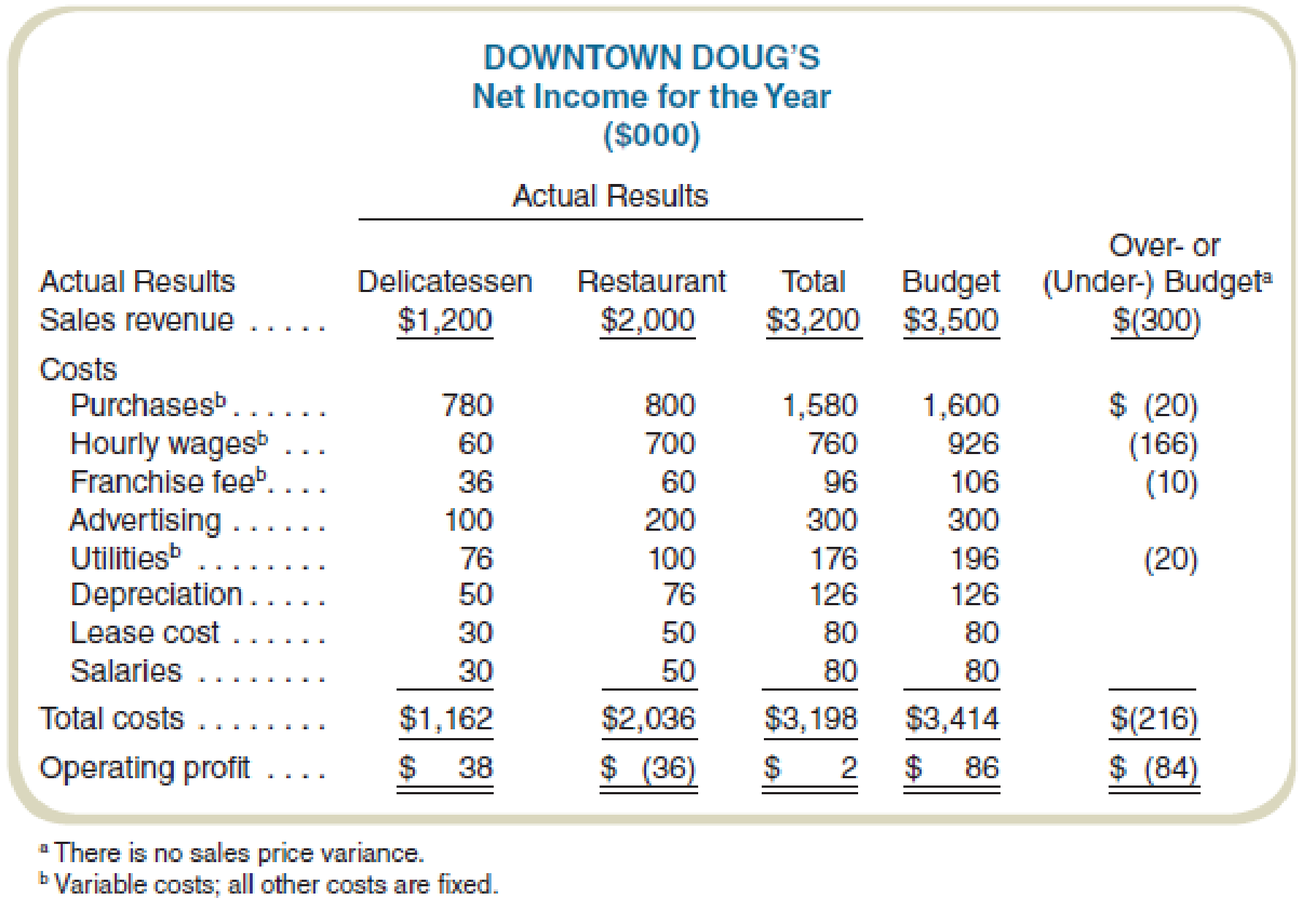

Doug’s Diner is planning to expand operations and is concerned that its reporting system might need improvement. The master

The company uses the following performance report for management evaluation:

Required

Prepare a profit

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Compute the annual rate of return on these financial accounting question

What is the result of this exchange on these financial accounting question?

Please provide correct answer this financial accounting question

Chapter 17 Solutions

FUNDAMENTALS OF COST ACCOUNTING W/CONNE

Ch. 17 - What complication arises in variance analysis when...Ch. 17 - Variance analysis can be useful in a manufacturing...Ch. 17 - How would you recommend accounting for variances...Ch. 17 - What does a manager learn by computing an industry...Ch. 17 - Why is there no efficiency variance for revenues?Ch. 17 - For what decisions would a manager want to know...Ch. 17 - If the sales activity or materials efficiency...Ch. 17 - Prob. 8RQCh. 17 - Prob. 9RQCh. 17 - What is the advantage of recognizing materials...

Ch. 17 - How could a professional sports firm use the mix...Ch. 17 - Prob. 12CADQCh. 17 - How could a hospital firm use the mix variance to...Ch. 17 - Prob. 14CADQCh. 17 - There is no reason to investigate favorable...Ch. 17 - Prob. 16CADQCh. 17 - Consider a firm in the sharing economy, such as...Ch. 17 - Prob. 18ECh. 17 - Prob. 19ECh. 17 - Prob. 20ECh. 17 - Variable Cost Variances: Materials Purchased and...Ch. 17 - Prob. 22ECh. 17 - Industry Volume and Market Share Variances DB Ice...Ch. 17 - Olive Tree Products sold 72,000 units during the...Ch. 17 - Prob. 25ECh. 17 - Sales Mix and Quantity Variances A-Zone Media...Ch. 17 - Prob. 27ECh. 17 - Sales Mix and Quantity Variances The restaurant at...Ch. 17 - Sales Mix and Quantity Variances Chow-4-Hounds...Ch. 17 - Materials Mix and Yield Variances Stacy, Inc.,...Ch. 17 - Materials Mix and Yield Variances Johns...Ch. 17 - Labor Mix and Yield Variances Matts Eat N Run has...Ch. 17 - Flexible Budgeting, Service Organization KB is a...Ch. 17 - Prob. 34ECh. 17 - Prob. 35ECh. 17 - Sales Price and Activity Variances EZ-Tax is a tax...Ch. 17 - Write a memo to the senior manager of EZ-Tax...Ch. 17 - Variable Cost Variances The standard direct labor...Ch. 17 - Refer to the information in Exercise...Ch. 17 - Prob. 40PCh. 17 - Variable Cost Variances: Materials Purchased and...Ch. 17 - Industry Volume and Market Share Variances:...Ch. 17 - Industry Volume and Market Share: Missing Data The...Ch. 17 - Sales Mix and Quantity Variances Lake Cellars...Ch. 17 - Analyze Performance for a Restaurant Dougs Diner...Ch. 17 - Nonmanufacturing Cost Variances FSBCU is a...Ch. 17 - Performance Evaluation in Service Industries Bay...Ch. 17 - Refer to the information in Problem...Ch. 17 - Prob. 49PCh. 17 - Refer to the data for the Peninsula Candy Company...Ch. 17 - Materials Mix and Yield Variances Plano Products...Ch. 17 - Pinnuck Products makes a liquid solvent using two...Ch. 17 - Labor Mix and Yield Variances Matthews Bros, is a...Ch. 17 - Refer to the information in Problem...Ch. 17 - Derive Amounts for Profit Variance Analysis...Ch. 17 - Flexible Budget Oak Hill Township operates a motor...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial Accounting Question please provide solutionarrow_forwardFGH Floral Company has a delivery truck that is being sold after 5 years of use. The current book value of the delivery truck is $6,000. If FGH Floral Company sells the delivery truck for $9,000, what is the impact of this transaction? Answerarrow_forwardFinancial Accounting Question please solvearrow_forward

- Y Company purchased an asset for $73,000 on January 1, Year 1. The asset was expected to have a four-year life and an $8,000 salvage value. What would be the amount of depreciation expense for Year 1 using double-declining balance? Answerarrow_forwardAnsarrow_forwardPlease give me true answer this financial accounting questionarrow_forward

- Can you please answer this financial accounting question?arrow_forwardY Company purchased an asset for $73,000 on January 1, Year 1. The asset was expected to have a four-year life and an $8,000 salvage value. What would be the amount of depreciation expense for Year 1 using double-declining balance? Ansarrow_forwardFinancial Accountingarrow_forward

- Snowbird Company is constructing a building that qualifies for interest capitalization. It is built between January 1 and December 31, Year 1. Snowbird made the following expenditures related to this building: April 1 $396,000July 1 400,000September 1 510,000December 1 120,000The company borrowed $500,000 at 12% to help finance the project. In addition, Snowbird had outstanding borrowings of $2 million at 8% and $1 million at 9%. Required: Compute the amount of interest capitalized related to the construction of the building. Next Level What effect does the interest capitalization have on the company’s financial statements after it completes the building?arrow_forwardFGH Floral Company has a delivery truck that is being sold after 5 years of use. The current book value of the delivery truck is $6,000. If FGH Floral Company sells the delivery truck for $9,000, what is the impact of this transaction? Provide Answerarrow_forwardOn August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for Common Stock, $22,000. Purchased supplies on account, $1,190. Earned sales commissions, receiving cash, $18,260. Paid rent on office and equipment for the month, $4,020. Paid creditor on account, $440. Paid dividends, $1,080. Paid automobile expenses (including rental charge) for month, $1,110, and miscellaneous expenses, $750. Paid office salaries, $2,340. Determined that the cost of supplies used was $660.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License