Concept explainers

Top Quality Fruit Company, based on Oahu, grows, processes, cans, and sells three main pineapple products: sliced, crushed, and juice. The outside skin is cut off in the Cutting Department and processed as animal feed. The feed is treated as a by-product. The company’s production process is as follows:

- Pineapples first are processed in the Cutting Department. The pineapples are washed and the outside skin is cut away. Then the pineapples are cored and trimmed for slicing. The three main products (sliced, crushed, juice) and the by-product (animal feed) are recognizable after processing in the Cutting Department. Each product then is transferred to a separate department for final processing.

- The trimmed pineapples are sent to the Slicing Department, where the pineapples are sliced and canned. Any juice generated during the slicing operation is packed in the cans with the slices.

- The pieces of pineapple trimmed from the fruit are diced and canned in the Crushing Department. Again, the juice generated during this operation is packed in the can with the crushed pineapple.

- The core and surplus pineapple generated from the Cutting Department are pulverized into a liquid in the Juicing Department. There is an evaporation loss equal to 8 percent of the weight of the good output produced in this department that occurs as the juices are heated.

- The outside skin is chopped into animal feed in the Feed Department.

Top Quality Fruit Company uses the net-realizable-value method to assign the costs of the joint process to its main products. The net realizable value of the by-product is subtracted from the joint cost before the allocation.

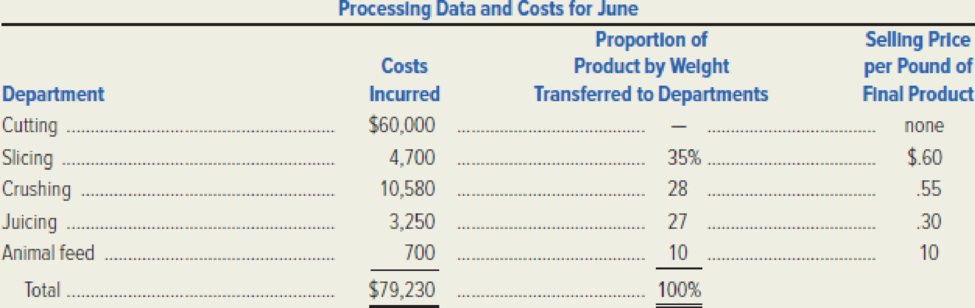

A total of 270,000 pounds were entered into the Cutting Department during June. The following schedule shows the costs incurred in each department, the proportion by weight transferred to the four final processing departments, and the selling price of each end product.

Required: Compute each of the following amounts.

- 1. The number of pounds of pineapple that result as output for pineapple slices, crushed pineapple, pineapple juice, and animal feed.

- 2. The net realizable value at the split-off point of the three main products.

- 3. The amount of the cost of the Cutting Department allocated to each of the three main products.

Want to see the full answer?

Check out a sample textbook solution

Chapter 17 Solutions

MANAGERIAL ACCOUNTING (PRINT UPGRADE)

- Kindly help me with accounting questionsarrow_forwardDetermine the cost per equipment unit of conversion for the month of Aprilarrow_forwardAcorn Construction (calendar-year-end C corporation) has had rapid expansion during the last half of the current year due to the housing market's recovery. The company has record income and would like to maximize its cost recovery deduction for the current year. (Use MACRS Table 1, Table 2, Table 3, Table 4, and Table 5.) Note: Round your answer to the nearest whole dollar amount. Acorn provided you with the following information: Asset Placed in Service Basis New equipment and tools August 20 $ 3,800,000 Used light-duty trucks October 17 2,000,000 Used machinery November 6 1,525,000 Total $ 7,325,000 The used assets had been contributed to the business by its owner in a tax-deferred transaction two years ago. a. What is Acorn's maximum cost recovery deduction in the current year?arrow_forward

- A manufacturing company allocates overhead at a fixed rate of $50 per hour based on direct labor hours. During the month, total overhead incurred was $375,000, and the total direct labor hours worked was 5,500. Job numbers 7-19 had 600 hours of direct labor. What is the amount of overhead allocated to job 7-19? a. $33,000 b. $28,500 c. $35,000 d. $30,000 helparrow_forwardSubject: financial accounting questionarrow_forwardPlease give me answer general accounting questionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning