Concept explainers

Biondi Industries is a manufacturer of chemicals for various purposes. One of the processes used by Biondi produces HTP–3, a chemical used in hot tubs and swimming pools; PST–4, a chemical used in pesticides; and RJ–5, a product that is sold to fertilizer manufacturers. Biondi uses the net-realizable-value method to allocate joint production costs. The ratio of output quantities to input quantities of direct material used in the joint process remains consistent from month to month. Biondi Industries uses FIFO (first-in, first-out) in valuing its finished-goods inventories.

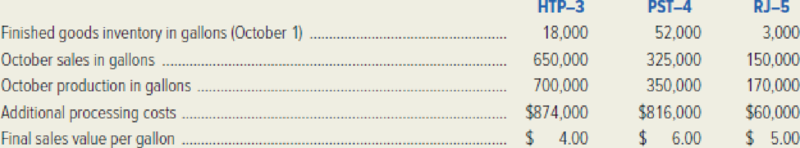

Data regarding Biondi’s operations for the month of October are as follows. During this month, Biondi incurred joint production costs of $1,700,000 in the manufacture of HTP–3, PST–4, and RJ–5.

Required:

- 1. Determine Biondi Industries’ allocation of joint production costs for the month of October. (Carry calculation of relative proportions to four decimal places.)

- 2. Determine the dollar values of the finished-goods inventories for HTP–3, PST–4, and RJ–5 as of October 31. (Round the cost per gallon to the nearest cent.)

- 3. Suppose Biondi Industries has a new opportunity to sell PST–4 at the split-off point for $3.80 per gallon. Prepare an analysis showing whether the company should sell PST–4 at the split-off point or continue to process this product further.

Want to see the full answer?

Check out a sample textbook solution

Chapter 17 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Financial accountingarrow_forwardLinden Corporation uses a predetermined overhead rate of $18.75 per direct labor hour. This predetermined rate was based on a cost formula that estimated $225,000 of total manufacturing overhead for an estimated activity level of 12,000 direct labor hours. During the period, the company incurred actual total manufacturing overhead costs of $210,000 and 11,200 total direct labor hours worked. Required: Determine the amount of manufacturing overhead that would have been applied to all jobs during the period.helparrow_forwardprovide correct answerarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning