Concept explainers

Celestial Artistry Company is developing departmental

Required:

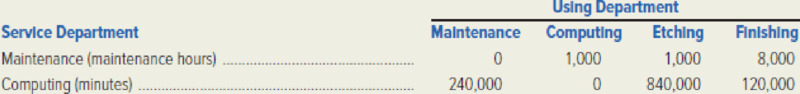

- 1. Use the direct method to allocate service department costs. Calculate the overhead rates per direct-labor hour for the Etching Department and the Finishing Department.

- 2. Use the step-down method to allocate service department costs. Allocate the Computing Department’s costs first. Calculate the overhead rates per direct-labor hour for the Etching Department and the Finishing Department.

Want to see the full answer?

Check out a sample textbook solution

Chapter 17 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Fletcher Corporation owns 75 percent of Montrose Company's stock. In the 20Y5 consolidated income statement, the noncontrolling interest was assigned $22,500 of income. There was no differential in the acquisition. What amount of net income did Montrose Company report for 20Y5?arrow_forwardWhat is the companys plant-wide predetermined overhead rate?arrow_forwardDo fast this question answer general accountingarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,