Bundle: College Accounting, Chapters 1-27, Loose-Leaf Version, 22nd + CengageNOWv2, 2 terms Printed Access Card

22nd Edition

ISBN: 9781305930421

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 17, Problem 1SEB

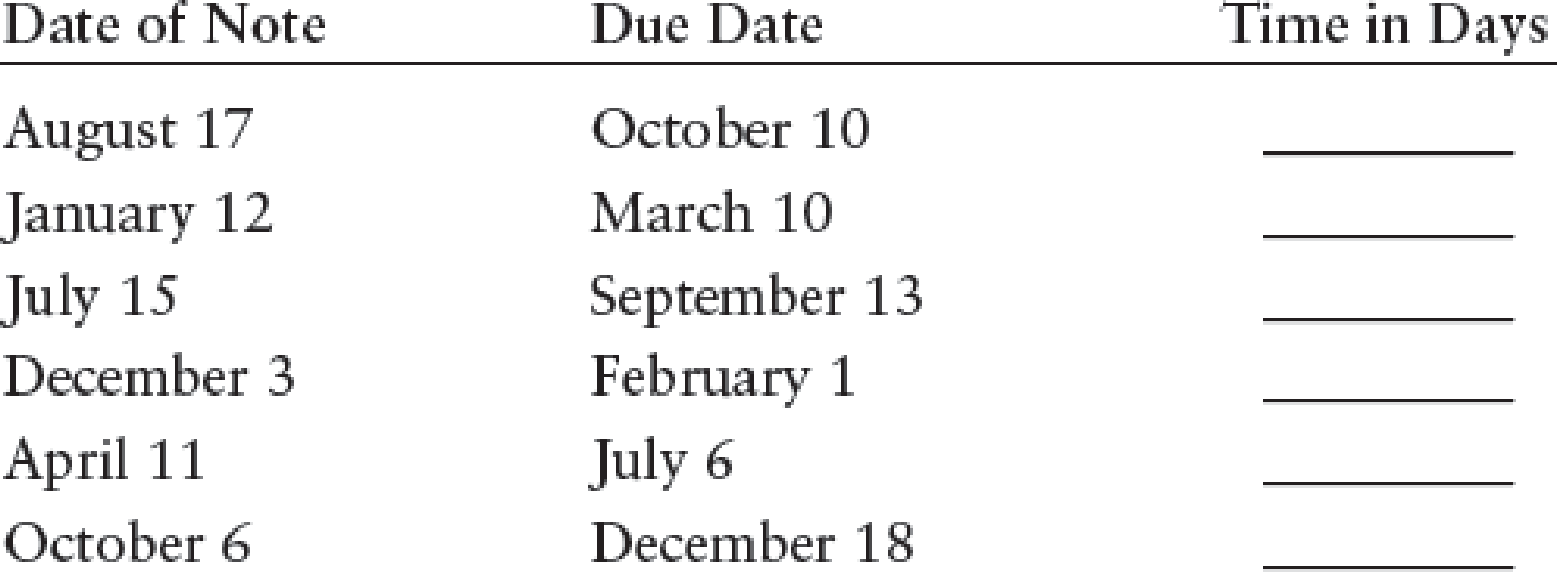

TERM OF A NOTE Calculate total time in days for the following notes. (Assume there are 28 days in February.)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

A 90-day note is signed on October 21. The due date of the note is:

◇ January 19

O January 21

◇ January 20

◇ January 18

What is the amount of interest revenue that must be accrued on December 31st for a nine-month, 6%, $2,000 note receivable that was accepted on November 1st?

what is the interest accrued?

Determine the due date and the amount of interest due at maturity on the following notes:

Date of Note

Face Amount

Interest Rate

Term of Note

a.

January 10*

$40,000

5%

90 days

b.

March 19

18,000

8

180 days

c.

June 5

90,000

7

30 days

d.

September 8

36,000

3

90 days

e.

November 20

27,000

4

60 days

*Assume that February has 28 days.

Assume 360-days in a year when computing the interest.

Note

Due Date

Interest

a.

$fill in the blank 2

b.

fill in the blank 4

c.

fill in the blank 6

d.

fill in the blank 8

e.

fill in the blank 10

Chapter 17 Solutions

Bundle: College Accounting, Chapters 1-27, Loose-Leaf Version, 22nd + CengageNOWv2, 2 terms Printed Access Card

Ch. 17 - The maturity value of a note includes both...Ch. 17 - Prob. 2TFCh. 17 - The difference between the maturity value of a...Ch. 17 - Prob. 4TFCh. 17 - When a dishonored note is collected, interest is...Ch. 17 - Principal plus interest equals ______ of a note....Ch. 17 - Prob. 2MCCh. 17 - Prob. 3MCCh. 17 - Prob. 4MCCh. 17 - Accrued interest payable is reported as a ______...

Ch. 17 - Prob. 1CECh. 17 - Prob. 2CECh. 17 - Prob. 3CECh. 17 - Prob. 1RQCh. 17 - Prob. 2RQCh. 17 - Prob. 3RQCh. 17 - Prob. 4RQCh. 17 - Prob. 5RQCh. 17 - Prob. 6RQCh. 17 - Prob. 7RQCh. 17 - Prob. 8RQCh. 17 - Prob. 9RQCh. 17 - On which notes receivable and notes payable is it...Ch. 17 - Prob. 11RQCh. 17 - When a business borrows money from a bank on a...Ch. 17 - What kind of account is Discount on Notes Payable,...Ch. 17 - Prob. 14RQCh. 17 - Prob. 15RQCh. 17 - TERM OF A NOTE Calculate total time in days for...Ch. 17 - Prob. 2SEACh. 17 - DETERMINING DUE DATE Determine the due date for...Ch. 17 - JOURNAL ENTRIES (NOTE RECEIVED, RENEWED, AND...Ch. 17 - Prob. 5SEACh. 17 - JOURNAL ENTRIES (ACCRUED INTEREST RECEIVABLE) At...Ch. 17 - JOURNAL ENTRIES (NOTE ISSUED, RENEWED, AND PAID)...Ch. 17 - JOURNAL ENTRIES (NOTE ISSUED FOR BANK LOAN)...Ch. 17 - JOURNAL ENTRIES (ACCRUED INTEREST PAYABLE) At the...Ch. 17 - NOTES RECEIVABLE ENTRIES J. K. Pratt Co. had the...Ch. 17 - NOTES RECEIVABLE DISCOUNTING Marienau Suppliers...Ch. 17 - ACCRUED INTEREST RECEIVABLE The following is a...Ch. 17 - NOTES PAYABLE ENTRIES Milo Radio Shop had the...Ch. 17 - ACCRUED INTEREST PAYABLE The following is a list...Ch. 17 - TERM OF A NOTE Calculate total time in days for...Ch. 17 - CALCULATING INTEREST Using 360 days as the...Ch. 17 - DETERMINING DUE DATE Determine the due date for...Ch. 17 - JOURNAL ENTRIES (NOTE RECEIVED, RENEWED, AND...Ch. 17 - JOURNAL ENTRIES (NOTE RECEIVED, DISCOUNTED,...Ch. 17 - JOURNAL ENTRIES (ACCRUED INTEREST RECEIVABLE) At...Ch. 17 - JOURNAL ENTRIES (NOTE ISSUED, RENEWED, AND PAID)...Ch. 17 - JOURNAL ENTRIES (NOTE ISSUED FOR BANK LOAN)...Ch. 17 - JOURNAL ENTRIES (ACCRUED INTEREST PAYABLE) At the...Ch. 17 - NOTES RECEIVABLE ENTRIES M. L. DiMaurizio had the...Ch. 17 - NOTES RECEIVABLE DISCOUNTING Madison Graphics had...Ch. 17 - ACCRUED INTEREST RECEIVABLE The following is a...Ch. 17 - Prob. 13SPBCh. 17 - ACCRUED INTEREST PAYABLE The following is a list...Ch. 17 - Prob. 1MYWCh. 17 - Rochelle needed to borrow 3,000 for three months...Ch. 17 - Eddie Edwards and Phil Bell own and operate The...Ch. 17 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For each notes receivable determine the interest revenue to be reported on the income statement for the year ended December 31. Use 360 days in your computations. date Face Rate% Term aug. 8. 45000. %7. 45days Oct. 7 62000 5 60 jan 6 28000 4 120 nov 12 43000 6 60arrow_forwardThe following table gives the average monthly balances for one bank customer for April through June. Calculate the weighted average balance for the three-month period. Note that each average monthly balance must be weighted by the number of days in that month. Round to the nearest cent. April-$435.21 May- $377.93 June- $261.79arrow_forwardCompute the maturity date and interest for the following notes.( use 360 days for calculation) Dates of notes Terms Principal Interest Rate a. April 17 45 days 48,000 3% b. August 11 2 months 72,000. 7% Maturity date. Interest a. ? $? b. ? $?arrow_forward

- Determine the due date and the amount of interest due at maturity on the following notes. When calculating interest amounts, assume there are 360 days in a year. Round intermediate calculations to 4 decimal places, and round your final answers to the nearest whole dollar. Date of Note Face Amount Interest Rate Term of Note a. January 15 $49,185 13 % 30 days b. April 1 18,045 11 90 days C. June 22 12,325 8 45 days d. August 30 18,975 12 120 days e. October 16 11,660 9 50 days Interest Due at Due Date Maturity a. b. نف C. d. e.arrow_forwardDetermine the interest on the following notes: (Use 360 days for calculation.) (a) $5,800 at 6% for 90 days. $Enter the interest in dollars (b) $800 at 9% for 5 months. $Enter the interest in dollars (c) $7,200 at 7% for 60 days. $Enter the interest in dollars (d) $1,800 at 7% for 6 months. $Enter the interest in dollarsarrow_forwardA 100-day note with a face amount of $54,000 and interest rate of 9% is issued on June 1. Required: 1.Compute the following using a 360-day year: a. Maturity value of the note $___________ b. Maturity date ___________ c. Interest $___________ 2.The note is discounted on July 1. The bank discount rate is 12%. Compute the following: a. Number of days in the discount period ___________ b. Discount amount $___________ c. Proceeds $___________arrow_forward

- please answer in text form and in proper format answer with must explanation , calculation for each part and steps clearlyarrow_forwardSuppose your MasterCard calculates interest using the average daily balance method, and the monthly interest rate is 1.6%. The itemized billing for the month of August is shown below. Detail Unpaid balance Charge Charge Charge Payment received Last day of billing period Payment due date Date August 1 August 9 August 10 August 18 August 25 August 31 September 7 (a) Find the average daily balance. $ (b) Find the interest due for this month. $ Amount 1085 125 1130 140 995 (c) Find the total balance owed on the last day of the billing period. $ 1,514.97 Or (d) This credit card requires a $15 minimum payment or 1/24 of the amount due, whichever is higher. What is the minimum monthly payment due for this month? $arrow_forwardUse the average daily balance method to compute the finance charge on the credit card account for the month of August (31 days). The starting balance from the previous month is $290. The transactions on the account for the month are given in the table to the right. Assume an annual interest rate of 21% on the account and that the billing date is August 1st. (see image for table.) The finance charge for the month of August is $___arrow_forward

- Determine the due date and the amount of interest due at maturity on the following notes: Date of Note Face Amount Interest Rate Term of Note a. January 5 * $90,000 6% 120 days b. February 15 * 21,000 4 30 days c. May 19 68,000 8 45 days d. August 20 34,400 5 90 days e. October 19 50,000 7 90 days * Assume a leap year in which February has 29 days. Assume 360 days in a year when computing the interest. Jan. 17 Mar. 16 May 4 July 3 Nov. 18 Note Due Date Interest (a) $fill in the blank 2 (b) $fill in the blank 4 (c) $fill in the blank 6 (d) $fill in the blank 8 (e) $fill in the blank 10arrow_forwardGg.101.arrow_forwardNotes receivable due in 90 days appear on what?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

How JOURNAL ENTRIES Work (in Accounting); Author: Accounting Stuff;https://www.youtube.com/watch?v=Y-_Q3rANyxU;License: Standard Youtube License