Concept explainers

Entries for

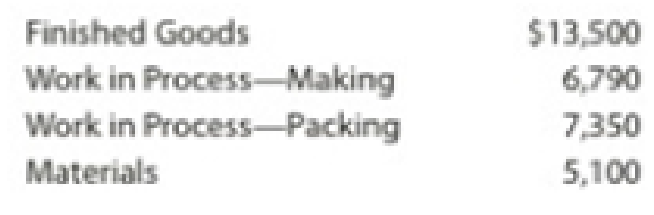

Preston & Grover Soap Company manufactures powdered detergent. Phosphate is placed in process in the Making Department, where it is turned into granulars. The output of Making is transferred to the Packing Department, where packaging is added at the beginning of the process. On July 1, Preston & Grover Soap Company had the following inventories:

Departmental accounts are maintained for factory

Manufacturing operations for July are summarized as follows:

Instructions

- 1.

Journalize the entries to record the operations, identifying each entry by letter. - 2. Compute the July 31 balances of the inventory accounts.

- 3. Compute the July 31 balances of the factory overhead accounts.

Journalize the entry to record material purchased on account of Company PGS.

Explanation of Solution

Work in process costs

It is the cost of production process that is used to manufacture partly completed products. It comprises the cost of raw materials, labor, and overhead that incurred for the production process of the products at various phases.

Direct materials cost

Manufacturing products arise with raw materials that are altered into finished products. The cost of any material that is an important part of the finished product is categorized as a direct materials cost.

Conversion cost

Cost of changing the materials into a finished product. It includes direct labor costs and factory overhead costs.

(A) Prepare the journal entry to record material purchased on account of Company PGS as shown below:

| Account title and Explanation | Debit | Credit |

| Materials | $149,800 | |

| Accounts payable | $149,800 | |

| (To record material purchased on account) |

Table (1)

- • Materials inventory is a current asset and increased. Therefore, debit material account for $149,800.

- • Accounts payable is a current liability and increased. Therefore, credit accounts payable account for $149,800.

(B) Prepare the journal entry to record material requisition used for production of Company PGS as shown below:

| Account title and Explanation | Debit | Credit |

| Work in process - Making Department | $105,700 | |

| Work in process - Packing Department | $31,300 | |

| Factory overhead - Making Department | $4,980 | |

| Factory overhead - Packing Department | $1,530 | |

| Materials | $143,510 | |

| (To record materials used in production) |

Table (2)

- • Work in process inventory – making department is a current asset account, and increased. Therefore, debit work in process – making department account for $105,700.

- • Work in process inventory – packing department is a current asset account, and increased. Therefore, debit work in process – packing department account for $31,300.

- • Factory overhead – making department is a component of stockholders’ equity, and decreased it. Therefore, debit factory overhead – making department account for $4,980.

- • Factory overhead – packing department is a component of stockholders’ equity, and decreased it. Therefore, debit factory overhead – packing department account for $1,530.

- • Materials inventory is a current asset, and decreased it. Therefore, credit material account for $143,510.

(C) Prepare the journal entry to record labor used for production of Company PGS as shown below:

| Account title and Explanation | Debit | Credit |

| Work in process - Making Department | $32,400 | |

| Work in process - Packing Department | $40,900 | |

| Factory overhead - Making Department | $15,400 | |

| Factory overhead - Packing Department | $18,300 | |

| Wages payable | $107,000 | |

| (To record labor cost incurred for production) |

Table (3)

- • Work in process inventory – making department is a current asset account, and increased. Therefore, debit work in process – making department account for $32,400.

- • Work in process inventory – packing department is a current asset account, and increased. Therefore, debit work in process – packing department account for $40,900.

- • Factory overhead – making department is a component of stockholders’ equity, and decreased it. Therefore, debit factory overhead – making department account for $15,400.

- • Factory overhead – packing department is a component of stockholders’ equity, and decreased it. Therefore, debit factory overhead – packing department account for $18,300.

- • Wages payable is a current liability, and increased. Therefore, credit wages payable account for $107,000.

(D) Prepare the journal entry to record accumulated depreciation on fixed asset of Company PGS as shown below:

| Account title and Explanation | Debit | Credit |

| Factory Overhead - Making Department | $10,700 | |

| Factory Overhead - Packing Department | $7,900 | |

| Accumulated depreciation – fixed asset | $18,600 | |

| (To record accumulated depreciation for fixed asset) |

Table (4)

- • Factory overhead – Making department is a component of stockholders’ equity, and decreased it. Therefore, debit factory overhead – Making department account for $10,700.

- • Factory overhead – Packing department is a component of stockholders’ equity, and decreased it. Therefore, debit factory overhead – Packing department account for $7,900.

- • Accumulated depreciation – fixed asset is a contra asset, and increased. Therefore, credit accumulated depreciation – fixed asset account for $18,600.

(E) Prepare the journal entry to record expired factory insurance of Company PGS as shown below:

| Account title and Explanation | Debit | Credit |

| Factory Overhead – Making Department | $2,000 | |

| Factory Overhead - Packing Department | $1,500 | |

| Prepaid insurance | $3,500 | |

| (To record expired prepaid factory insurance) |

Table (5)

- • Factory overhead – Making department is a component of stockholders’ equity, and decreased it. Therefore, debit factory overhead – Making department account for $2,000.

- • Factory overhead – Packing department is a component of stockholders’ equity, and decreased it. Therefore, debit factory overhead – Packing department account for $1,500.

- • Prepaid insurance is a current asset, and decreased. Therefore, credit prepaid insurance account for $3,500.

(F) Prepare the journal entry to record applied factory overhead of Company PGS as shown below:

| Account title and Explanation | Debit | Credit |

| Work in process – Making Department | $32,570 | |

| Work in process - Packing Department | $30,050 | |

| Factory overhead – Making Department | $32,570 | |

| Factory overhead - Packing Department | $30,050 | |

| (To record allocation of factory overhead) |

Table (6)

- • Work in process inventory – Making department is a current asset account, and increased. Therefore, debit work in process – Making department account for $32,570.

- • Work in process inventory – Packing department is a current asset account, and increased. Therefore, debit work in process – Packing department account for $30,050.

- • Factory overhead – Making department is a component of stockholders’ equity, and increased it. Therefore, credit factory overhead – Making department account for $32,570.

- • Factory overhead – Packing department is a component of stockholders’ equity, and decreased it. Therefore, credit factory overhead – Packing department account for $30,050.

(G) Prepare the journal entry to record production costs transferred from making department to packing department of Company PGS as shown below:

| Account title and Explanation | Debit | Credit |

| Work in process - Packing Department | $166,790 | |

| Work in process – Making Department | $166,790 | |

| (To record production costs transferred from Making department to Packing department) |

Table (7)

- • Work in process inventory – Making department is a current asset account, and increased. Therefore, debit work in process – Making department account for $166,790.

- • Work in process inventory – Packing department is a current asset account, and decreased. Therefore, credit work in process – Packing department account for $166,790.

(H) Prepare the journal entry to record production costs transferred from Packing department to finished goods of Company PGS as shown below:

| Account title and Explanation | Debit | Credit |

| Finished goods | $263,400 | |

| Work in process - Packing Department | $263,400 | |

| (To record production costs transferred from Packing department to Finished goods) |

Table (8)

- • Finished goods inventory is a current asset, and increased. Therefore, debit finished goods account for $263,400.

- • Work in process inventory – Packing department is a current asset, and decreased. Therefore, credit work in process – Packing department account for $263,400.

(I) Prepare the journal entry to record cost of goods sold during the period of Company PGS as shown below:

| Account title and Explanation | Debit | Credit |

| Cost of Goods sold | $265,200 | |

| Finished goods | $265,200 | |

| (To record cost of goods sold during the period) |

Table (9)

- • Cost of goods sold is a component of stockholders’ equity, and increased it. Therefore, debit cost of goods sold account for $265,200.

- • Finished goods inventory is a current asset, and decreased. Therefore, credit finished goods account for $265,200.

(2)

Compute the ending balance of inventory accounts of Company PGS.

Explanation of Solution

Calculate ending balance of inventory account of Company PGS as shown below:

| Particulars | Amount | |||

| Materials | Work in Process – Making Department | Work in Process - Packing Department | Finished Goods | |

| Balance, July 1 | $5,100 | $6,790 | $7,350 | $13,500 |

| Add: Debit balance | $149,800 | $170,670 | $269,040 | $263,400 |

| Less: Credit balance | $143,510 | $166,790 | $263,400 | $265,200 |

| Balance, July 31 | $11,390 | $10,670 | $12,990 | $11,700 |

Table (10)

Working notes:

Calculate debit balance for work in process – Making department of Company PGS as shown below:

Calculate debit balance for work in process – Packing department of Company PGS as shown below:

Ending balance of inventory account is calculated by adding opening balance of inventory, debit balance and then deduct with credit balance. Hence, ending balance for materials is $11,390 (debit balance), ending balance for work in process – Making department is $10,670 (debit balance), ending work in process - Packing department is $12,990 (debit balance), and ending balance for finished goods is $11,700 (debit balance).

(3)

Compute the ending balance of factory overhead accounts of Company PGS.

Explanation of Solution

Calculate ending balance of factory overhead accounts of Company PGS as shown below:

| Particulars | Amount | |

| Factory Overhead – Making Department | Factory Overhead - Packing Department | |

| Balance, July 1 | $0 | $0 |

| Add: Debit balance | $33,080 | $29,230 |

| Less: Credit balance | $32,570 | $30,050 |

| Balance, July 31 | $510 | ($820) |

Table (11)

Working notes:

Calculate credit balance for factory overhead– Making department of Company PGS as shown below:

Calculate debit balance for factory overhead – Packing department of Company PGS as shown below:

Ending balance of factory overhead account is calculated by adding opening balance of factory overhead, debit balance and then deduct with credit balance. Hence, ending balance of factory overhead – Making department is $510 (debit balance), and ending balance of factory overhead – Packing department is $820 (credit balance).

Want to see more full solutions like this?

Chapter 17 Solutions

Financial And Managerial Accounting

- Question Content Area Work in Process Account Data for Two Months; Cost of Production Reports Pittsburgh Aluminum Company uses process costing to record the costs of manufacturing rolled aluminum, which consists of the smelting and rolling processes. Materials are entered from smelting at the beginning of the rolling process. The inventory of Work in Process—Rolling on September 1 and debits to the account during September were as follows:arrow_forwardQuestion Content Area Work in Process Account Data for Two Months; Cost of Production Reports Pittsburgh Aluminum Company uses process costing to record the costs of manufacturing rolled aluminum, which consists of the smelting and rolling processes. Materials are entered from smelting at the beginning of the rolling process. The inventory of Work in Process—Rolling on September 1 and debits to the account during September were as follows:arrow_forwardA B CORRECT ANSWER PLEASarrow_forward

- Kindly help me with accounting questionsarrow_forward1. I want to know how to solve these 2 questions and what the answers are 3. Field & Co. expects its EBIT to be $125,000 every year forever. The firm can borrow at 7%. The company currently has no debt, and its cost of equity is 12%. If the tax rate is 24%, what is the value of the firm? What will the value be if the company borrows $205,000 and uses the proceeds to purchase shares? 2. Firms HD and LD each have $30m in invested capital, $8m of EBIT, and a tax rate of 25%. Firm HD has a D/E ratio of 50% with an interest rate of 8% on their debt. Firm LD has a debt-to-capital ratio of 30%, however, pays 9% interest on its debt. Calculate the following: a. Return on invested capital for firm LDb. Return on equity for each firmc. If HD’s CFO is thinking of lowering the D/E from 50% to 40%, which will lower their interest rate further from 8% to 7%, calculate the new ROE for firm HD.arrow_forwardwhat is the variable cost per minute?arrow_forward

- I want to know how to solve these 2 questions and what the answers are 1. Stella Motors has $50m in assets, which is financed with 40% debt and 60% common equity. The company’s beta is currently 1.25 and its tax rate is 30%. Find Stella’s unlevered beta. 2. Sugar Corp. uses no debt. The weighted average cost of capital is 7.9%. If the current market value of the equity is $15.6 million and there are no taxes, what is the company’s EBIT?arrow_forwardI don't need ai answer general accounting questionarrow_forwardCan you help me with accounting questionsarrow_forward

- Cariveh Co sells automotive supplies from 25 different locations in one country. Each branch has up to 30 staff working there, although most of the accounting systems are designed and implemented from the company's head office. All accounting systems, apart from petty cash, are computerised, with the internal audit department frequently advising and implementing controls within those systems. Cariveh has an internal audit department of six staff, all of whom have been employed at Cariveh for a minimum of five years and some for as long as 15 years. In the past, the chief internal auditor appoints staff within the internal audit department, although the chief executive officer (CEO) is responsible for appointing the chief internal auditor. The chief internal auditor reports directly to the finance director. The finance director also assists the chief internal auditor in deciding on the scope of work of the internal audit department. You are an audit manager in the internal audit…arrow_forwardCariveh Co sells automotive supplies from 25 different locations in one country. Each branch has up to 30 staff working there, although most of the accounting systems are designed and implemented from the company's head office. All accounting systems, apart from petty cash, are computerised, with the internal audit department frequently advising and implementing controls within those systems. Cariveh has an internal audit department of six staff, all of whom have been employed at Cariveh for a minimum of five years and some for as long as 15 years. In the past, the chief internal auditor appoints staff within the internal audit department, although the chief executive officer (CEO) is responsible for appointing the chief internal auditor. The chief internal auditor reports directly to the finance director. The finance director also assists the chief internal auditor in deciding on the scope of work of the internal audit department. You are an audit manager in the internal audit…arrow_forwardProvide solution of this all Question please Financial Accountingarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning