Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 17, Problem 1FSA

Financial Statement Analysis

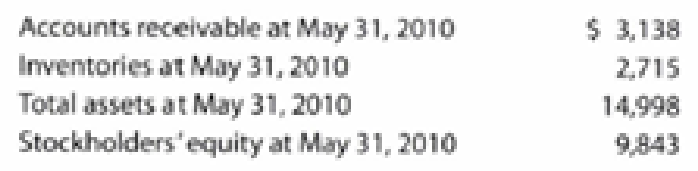

The financial statements for Nike, Inc., are presented in Appendix C at the end of the text. The following additional information (in thousands) is available:

Instructions

- 1. Determine the following measures for the fiscal years ended May 31, 2013 (fiscal 2012), and May 31, 2012 (fiscal 2011), rounding to one decimal place.

- a.

Working capital - b.

Current ratio - c. Quick ratio

- d.

Accounts receivable turnover - e. Number of days’ sales in receivables

- f. Inventory turnover

- g. Number of days’ sales in inventory

- h. Ratio of liabilities to stockholders’ equity

- i. Ratio of sales to assets

- j. Rate earned on total assets, assuming interest expense is $23 million for the year ending May 31, 2013, and $31 million for the year ending May 31, 2012

- k. Rate earned on common stockholders’ equity

- l. Price-earnings ratio, assuming that the market price was $61.66 per share on May 31, 2013, and $53.10 per share on May 31, 2012

- m. Percentage relationship of net income to sales

- a.

- 2. What conclusions can be drawn from these analyses?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Can you please help me by providing clear neat organized answers. Thank you!

Can you please help me by providing clear neat organized answers. Thank you!

Can you please help me by providing clear neat organized answers. Thank you!

Chapter 17 Solutions

Financial Accounting

Ch. 17 - Prob. 1DQCh. 17 - What is the advantage of using comparative...Ch. 17 - Prob. 3DQCh. 17 - How would the current and quick ratios of a...Ch. 17 - Prob. 5DQCh. 17 - What do the following data, taken from a...Ch. 17 - a. How does the rate earned on total assets differ...Ch. 17 - Kroger, a grocery store, recently had a...Ch. 17 - Prob. 9DQCh. 17 - Prob. 10DQ

Ch. 17 - Prob. 1PEACh. 17 - Prob. 1PEBCh. 17 - Prob. 2PEACh. 17 - Vertical analysis Income statement information for...Ch. 17 - Prob. 3PEACh. 17 - Prob. 3PEBCh. 17 - Prob. 4PEACh. 17 - Prob. 4PEBCh. 17 - Prob. 5PEACh. 17 - Inventory analysis A company reports the...Ch. 17 - Prob. 6PEACh. 17 - Prob. 6PEBCh. 17 - Times interest earned A company reports the...Ch. 17 - Times interest earned A company reports the...Ch. 17 - Asset turnover A company reports the following:...Ch. 17 - Asset turnover A company reports the following:...Ch. 17 - Prob. 9PEACh. 17 - Prob. 9PEBCh. 17 - Common stockholders' profitability analysis A...Ch. 17 - Common stockholders' profitability analysis A...Ch. 17 - Earnings per share and price-earnings ratio A...Ch. 17 - Earnings per share and price-earnings ratio A...Ch. 17 - Revenue and expense data for Gresham Inc. for two...Ch. 17 - Prob. 2ECh. 17 - Common-sized income statement Revenue and expense...Ch. 17 - Prob. 4ECh. 17 - Prob. 5ECh. 17 - The following data were taken from the balance...Ch. 17 - Prob. 7ECh. 17 - The bond indenture for the 10-year, 9% debenture...Ch. 17 - The following data are taken from the financial...Ch. 17 - Prob. 10ECh. 17 - The following data were extracted from the income...Ch. 17 - Prob. 12ECh. 17 - Ratio of liabilities to stockholders equity and...Ch. 17 - Hasbro and Mattel, Inc., are the two largest toy...Ch. 17 - Ratio of liabilities to stockholders equity and...Ch. 17 - Three major segments of the transportation...Ch. 17 - Prob. 17ECh. 17 - Profitability ratios Ralph Lauren Corporation...Ch. 17 - The following data were taken from the financial...Ch. 17 - The balance sheet for Garcon Inc. at the end of...Ch. 17 - Earnings per share, price-earnings ratio, dividend...Ch. 17 - The table that follows shows the stock price,...Ch. 17 - Earnings per share, discontinued operations The...Ch. 17 - Prob. 24ECh. 17 - Prob. 25ECh. 17 - Unusual items Explain whether Colston Company...Ch. 17 - Prob. 1PACh. 17 - For 2016, Indigo Company initiated a sales...Ch. 17 - Effect of transactions on current position...Ch. 17 - The comparative financial statements of Bettancort...Ch. 17 - Addai Company has provided the following...Ch. 17 - Prob. 1PBCh. 17 - Prob. 2PBCh. 17 - Effect of transactions on current position...Ch. 17 - Prob. 4PBCh. 17 - Crosby Company has provided the following...Ch. 17 - Financial Statement Analysis The financial...Ch. 17 - Prob. 1CPCh. 17 - Prob. 2CPCh. 17 - The condensed income statements through income...Ch. 17 - Prob. 4CPCh. 17 - Marriott International, Inc., and Hyatt Hotels...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you please help me by providing clear neat organized answers. Thank you!arrow_forwardSummary: You will investigate a case of asset theft involving several fraudsters for this assignment. The case offers a chance to assess an organization's corporate governance, fraud prevention, and risk factors. Get ready: Moha Computer Services Limited Links to an external website: Finish the media activity. The scenario you need to finish the assignment is provided by this media activity. Directions: Make a four to five-page paper that covers the following topics. Management must be questioned by an auditor regarding the efficacy of internal controls and the potential for fraud. A number of warning signs point to the potential for fraud in this instance. List at least three red flags (risk factors for fraud) that apply to the Moha case. Sort them into three groups: opportunities, pressures/incentives, and (ethical) attitudes/justifications. Determine which people and organizations were impacted by Moha Computer Services Limited's enormous scam. Describe the fraud's financial and…arrow_forwardCoarrow_forward

- Critically assess the role of the Conceptual Framework in financial reporting and its influence onaccounting theory and practice. Discuss how the qualitative characteristics outlined in theConceptual Framework enhance financial reporting and contribute to decision-usefulness. Provideexamples to support your analysis.arrow_forwardCritically analyse the role of financial reporting in investment decision-making,emphasizing the qualitative characteristics that enhance the usefulness of financialstatements. Discuss how financial reporting influences both investor confidence andregulatory decisions, using relevant examples.arrow_forwardHelp need!!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License