Concept explainers

FIFO method (continuation of 17-41).

- 1. Complete Problem 17-41 using the FIFO method of

process costing .

Required

- 2. If you did Problem 17-41, explain any difference between the cost of work completed and transferred out and the cost of ending work in process in the assembly department under the weighted-average method and the FIFO method. Should McKnight’s managers choose the weighted-average method or the FIFO method? Explain briefly.

17-41 Weighted-average method. McKnight Handcraft is a manufacturer of picture frames for large retailers. Every picture frame passes through two departments: the assembly department and the finishing department. This problem focuses on the assembly department. The process-costing system at McKnight has a single direct-cost category (direct materials) and a single indirect-cost category (conversion costs). Direct materials are added when the assembly department process is 10% complete. Conversion costs are added evenly during the assembly department’s process.

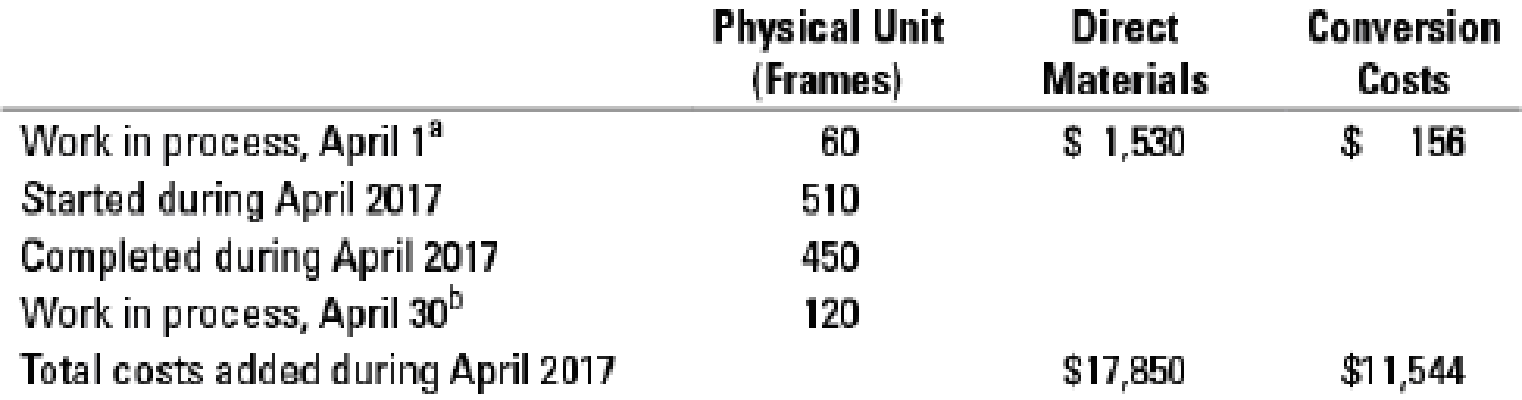

McKnight uses the weighted-average method of process costing. Consider the following data for the assembly department in April 2017:

a Degree of completion: direct materials, 100%; conversion costs, 40%.

b Degree of completion: direct materials, 100%; conversion costs, 15%.

- 1. Summarize the total assembly department costs for April 2017, and assign them to units completed (and transferred out) and to units in ending work in process.

Required

- 2. What issues should a manager focus on when reviewing the equivalent units calculation?

Want to see the full answer?

Check out a sample textbook solution

Chapter 17 Solutions

EBK HORNGREN'S COST ACCOUNTING

- BatCo makes metal baseball bats. Each bat requires 1.00 kg of aluminum at $24 per kg and 0.30 direct labor hours at $18 per hour. Overhead is assigned at the rate of $32 per direct labor hour. What amounts would appear on a standard cost card for BatCo?arrow_forwardAccounting problem with correct solutionarrow_forwardPlease need answerarrow_forward

- Waterway Industries expects direct materials cost of $8 per unit for 50,000 units (a total of $400,000 of direct materials costs). Waterway's standard direct materials cost and budgeted direct materials cost are: Sr. No. Standard a. b. $400,000 per year $8 per unit Budgeted $400,000 per year $400,000 per year $8 per unit C. $400,000 per year d. $8 per unit $8 per unitarrow_forwardGeneral accountingarrow_forwardYour boss at LK Enterprises asks you to compute the company's cash conversion cycle. Looking at the financial statements, you see that the average inventory for the year was $135,500, accounts receivable were $102,400, and accounts payable were at $121,700. You also see that the company had sales of $356,000 and that cost of goods sold was $298,500. What is your firm's cash conversion cycle? Round to the nearest day. Financial accounting problemarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College