Concept explainers

Transferred-in costs, FIFO method (continuation of 17-39). Refer to the information in Problem 17-39. Suppose that Hoffman Company uses the FIFO method instead of the weighted-average method in all of its departments. The only changes to Problem 17-39 under the FIFO method are that total transferred-in costs of beginning work in process on October 1 are $2,879,000 (instead of $2,931,000) and that total transferred-in costs added during October are $9,048,000 (instead of $8,094,000).

Using the FIFO process-costing method, complete Problem 17-39.

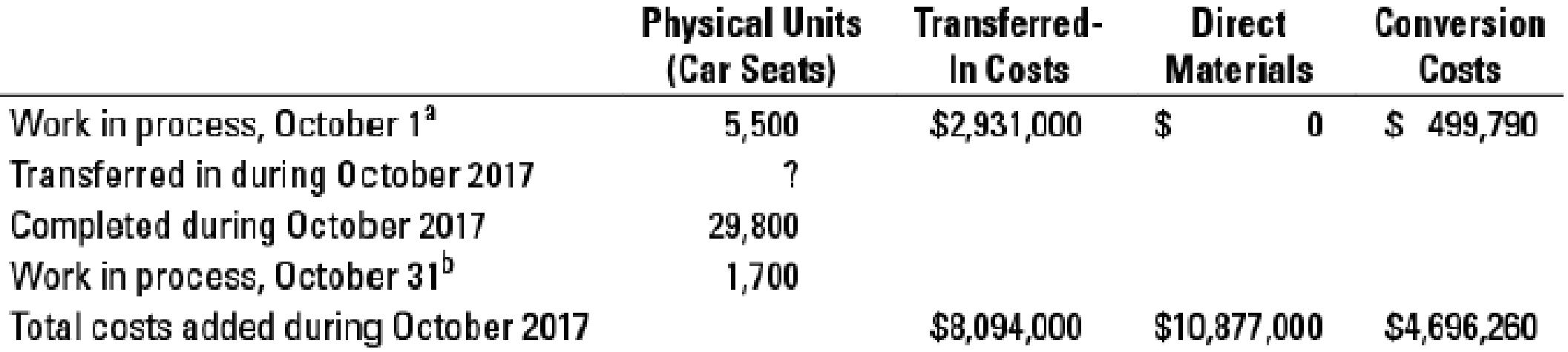

17-39 Transferred-in costs, weighted-average method (related to 17-36 to 17-38). Hoffman Company, as you know, is a manufacturer of car seats. Each car seat passes through the assembly department and testing department. This problem focuses on the testing department. Direct materials are added when the testing department process is 90% complete. Conversion costs are added evenly during the testing department’s process. As work in assembly is completed, each unit is immediately transferred to testing. As each unit is completed in testing, it is immediately transferred to Finished Goods.

Hoffman Company uses the weighted-average method of

a Degree of completion: transferred-in costs, ?%; direct materials, ?%; conversion costs, 65%.

b Degree of completion: transferred-in costs, ?%; direct materials, ?%; conversion costs, 45%.

- 1. What is the percentage of completion for (a) transferred-in costs and direct materials in beginning work-in-process inventory and (b) transferred-in costs and direct materials in ending work-in-process inventory?

- 2. For each cost category, compute equivalent units in the testing department. Show physical units in the first column of your schedule.

- 3. For each cost category, summarize total testing department costs for October 2017, calculate the cost per equivalent unit, and assign costs to units completed (and transferred out) and to units in ending work in process.

- 4. Prepare

journal entries for October transfers from the assembly department to the testing department and from the testing department to Finished Goods.

Want to see the full answer?

Check out a sample textbook solution

Chapter 17 Solutions

COST ACCOUNTING

Additional Business Textbook Solutions

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Marketing: An Introduction (13th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- What is the thus option of this question general Accountingarrow_forwardPlease help me correct my mistakes. If theres X beside the number that means the number is wrong, if theres X beside the account that means its the wrong account for the T accounts of 2022 and 2023, the options for accounts names are bad debt expense, collections, credit sales and write offsarrow_forwardchose best answer financial accountingarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning