Concept explainers

FIFO method, assigning costs.

- 1. Do Exercise 17-29 using the FIFO method.

Required

- 2. ZanyBrainy’s management seeks to have a more consistent cost per equivalent unit. Which method of

process costing should the company choose and why?

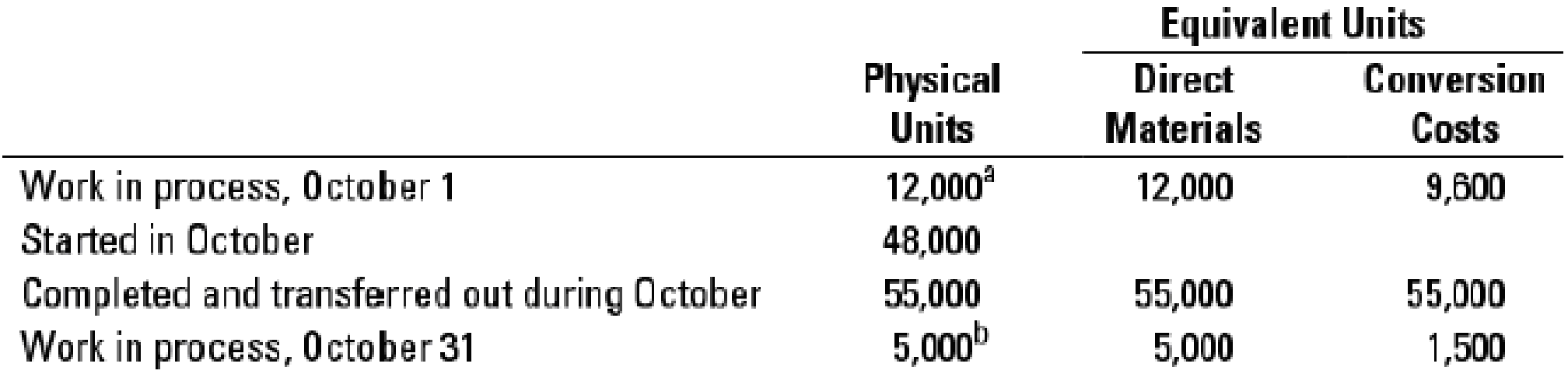

17-29 Weighted-average method, assigning costs. ZanyBrainy Corporation makes interlocking children’s blocks in a single processing department. Direct materials are added at the start of production. Conversion costs are added evenly throughout production. ZanyBrainy uses the weighted-average method of process costing. The following information for October 2017 is available.

a Degree of completion: direct materials, 100%; conversion costs, 80%.

b Degree of completion: direct materials, 100%; conversion costs, 30%.

Total Costs for October 2017

| Work in process, beginning | ||

| Direct materials | $ 5,760 | |

| Conversion costs | 14,825 | $ 20,585 |

| Direct materials added during October | 25,440 | |

| Conversion costs added during October | 58,625 | |

| Total costs to account for | $104,650 |

- 1. Calculate the cost per equivalent unit for direct materials and conversion costs.

Required

- 2. Summarize the total costs to account for and assign them to units completed (and transferred out) and to units in ending work in process.

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Chapter 17 Solutions

REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

Additional Business Textbook Solutions

Principles of Economics (MindTap Course List)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

MARKETING:REAL PEOPLE,REAL CHOICES

Financial Accounting: Tools for Business Decision Making, 8th Edition

Engineering Economy (17th Edition)

Foundations of Financial Management

- A company's normal selling price for its product isarrow_forwardFinancial Accounting Questionarrow_forwardThe equipment was sold for $60,000 The equipment was originally purchased for $33,000. At the time of the sale, the equipment had accumulated depreciation of $30,000. Calculate the gain or loss to be recorded on the sale of equipment.arrow_forward

- What is the level of fixed costs?arrow_forwardPlease give me true answer this financial accounting questionarrow_forwardThe following transactions of Weber Company occurred during the current year: The company acquired a tract of land in exchange for 1,000 shares of $10 par value common stock. The stock was traded on the New York Stock Exchange at $24 on the date of exchange. The land had a book value on the selling company’s records of $5,000, and it was believed to be worth “anything up to $30,000.” An engine on a truck was replaced. When the truck was purchased 3 years ago, it cost $10,000 and was being depreciated at $2,000 per year. The engine cost $1,000 to replace. The company acquired a tract of land that was believed to have mineral deposits by issuing 500 shares of preferred stock of $50 par value. The preferred stock was rarely traded. The last transaction was 2 months earlier, when 50 shares were sold at $75 per share. The owner of the land was willing to accept cash of $55,000, and an appraisal had shown a value of $60,000. The company purchased a machine with a list price of $8,500 by…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,