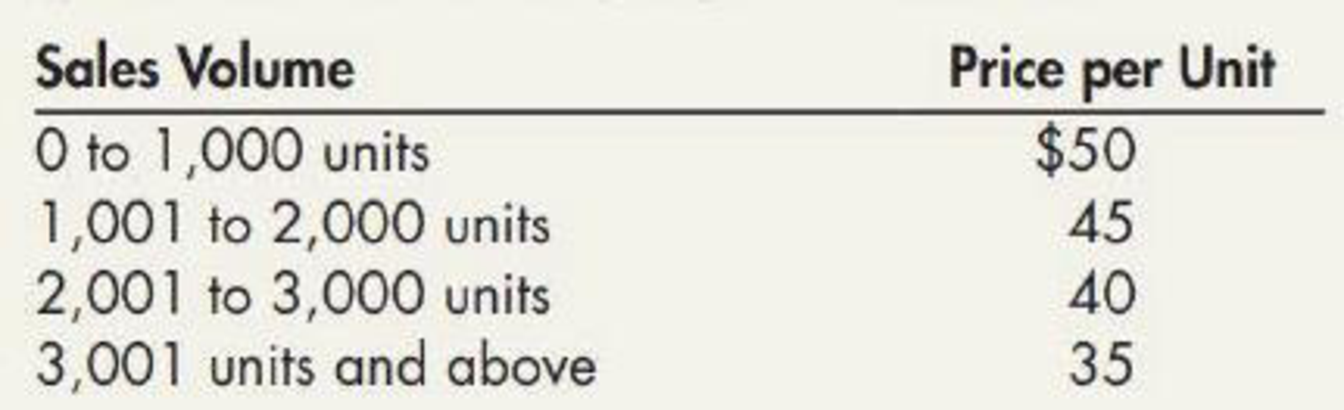

On January 1, 2019, Piper Company entered into an agreement with Save-Mart to sell its most popular product, the gadget. The contract stipulates that the price per unit will decrease as Save-Mart purchases higher volumes of the gadget, as follows:

The contract states that Save-Mart pays Piper the unit price based on the current sales volume. Once a volume threshold is reached, the price is retroactively reduced to the applicable price per unit. Based on its past experience with similar contracts, Piper believes that the total sales volume for the year will be 1,800 units and uses the most likely amount approach to estimate variable consideration. In addition, Piper concludes it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur once the uncertainty surrounding the variable consideration is resolved.

Required:

1. Determine the transaction price per unit that Piper should use to record revenue.

2. Assume that Save-Mart purchases 800 units in the first quarter of 2019 and 900 units in the second quarter of 2019. Prepare Piper’s journal entries to record the sales in the first and second quarters.

3. Given the higher than expected sales volume in the first half of the year, Piper increases its estimate of the sales volume to 2,800 units. Prepare the

1.

Ascertain the transaction price per unit that is used to record the revenue.

Explanation of Solution

Transaction price:

Transaction price is the amount of consideration that is estimated by the company to be authorized in exchange, for delivering the promised goods and services to the customer. Transaction price is examined by the seller by analyzing the terms of the contract and the normally conducts of the business.

$45 is the transaction price per unit since, sales of 1,800 units is expected and the price per unit with sales volume of 1,001-2,000 units is $45.

2.

Journalize entries to record the sakes made in the first and second quarters.

Explanation of Solution

Contract:

Contract is an agreement among two parties or more parties which includes enforceable obligations and rights. A contract can be written, oral or implied by ordinary business practices.

Journal entry:

Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Accounting rules for Journal entries:

- To record increase balance of account: Debit assets, expenses, losses and credit liabilities, capital, revenue and gains.

- To record decrease balance of account: Credit assets, expenses, losses and debit liabilities, capital, revenue and gains.

Prepare journal entry for the first quarter:

| Date | Account title and explanation | Debit ($) | Credit ($) |

| Cash (1) | 40,000 | ||

| Sales revenue (2) | 36,000 | ||

| Return liability (3) | 4,000 | ||

| (To record the recognition of liability) |

Table (1)

- Cash is an asset and it is increased. Therefore, debit cash account by $40,000.

- Sales revenue is a component of stockholders’ equity and it is increased. Therefore, credit sales revenue account by $36,000.

- Return liability is increased. Therefore, credit returns liability account by $4,000.

Prepare journal entry for the second quarter:

| Date | Account title and explanation | Debit ($) | Credit ($) |

| Cash (Balancing figure) | 36,500 | ||

| Refund liability (3) | 4,000 | ||

| Sales revenue (4) | 40,500 | ||

| (To record the payment of refund) |

Table (2)

- Cash is an asset and it is increased. Therefore, debit cash account by $36,500.

- Refund liability is decreased. Therefore, debit returns liability account by $4,000.

- Sales revenue is a component of stockholders’ equity and it is increased. Therefore, credit sales revenue account by $40,500.

Working notes:

(1)Calculate the amount of cash during the first quarter:

Note: $50 is the price per unit for the sales of 0 to 1,000 units.

(2)Calculate the amount of sales revenue:

Note: $45 is the price per unit for the sales of 1,001 to 2,000 units.

(3)Calculate the amount of refund liability:

Note: $5 is the difference between

(4)Calculate the amount of sales revenue:

3.

Journalize entries to record the change in estimate.

Explanation of Solution

Prepare journal entry:

| Date | Account title and explanation | Debit ($) | Credit ($) |

| Sales revenue (5) | 8,500 | ||

| Refund liability | 8,500 | ||

| ( To record the refund liability) |

Table (3)

- Sales revenue is a component of stockholders’ equity and it is decreased. Therefore, debit sales revenue account by $8,500.

- Refund liability is increased. Therefore, credit returns liability account by $8,500.

Working note:

(5)Calculate the amount of sales revenue:

Note: $5 is the difference between

Want to see more full solutions like this?

Chapter 17 Solutions

EBK INTERMEDIATE ACCOUNTING: REPORTING

- Using the Hofstede Country Comparison ToolLinks to an external site., compare your nation to two other nations on Hofstede’s dimensions. Based on what you know about these national cultures and the cultural dimensions discussed in class, how do you interpret the accuracy of this information?arrow_forwardI need help with this solution for accountingarrow_forwardGeneral accountingarrow_forward

- You want to buy a $259,000 home. You plan to pay 10% as a down payment and take out a 30- year loan for the rest. a) How much is the loan amount going to be? b) What will your monthly payments be if the interest rate is 5%? c) What will your monthly payments be if the interest rate is 6%?arrow_forwardI need help with solution accountingarrow_forwardPlease provide correct solution and accountingarrow_forward

- Mega Company believes the price of oil will increase in the coming months. Therefore, it decides to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On November 30, 20X1, Mega purchases call options for 14,000 barrels of oil at $30 per barrel at a premium of $2 per barrel with a March 1, 20X2, call date. The following is the pricing information for the term of the call: Date Spot Price Futures Price (for March 1, 20X2, delivery) November 30, 20X1 $ 30 $ 31 December 31, 20X1 31 32 March 1, 20X2 33 The information for the change in the fair value of the options follows: Date Time Value Intrinsic Value Total Value November 30, 20X1 $ 28,000 $ –0– $ 28,000 December 31, 20X1 6,000 14,000 20,000 March 1, 20X2 42,000 42,000 On March 1, 20X2, Mega sells the options at their value on that date and acquires 14,000 barrels of oil at the spot price. On June 1, 20X2, Mega sells the…arrow_forwardTex Hardware sells many of its products overseas. The following are some selected transactions. Tex sold electronic subassemblies to a firm in Denmark for 120,000 Danish kroner (Dkr) on June 6, when the exchange rate was Dkr 1 = $0.1750. Collection was made on July 3 when the rate was Dkr 1 = $0.1753. On July 22, Tex sold copper fittings to a company in London for £35,000 with payment due on September 20. Also, on July 22, Tex entered into a 60-day forward contract to sell £35,000 at a forward rate of £1 = $1.630. The forward contract is not designated as a hedge. The spot rates follow: July 22 £1 = $1.580 September 20 £1 = $1.612 Tex sold storage devices to a Canadian firm for C$71,000 (Canadian dollars) on October 11, with payment due on November 10. On October 11, Tex entered into a 30-day forward contract to sell Canadian dollars at a forward rate of C$1 = $0.730. The forward contract is not designated as a hedge. The spot rates were as follows: October 11 C$1 =…arrow_forwardI want the correct answer is accountingarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning