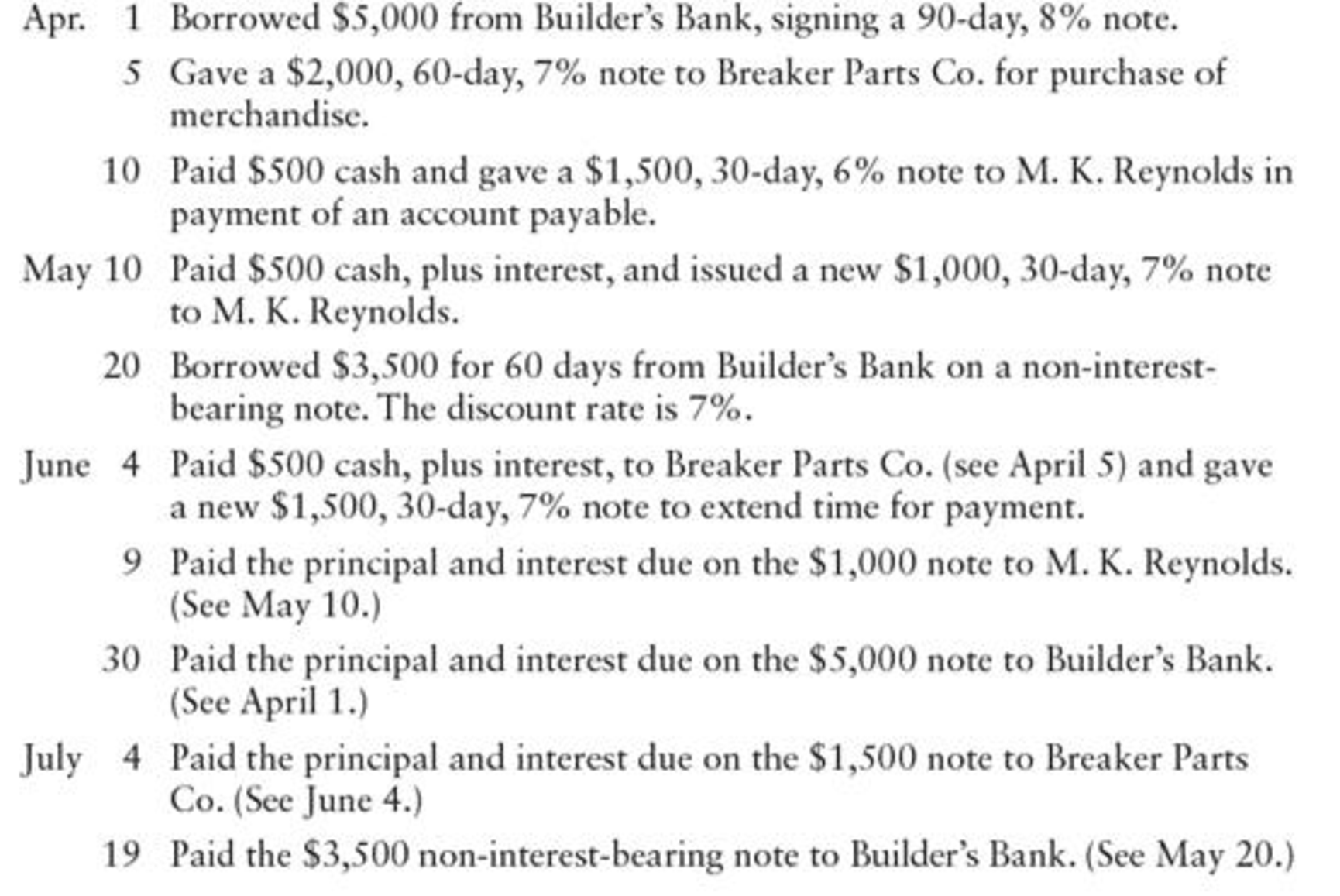

NOTES PAYABLE ENTRIES Milo Radio Shop had the following notes payable transactions:

REQUIRED

Record the transactions in a general journal.

Prepare journal entry to record the following transactions of MR Shop.

Explanation of Solution

Note Payable:

Note payable is an obligation of the business to pay to its creditors in future for the benefits received that carries some interest.

Prepare journal entry to record the following transactions of MR Shop are shown below:

| Date | Account titles and Explanation | Debit | Credit |

| April 1 | Cash | $5,000 | |

| Notes payable | $5,000 | ||

| (To record note issued for bank loan) | |||

| April 5 | Purchases | $2,000 | |

| Notes payable | $2,000 | ||

| (To record note issued for inventory purchase) | |||

| April 10 | Accounts payable - M.K.R | $2,000 | |

| Cash | $500 | ||

| Notes payable | $1,500 | ||

| (To record partial payment made and issued note to settle account) | |||

| May 10 | Notes payable (old note) | $1,500 | |

| Interest expense (1) | $7.50 | ||

| Cash | $507.50 | ||

| Notes payable (new note) | $1,000 | ||

| (To record paid interest and part of partial of principal on old note and issued new note) | |||

| May 20 | Cash (3) | $3,459.17 | |

| Discount on bonds payable (2) | $40.83 | ||

| Notes payable | $3,500 | ||

| (To record issued note for bank loan) | |||

| June 4 | Notes payable (old note) | $2,000 | |

| Interest expense (4) | $23.33 | ||

| Cash | $523.33 | ||

| Notes payable (new note) | $1,500 | ||

| (To record paid interest and part of partial of principal on old note and issued new note) | |||

| June 9 | Notes payable | $1,000 | |

| Interest expense (5) | $5.83 | ||

| Cash | $1,005.83 | ||

| (To record paid note with interest at maturity) | |||

| June 30 | Notes payable | $5,000 | |

| Interest expense (6) | $100 | ||

| Cash | $5,100 | ||

| (To record paid note with interest at maturity) | |||

| July 4 | Notes payable | $1,500 | |

| Interest expense (7) | $8.75 | ||

| Cash | $1,508.75 | ||

| (To record paid note with interest at maturity) | |||

| July 19 | Notes payable | $3,500 | |

| Interest expense (8) | $40.83 | ||

| Discount on notes payable | $40.83 | ||

| Cash | $3,500 | ||

| (To record paid note at maturity) |

Table (1)

Working notes:

(1)Calculate interest expenses.

(2)Calculate discount on notes payable.

(3)Calculate cash proceeds.

(4)Calculate interest expense.

(5)Calculate interest expense.

(6)Calculate interest expense.

(7)Calculate interest expense.

(8)Calculate interest expense.

Want to see more full solutions like this?

Chapter 17 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

- Define in detail the following in relation to Organizational Ethics. The Ethical Culture of an organization. Define these Five Signs of Ethical Collapse a) Pressure to maintain the numbers b) Fear of reprisals c) Loyalty to the boss d) Innovations e) Goodness in some areas, atones for evil in othersarrow_forwardCalculate the stock in the beginningarrow_forwardI need help with this problem and accountingarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage