Construction Accounting And Financial Management (4th Edition)

4th Edition

ISBN: 9780135232873

Author: Steven J. Peterson MBA PE

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 17, Problem 13P

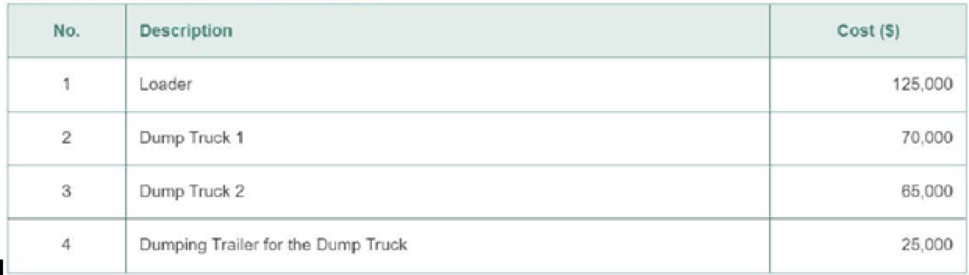

A manager has up to $190.000 available to invest in new construction equipment for the company. The manager must purchase a new dump truck and does not have a need for a second dump truck. The dumping trailer can only be purchased along with a dump truck. From the list of possible equipment in Table 17-11, identify all of the mutually exclusive alternatives and identify which of the alternatives are not acceptable.

Table 17-11 Alternatives for Problem 13

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Coronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a

commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi-

purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of

multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct

labor hours are 96,300 or [1.5 hours x (54,000+10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the

predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for

the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial

models.

The company's managers identified six activity cost pools and related…

Coronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a

commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi-

purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of

multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct

labor hours are 96,300 or [1.5 hours x (54,000+ 10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the

predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for

the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial

models.

The company's managers identified six activity cost pools and related…

The completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated.

Required:

Using the payroll registers, complete the General Journal entries as follows:

February 10 Journalize the employee pay.

February 10 Journalize the employer payroll tax for the February 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base.

February 14 Issue the employee pay.

February 24 Journalize the employee pay.

February 24 Journalize the employer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base.

February 28 Issue the employee pay.

February 28 Issue payment for the payroll liabilities.

March 10 Journalize the employee pay.

March 10 Journalize the employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base.…

Chapter 17 Solutions

Construction Accounting And Financial Management (4th Edition)

Ch. 17 - What is the do nothing alternative?Ch. 17 - Why is it important to compare all possible...Ch. 17 - What is a sunk cost? How should sunk costs be...Ch. 17 - Prob. 4DQCh. 17 - Prob. 5DQCh. 17 - What is a study period? Why must all of the...Ch. 17 - Why do the NPV, the future worth, and the annual...Ch. 17 - Why must you use mutually exclusive alternatives...Ch. 17 - Why would one use the capital recovery with return...Ch. 17 - What are the weaknesses of the payback period...

Ch. 17 - What types of investments does the payback period...Ch. 17 - What is the advantage of using the project balance...Ch. 17 - A manager has up to 190.000 available to invest in...Ch. 17 - A manager has up to 200,000 available to invest in...Ch. 17 - Determine the MARR for a company that can borrow...Ch. 17 - Determine the MARR for a company that can invest...Ch. 17 - Your company is looking at purchasing a dump truck...Ch. 17 - Your company is looking at purchasing a loader at...Ch. 17 - Your company needs to purchase a new track hoe and...Ch. 17 - Your company needs to purchase a new track hoe and...Ch. 17 - Your company needs to purchase a track hoe and has...Ch. 17 - Your company needs to purchase a truck and has...Ch. 17 - Prob. 23PCh. 17 - Determine the incremental net present value for...Ch. 17 - Determine the future worth for Problem 17. Should...Ch. 17 - Determine the future worth for Problem 18. Should...Ch. 17 - Prob. 27PCh. 17 - Determine the annual equivalent for Problem 18....Ch. 17 - Determine the rate of return for Problem 17....Ch. 17 - Determine the rate of return for Problem 18....Ch. 17 - Your company has 100,000 to invest and has...Ch. 17 - Your company has 200,000 to invest and has...Ch. 17 - Determine the incremental rate of return for...Ch. 17 - Prob. 34PCh. 17 - Your company has purchased a new track hoe for...Ch. 17 - Your company has purchased a new excavator for...Ch. 17 - Determine the payback period without interest for...Ch. 17 - Determine the payback period without interest for...Ch. 17 - Prob. 39PCh. 17 - Determine the payback period with interest for...Ch. 17 - Draw a project balance chart for Problem 17.Ch. 17 - Draw a project balance chart for Problem 18.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License