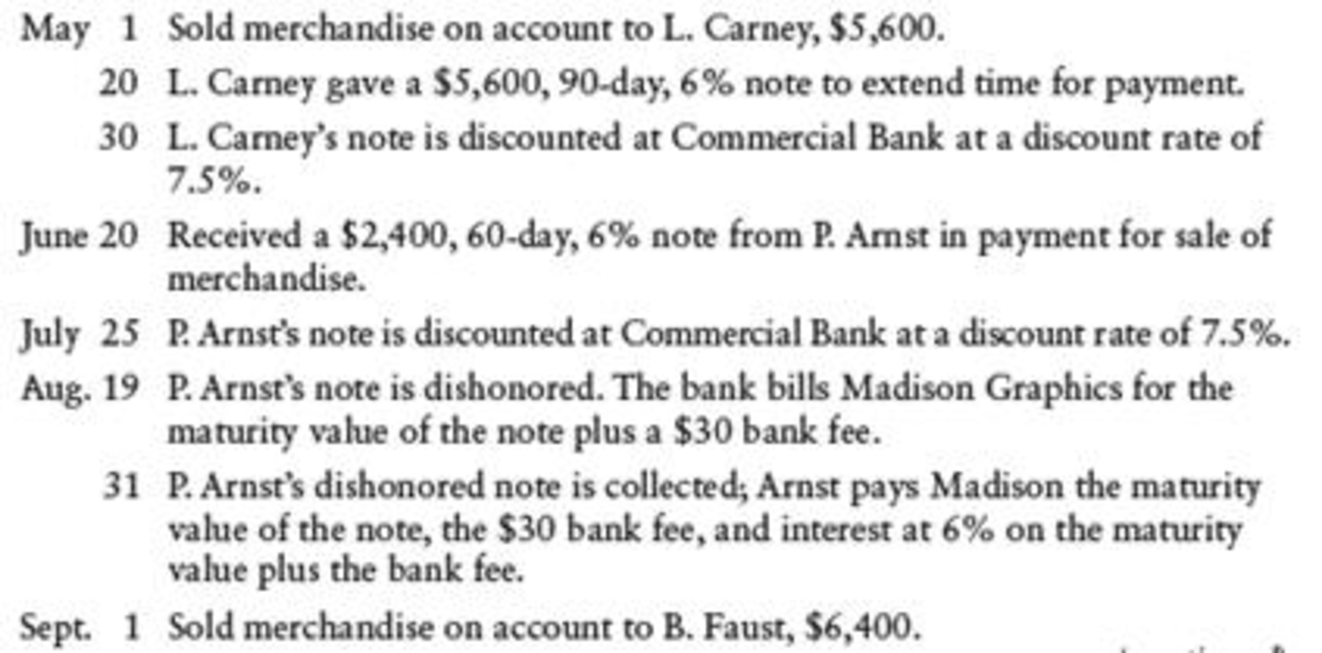

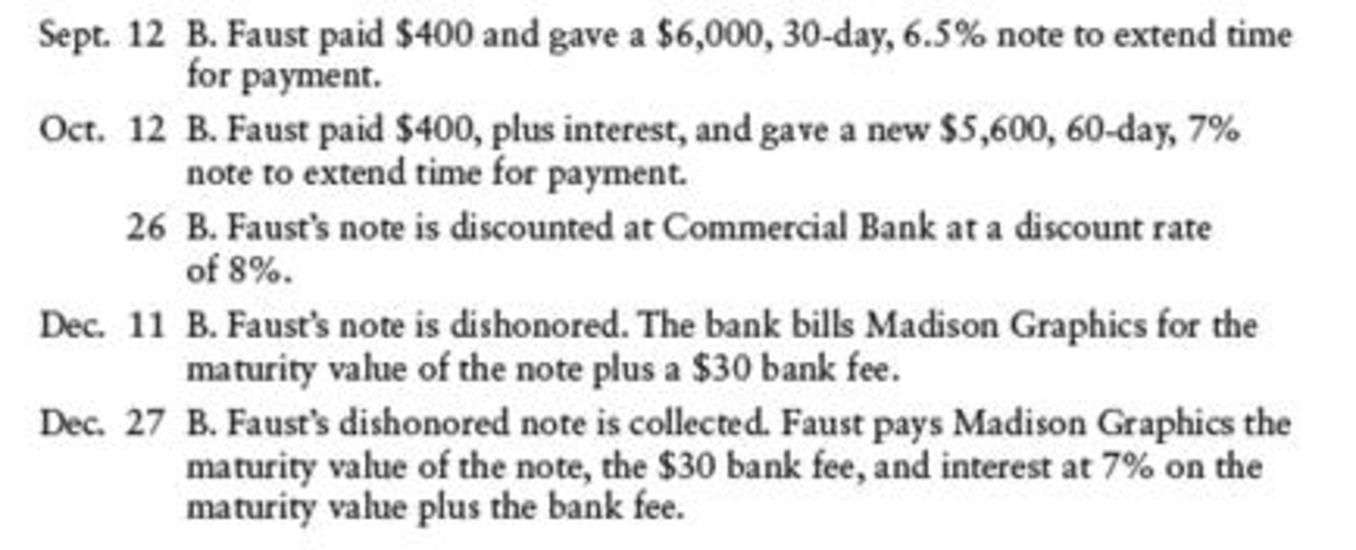

NOTES RECEIVABLE DISCOUNTING Madison Graphics had the following notes receivable transactions:

REQUIRED

Record the transactions in a general journal.

Prepare a journal entry to record Suppliers MG.

Explanation of Solution

Note receivable:

Note receivable refers to a written promise for the amounts to be received within a stipulated period of time. This written promise is issued by a debtor or, borrower to the lender or creditor. Notes receivable is an asset of a business.

| Date | Account titles and Explanation | Debit | Credit |

| May 1 | Accounts receivable -L.C | $5,600 | |

| Sales | $5,600 | ||

| (To record sale made on account) | |||

| May 20 | Notes receivable | $5,600 | |

| Accounts receivable - L.C | $5,600 | ||

| (To record received note to settle account) | |||

| May 30 | Cash (1) | $5,589.27 | |

| Interest expense (2) | $10.73 | ||

| Notes receivable | $5,600 | ||

| (To record discount on notes receivable) | |||

| June 20 | Notes receivable | $2,400 | |

| Sales | $2,400 | ||

| (To record received note for merchandise sale) | |||

| July 25 | Cash (3) | $2,411.37 | |

| Notes receivable | $2,400 | ||

| Interest revenue (4) | $11.37 | ||

| (To record received payment of note with interest) | |||

| August 19 | Accounts receivable - P.A | $2,454 | |

| Cash | $2,454 | ||

| (To record cash paid for dishonoured note) | |||

| August 31 | Cash | $2,458.91 | |

| Accounts receivable - D. L | $2,454 | ||

| Interest revenue (5) | $4.91 | ||

| (To record Collected dishonoured note with interest) | |||

| September 1 | Accounts receivable - B.F | $6,400 | |

| Sales | $6,400 | ||

| (To record sale made on account) | |||

| September 12 | Cash | $400 | |

| Notes receivable | $5,600 | ||

| Accounts receivable - A.B | $6,000 | ||

| (To record cash received and note to settle account) | |||

| October 12 | Cash (6) | $432.50 | |

| Notes receivable (new note) | $5,600 | ||

| Notes receivable (old note) | $6,000 | ||

| Interest revenue (7) | $32.50 | ||

| (To record received new note plus interest on old note) | |||

| October 26 | Cash | $5,607.42 | |

| Notes receivable | $5,600 | ||

| Interest revenue | $7.42 | ||

| (To record received payment of note with interest) | |||

| December 11 | Accounts receivable – B.F | $5,695.33 | |

| Cash | $5,695.33 | ||

| (To record cash paid for dishonoured note) | |||

| December 27 | Cash | $5,713.05 | |

| Accounts receivable - A.B | $5,695.33 | ||

| Interest revenue (8) | $17.72 | ||

| (To record Collected dishonoured note with interest) |

Table (1)

Working notes:

(1)Calculate cash proceeds.

(2)Calculate interest expense.

(3)Calculate cash proceeds.

(4)Calculate interest revenue.

(5)Calculate interest revenue.

(6)Calculate interest revenue.

(6)Calculate cash proceeds.

(7)Calculate interest revenue.

(8)Calculate interest revenue.

Want to see more full solutions like this?

Chapter 17 Solutions

College Accounting, Chapters 1-9 (New in Accounting from Heintz and Parry)

- The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $520,000; Office salaries, $104,000; Federal income taxes withheld, $156,000; State income taxes withheld, $35,000; Social security taxes withheld, $38,688; Medicare taxes withheld, $9,048; Medical insurance premiums, $12,500; Life insurance premiums, $9,500; Union dues deducted, $6,500; and Salaries subject to unemployment taxes, $61,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%. 1. & 2. Using the above information, complete the below table and prepare the journal entries to record accrued payroll, including employee deductions, and cash payment of the net payroll (salaries payable) for July. 3. Using the above information, complete the below table. 4. Record the accrued employer payroll taxes and other related employment expenses and the cash payment of all liabilities…arrow_forwardAt the beginning of the year, Vanguard Systems, Inc. determined that estimated overhead costs would be $720,000, while actual overhead costs for the year totaled $770,000. Furthermore, it was determined that the estimated allocation basis would be 75,000 direct labor hours, while direct laborers actually worked 78,000 hours. What was the dollar amount of underallocated or overallocated manufacturing overhead?arrow_forwardWhat are impaired assets and its pros and cons?arrow_forward

- Ming Chen started a business and had the following transactions in June. a. Owner invested $60,000 cash in the company along with $15,000 of equipment. b. The company paid $2,000 cash for rent of office space for the month. c. The company purchased $18,000 of additional equipment on credit (payment due within 30 days). d. The company completed work for a client and immediately collected $1,600 cash. e. The company completed work for a client and sent a bill for $7,300 to be received within 30 days. f. The company purchased additional equipment for $5,000 cash. g. The company paid an assistant $2,400 cash as wages for the month. h. The company collected $4,500 cash as a partial payment for the amount owed by the client in transaction e. i. The company paid $18,000 cash to settle the liability created in transaction c. j. The owner withdrew $1,500 cash from the company for personal use.arrow_forwardNeed answer the financial accounting question not use aiarrow_forwardGet correct answer the general accounting questionarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,