ESSENTIALS CORPORATE FINANCE + CNCT A.

9th Edition

ISBN: 9781259968723

Author: Ross

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 9QP

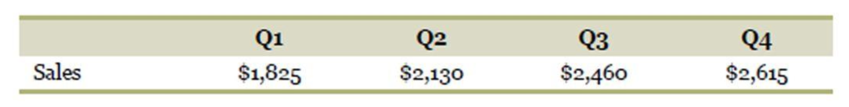

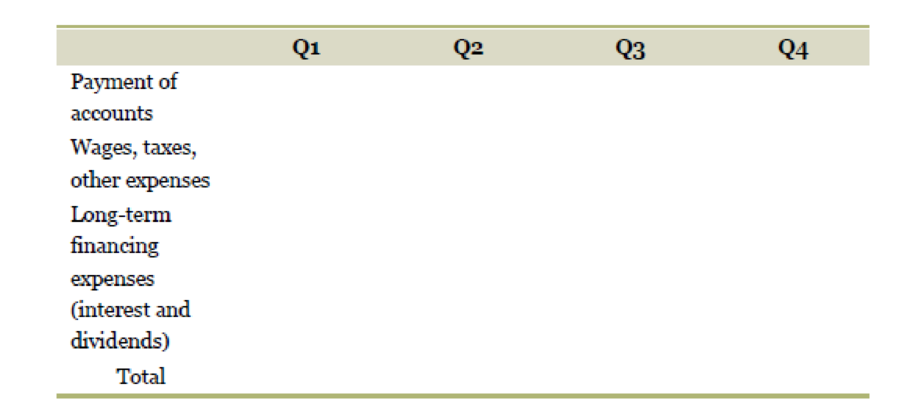

Calculating Payments. The Sepulcro Corporation’s purchases from suppliers in a quarter are equal to 75 percent of the next quarter’s

Sales for the first quarter of the following year are projected at $2,230. Calculate the company’s cash outlays by completing the following:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You plan to save $X per year for 6 years, with your first savings contribution in 1 year. You and your heirs then plan to withdraw

$43,246 per year forever, with your first withdrawal expected in 7 years. What is X if the expected return per year is 18.15 percent per

year?

Input instructions: Round your answer to the nearest dollar.

59

$

Are there assets for which a value might be considered to be hard to determine?

You plan to save $X per year for 7 years, with your first savings contribution in 1 year. You and your heirs then plan to make annual

withdrawals forever, with your first withdrawal expected in 8 years. The first withdrawal is expected to be $43,596 and all subsequent

withdrawals are expected to increase annually by 1.84 percent forever. What is X if the expected return per year is 11.34 percent per

year?

Input instructions: Round your answer to the nearest dollar.

$

Chapter 16 Solutions

ESSENTIALS CORPORATE FINANCE + CNCT A.

Ch. 16.1 - What is the difference between net working capital...Ch. 16.1 - Prob. 16.1BCQCh. 16.1 - Prob. 16.1CCQCh. 16.1 - List five potential sources of cash.Ch. 16.2 - What does it mean to say that a firm has an...Ch. 16.2 - Prob. 16.2BCQCh. 16.2 - Prob. 16.2CCQCh. 16.3 - Prob. 16.3ACQCh. 16.3 - Prob. 16.3BCQCh. 16.4 - Prob. 16.4ACQ

Ch. 16.4 - Prob. 16.4BCQCh. 16.5 - What are the two basic forms of short-term...Ch. 16.5 - Prob. 16.5BCQCh. 16.6 - Prob. 16.6ACQCh. 16.6 - Prob. 16.6BCQCh. 16 - Prob. 16.1CCh. 16 - Prob. 16.2CCh. 16 - Prob. 16.3CCh. 16 - Prob. 16.5CCh. 16 - Operating Cycle. What are some of the...Ch. 16 - Prob. 2CTCRCh. 16 - Prob. 3CTCRCh. 16 - Cost of Current Assets. Kane Manufacturing. Inc.,...Ch. 16 - Prob. 5CTCRCh. 16 - Prob. 6CTCRCh. 16 - Prob. 7CTCRCh. 16 - Use the following information to answer Questions...Ch. 16 - Prob. 9CTCRCh. 16 - Prob. 10CTCRCh. 16 - Prob. 1QPCh. 16 - Prob. 2QPCh. 16 - Changes in the Operating Cycle. Indicate the...Ch. 16 - Prob. 4QPCh. 16 - Calculating Cash Collections. The Jallouk Company...Ch. 16 - Prob. 6QPCh. 16 - Prob. 7QPCh. 16 - Calculating Payments. Brunell Products has...Ch. 16 - Calculating Payments. The Sepulcro Corporations...Ch. 16 - Prob. 10QPCh. 16 - Calculating the Cash Budget. Here are some...Ch. 16 - Prob. 12QPCh. 16 - Costs of Borrowing. In exchange for a 400 million...Ch. 16 - Costs of Borrowing. Come and Go Bank offers your...Ch. 16 - Prob. 13QPCh. 16 - Costs of Borrowing. A bank offers your firm a...Ch. 16 - Cash and Operating Cycles. Calvani, Inc., has a...Ch. 16 - Prob. 16QPCh. 16 - Prob. 1CC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You plan to save $41,274 per year for 4 years, with your first savings contribution later today. You then plan to make X withdrawals of $41,502 per year, with your first withdrawal expected in 4 years. What is X if the expected return per year is 8.28 percent per year? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardYou plan to save $X per year for 10 years, with your first savings contribution in 1 year. You then plan to withdraw $58,052 per year for 9 years, with your first withdrawal expected in 10 years. What is X if the expected return is 7.41 percent per year? Input instructions: Round your answer to the nearest dollar. 69 $arrow_forwardYou plan to save $X per year for 7 years, with your first savings contribution later today. You then plan to withdraw $30,818 per year for 5 years, with your first withdrawal expected in 8 years. What is X if the expected return per year is 6.64 percent per year? Input instructions: Round your answer to the nearest dollar. $arrow_forward

- You plan to save $24,629 per year for 8 years, with your first savings contribution in 1 year. You then plan to withdraw $X per year for 7 years, with your first withdrawal expected in 8 years. What is X if the expected return per year is 5.70 percent per year? Input instructions: Round your answer to the nearest dollar. $ SAarrow_forwardYou plan to save $15,268 per year for 7 years, with your first savings contribution later today. You then plan to withdraw $X per year for 9 years, with your first withdrawal expected in 8 years. What is X if the expected return per year is 10.66 percent per year? Input instructions: Round your answer to the nearest dollar. GA $arrow_forwardYou plan to save $19,051 per year for 5 years, with your first savings contribution in 1 year. You then plan to make X withdrawals of $30,608 per year, with your first withdrawal expected in 5 years. What is X if the expected return per year is 14.61 percent per year? Input instructions: Round your answer to at least 2 decimal places.arrow_forward

- What is the value of a building that is expected to generate no cash flows for several years and then generate annual cash flows forever if the first cash flow is expected in 10 years, the first cash flow is expected to be $49,900, all subsequent cash flows are expected to be 3.42 percent higher than the previous cash flow, and the cost of capital is 15.90 percent per year? Input instructions: Round your answer to the nearest dollar. $arrow_forwardYou plan to save $X per year for 8 years, with your first savings contribution later today. You and your heirs then plan to make annual withdrawals forever, with your first withdrawal expected in 9 years. The first withdrawal is expected to be $29,401 and all subsequent withdrawals are expected to increase annually by 3.08 percent forever. What is X if the expected return per year is 9.08 percent per year? Input instructions: Round your answer to the nearest dollar. 59 $arrow_forwardYou own investment A and 10 bonds of bond B. The total value of your holdings is $12,185.28. Bond B has a coupon rate of 18.82 percent, par value of $1000, YTM of 15.36 percent, 7 years until maturity, and semi-annual coupons with the next coupon expected in 6 months. Investment A is expected to pay $X per year for 12 years, has an expected return of 19.64 percent, and is expected to make its first payment later today. What is X? Input instructions: Round your answer to the nearest dollar. 59 $arrow_forward

- You plan to save $X per year for 8 years, with your first savings contribution later today. You then plan to withdraw $43,128 per year for 6 years, with your first withdrawal expected in 8 years. What is X if the expected return per year is 13.14 percent per year? Input instructions: Round your answer to the nearest dollar. 59 $arrow_forwardYou plan to save $X per year for 6 years, with your first savings contribution in 1 year. You then plan to withdraw $20,975 per year for 8 years, with your first withdrawal expected in 7 years. What is X if the expected return is 13.29 percent per year? Input instructions: Round your answer to the nearest dollar. 59 $arrow_forwardYou plan to save $X per year for 7 years, with your first savings contribution later today. You and your heirs then plan to withdraw $31,430 per year forever, with your first withdrawal expected in 8 years. What is X if the expected return per year is 14.95 percent per year per year? Input instructions: Round your answer to the nearest dollar. 6A $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

INVENTORY & COST OF GOODS SOLD; Author: Accounting Stuff;https://www.youtube.com/watch?v=OB6RDzqvNbk;License: Standard Youtube License