College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 8SPB

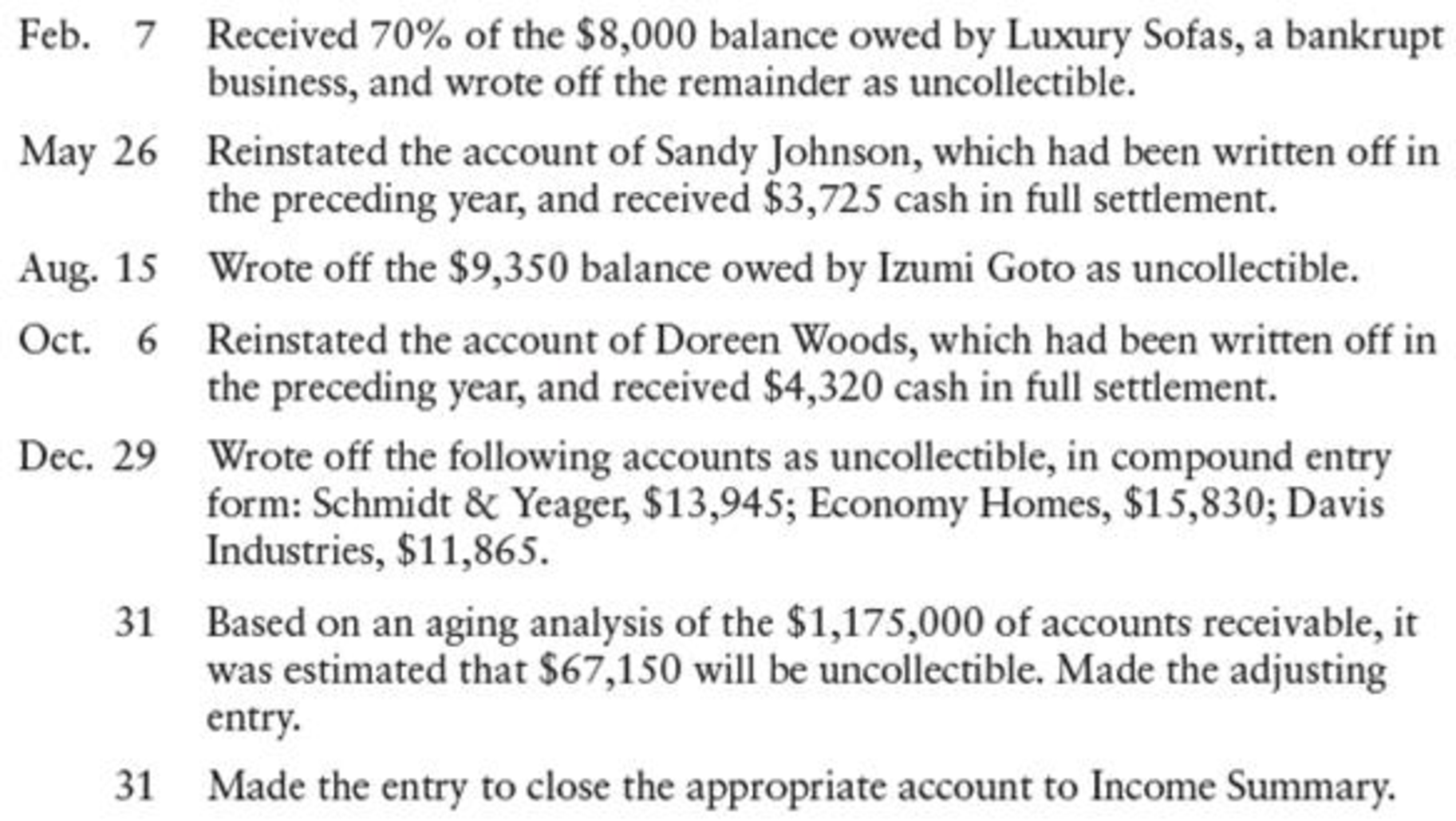

UNCOLLECTIBLE ACCOUNTS—ALLOWANCE METHOD Lewis Warehouse used the allowance method to record the following transactions,

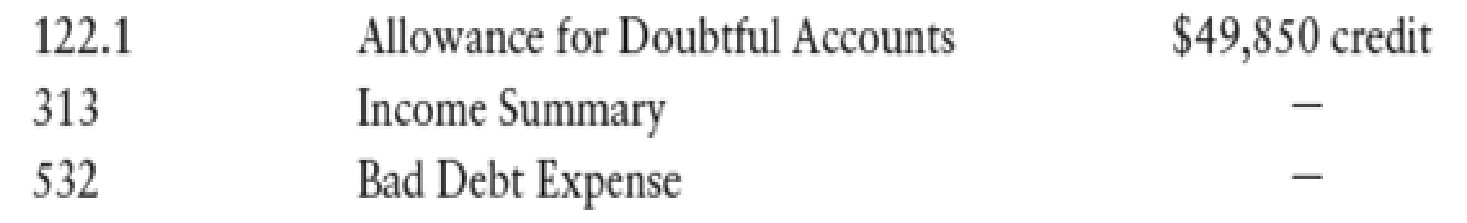

Selected accounts and beginning balances on January 1, 20--, are as follows:

REQUIRED

- 1. Open the three selected general ledger accounts.

- 2. Enter the transactions and the adjusting and closing entries in a general journal (page 6). After each entry, post to the appropriate selected accounts.

- 3. Determine the net realizable value as of December 31, 20--.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

hi expert please help me

need help this answer

For each of the transactions above, indicate the amount of the adjusting entry on the elements of the balance sheet and income statement.Note: Enter negative amounts with a minus sign.

Chapter 16 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

Ch. 16 - There are two methods of accounting for...Ch. 16 - The matching principle states that debits should...Ch. 16 - Using the percentage of sales method, the balance...Ch. 16 - When an account is written off under the allowance...Ch. 16 - Each time an account is written off under the...Ch. 16 - The dollar difference between Accounts Receivable...Ch. 16 - A business has an ending balance in Accounts...Ch. 16 - A business has an ending balance in Accounts...Ch. 16 - Prob. 4MCCh. 16 - Under the allowance method, when an account is...

Ch. 16 - Prob. 1CECh. 16 - Tonis Tech Shop has total credit sales for the...Ch. 16 - Fionas Pharmacy uses the direct write-off method...Ch. 16 - Prob. 1RQCh. 16 - Prob. 2RQCh. 16 - Prob. 3RQCh. 16 - Prob. 4RQCh. 16 - Prob. 5RQCh. 16 - Prob. 6RQCh. 16 - Prob. 7RQCh. 16 - Under the allowance method, what journal entries...Ch. 16 - Prob. 9RQCh. 16 - Prob. 10RQCh. 16 - CALCULATION OF NET REALIZABLE VALUE L. R. Updike...Ch. 16 - UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES Rossins...Ch. 16 - UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF RECEIVABLES...Ch. 16 - COLLECTION OF ACCOUNTS WRITTEN OFFALLOWANCE METHOD...Ch. 16 - UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND...Ch. 16 - DIRECT WRITE-OFF METHOD Maria Rivera, owner of...Ch. 16 - COLLECTION OF ACCOUNT WRITTEN OFFDIRECT WRITE-OFF...Ch. 16 - UNCOLLECTIBLE ACCOUNTSALLOWANCE METHOD Pyle...Ch. 16 - UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND...Ch. 16 - AGING ACCOUNTS RECEIVABLE An analysis of the...Ch. 16 - DIRECT WRITE-OFF METHOD Williams Hendricks...Ch. 16 - CALCULATION OF NET REALIZABLE VALUE Mary Martin...Ch. 16 - UNCOLLECTIBLE ACCOUNTS-PERCENTAGE OF SALES Nicoles...Ch. 16 - UNCOLLECTIBLE ACCOUNTS-PERCENTAGE OF RECEIVABLES...Ch. 16 - COLLECTION OF ACCOUNT WRITTEN OFFALLOWANCE METHOD...Ch. 16 - UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND...Ch. 16 - DIRECT WRITE-OFF METHOD Brent Mussellman, owner of...Ch. 16 - COLLECTION OF ACCOUNT WRITTEN OFFDIRECT WRITE-OFF...Ch. 16 - UNCOLLECTIBLE ACCOUNTSALLOWANCE METHOD Lewis...Ch. 16 - UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND...Ch. 16 - AGING ACCOUNTS RECEIVABLE An analysis of the...Ch. 16 - DIRECT WRITE-OFF METHOD Lee and Chen Distributors...Ch. 16 - Sam and Robert are identical twins. They opened...Ch. 16 - Martel Co. has 320,000 in Accounts Receivable on...Ch. 16 - Prob. 2CPCh. 16 - At the end of 20-3, Martel Co. had 410,000 in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kindly help me with accounting questionsarrow_forwardDuo Corporation is evaluating a project with the following cash flows: Year 0 1 2 3 Cash Flow -$ 30,000 12,200 14,900 16,800 4 5 13,900 -10,400 The company uses an interest rate of 8 percent on all of its projects. a. Calculate the MIRR of the project using the discounting approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. Calculate the MIRR of the project using the reinvestment approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. c. Calculate the MIRR of the project using the combination approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Discounting approach MIRR b. Reinvestment approach MIRR c. Combination approach MIRR % % %arrow_forwardHello tutor please provide this question solution general accountingarrow_forward

- Need help with this question solution general accountingarrow_forwardConsider a four-year project with the following information: Initial fixed asset investment = $555,000; straight-line depreciation to zero over the four-year life; zero salvage value; price = $37; variable costs = $25; fixed costs = $230,000; quantity sold = 79,000 units; tax rate = 24 percent. How sensitive is OCF to changes in quantity sold?arrow_forwardLight emitting diodes (LED) light bulbs have become required in recent years, but do they make financial sense? Suppose a typical 60-watt incandescent light bulb costs $.39 and lasts 1,000 hours. A 15-watt LED, which provides the same light, costs $3.10 and lasts for 12,000 hours. A kilowatt-hour of electricity costs $.115. A kilowatt-hour is 1,000 watts for 1 hour. If you require a return of 11 percent and use a light fixture 500 hours per year, what is the equivalent annual cost of each light bulb? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License