Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 6SE

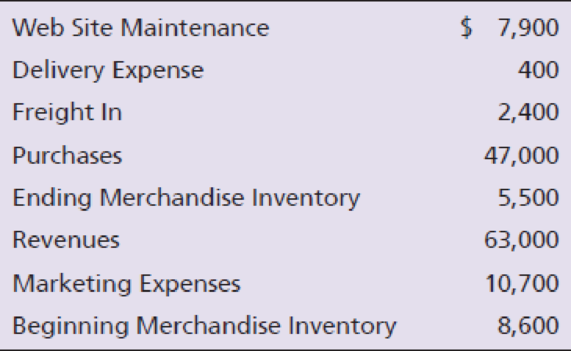

Use the following information for The Windshield Helper, a retail merchandiser of auto windshields, to compute the cost of goods sold:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you please solve this questions

help me to solve this question

How many units must be sold to reach this profit goal ? General accounting

Chapter 16 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. 16 - Identify the following characteristics as...Ch. 16 - Identify the following characteristics as...Ch. 16 - Identify the following characteristics as...Ch. 16 - Identify the following characteristics as...Ch. 16 - Identify the following characteristics as...Ch. 16 - Prob. 6TICh. 16 - Prob. 7TICh. 16 - Prob. 8TICh. 16 - Identify each cost as a period cost or a product...Ch. 16 - Identify each cost as a period cost or a product...

Ch. 16 - Prob. 11TICh. 16 - ABC Manufacturing Company has the following data...Ch. 16 - Prob. 13TICh. 16 - Match the definition to the key term. Value chain...Ch. 16 - Match the definition to the key term. 13. Triple...Ch. 16 - Prob. 16TICh. 16 - Prob. 17TICh. 16 - Prob. 18TICh. 16 - Prob. 1QCCh. 16 - Prob. 2QCCh. 16 - Dunaway Company reports the following costs for...Ch. 16 - Which of the following is a direct cost of...Ch. 16 - Which of the following is not part of...Ch. 16 - Prob. 6QCCh. 16 - Suppose a bakery reports the following...Ch. 16 - What is the cost of goods manufactured? a. 151,000...Ch. 16 - World-class businesses use which of these systems...Ch. 16 - Todays business environment is characterized by a....Ch. 16 - Prob. 1RQCh. 16 - List six differences between financial accounting...Ch. 16 - Explain the difference between line positions and...Ch. 16 - Prob. 4RQCh. 16 - Prob. 5RQCh. 16 - Describe a service company, and give an example.Ch. 16 - Prob. 7RQCh. 16 - Prob. 8RQCh. 16 - Prob. 9RQCh. 16 - Explain the difference between a direct cost and...Ch. 16 - What are the three manufacturing costs for a...Ch. 16 - Give five examples of manufacturing overhead.Ch. 16 - What are prime costs? Conversion costs?Ch. 16 - What are product costs?Ch. 16 - How do period costs differ from product costs?Ch. 16 - How is cost of goods manufactured calculated?Ch. 16 - Prob. 17RQCh. 16 - Prob. 18RQCh. 16 - How does a service company calculate unit cost per...Ch. 16 - Prob. 20RQCh. 16 - Prob. 1SECh. 16 - Prob. 2SECh. 16 - Granger Cards is a manufacturer of greeting cards....Ch. 16 - Computing manufacturing overhead Sunglasses...Ch. 16 - Identifying product costs and period costs...Ch. 16 - Use the following information for The Windshield...Ch. 16 - Prob. 7SECh. 16 - Computing direct materials used Tuscany, Inc. has...Ch. 16 - Computing cost of goods manufactured Use the...Ch. 16 - Use the following information to calculate the...Ch. 16 - Match the term with the correct definition. 1. A...Ch. 16 - Marx and Tyler provides hair-cutting services in...Ch. 16 - Comparing managerial accounting and financial...Ch. 16 - Prob. 14ECh. 16 - Wheels, Inc. manufactures wheels for bicycles,...Ch. 16 - Identifying differences between service,...Ch. 16 - Prob. 17ECh. 16 - Selected data for three companies are given below....Ch. 16 - Computing cost of goods manufactured Consider the...Ch. 16 - Wilson Corp., a lamp manufacturer, provided the...Ch. 16 - Computing cost of goods manufactured and cost of...Ch. 16 - Match the following terms to the appropriate...Ch. 16 - Buddy Grooming provides grooming services for...Ch. 16 - Conway Brush Company sells standard hair brushes....Ch. 16 - Natalia Wallace is the new controller for Smart...Ch. 16 - Lawlor, Inc. is the manufacturer of lawn care...Ch. 16 - Prob. 27APCh. 16 - Gourmet Bones manufactures its own brand of pet...Ch. 16 - Preparing a schedule of cost of goods manufactured...Ch. 16 - Root Shoe Company makes loafers. During the most...Ch. 16 - The Windshield Doctors repair chips in car...Ch. 16 - Prob. 32APCh. 16 - Ava Borzi is the new controller for Halo Software,...Ch. 16 - Langley, Inc. is the manufacturer of lawn care...Ch. 16 - Below are data for two companies: Requirements 1....Ch. 16 - Chewy Bones manufactures its own brand of pet chew...Ch. 16 - Prob. 37BPCh. 16 - True Fit Shoe Company makes loafers. During the...Ch. 16 - The Glass Doctors repair chips in car windshields....Ch. 16 - Prob. 40BPCh. 16 - This is the first problem in a sequence of...Ch. 16 - Winnebago Industries, Inc. is a leading...Ch. 16 - Prob. 1DCCh. 16 - Prob. 1EICh. 16 - In 100 words or fewer, explain the difference...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Real options and its types. Introduction: The net present value is the variation between present cash inflows v...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

A typical discounted price of a AAA battery is 0.75. It is designed to provide 1.5 volts and 1.0 amps for about...

Engineering Economy (17th Edition)

Explain how to derive a total expenditures (TE) curve.

Macroeconomics

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License