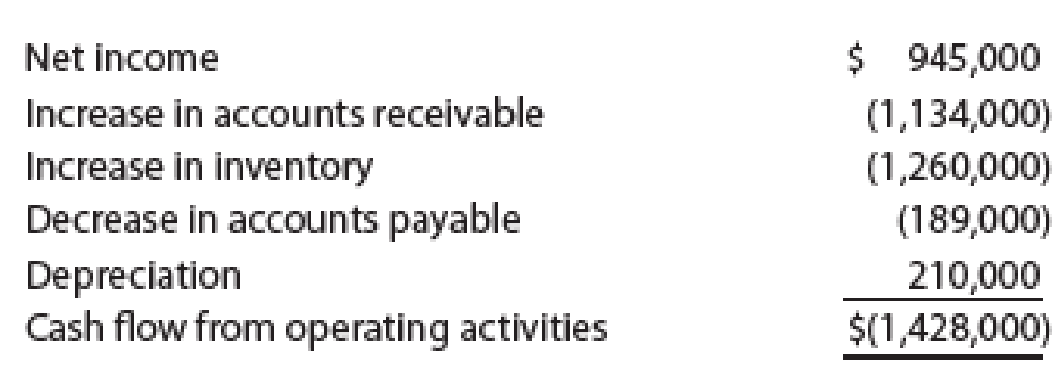

The Commercial Division of Tidewater Inc. provided the following information on its

The manager of the Commercial Division provided the accompanying memo with this report:

From: Senior Vice President, Commercial Division

I am pleased to report that we had earnings of $945,000 over the last period. This resulted in a

Comment on the senior vice president’s memo in light of the cash flow information.

Comment on the senior vice president’s memo in light of the cash flow information.

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

Financial Accounting

- Bridgestone Manufacturing Company's manufacturing overhead is 70% of its total conversion costs. If direct labor is $45,000 and direct materials are $28,000, what is the manufacturing overhead?arrow_forwardWhat is the compliance ratearrow_forwardGreen Tech Industries disposed of an asset at the endarrow_forward

- The kitchen manager at Ruby Restaurant established portion control standards. Daily rice preparation shows 45kg cooked from 15kg raw, against standard yield of 2.8kg cooked per 1kg raw. Kitchen supervisor needs to identify production efficiency. [5 points Financial Accounting]arrow_forwardWW Office Solutions implemented a new supply requisition system. Departments must submit requests by Thursday for next week, maintain minimum 20% buffer stock, and obtain supervisor approval for urgent orders. From 85 total requisitions last month, 65 followed timeline, 72 maintained proper buffer, and 58 met both conditions. What is the compliance rate? Answer this Questionarrow_forwardGet correct solution this financial accounting question without use Aiarrow_forward

- Accurate Answerarrow_forwardPlease answer the financial accounting question not use aiarrow_forwardGreenfield Corp., which owes Oakwood Inc. $750,000 in notes payable with accrued interest of $60,000, is experiencing financial difficulties. To settle the debt, Oakwood agrees to accept from Greenfield machinery with a fair value of $700,000, an original cost of $900,000, and accumulated depreciation of $240,000. Requirements: Compute the gain or loss on the transfer of machinery.arrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning