(A)

To Compute:

What will be the payoff to the put,

Introduction:

The payoff to the put,

Explanation of Solution

Valuation of one year European put option using the two-state approach is described as

follows:

The put price for increase factor of 1.1,

decrease factor of 0.95,

$110.

Calculate the probable value of put, in case stock price increases (

(B)

To Compute:

What will be the payoff,

Introduction:

The payoff,

Explanation of Solution

The hedge ratio at this point can be calculated by using the following formula:

Substitute the value to calculate hedge ratio as follows:

Hence, the hedge ratio is

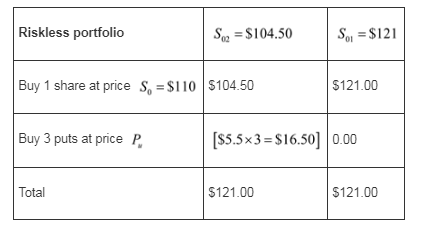

The final stock price of the portfolio that will be worth $121 at expiry regardless of the final stock price is as follows:

The portfolio must have a current market value equal to the

Calculate the value of put in case stock price decreases

The put price for increase factor of 1.1,

decrease factor of 0.95,

$110

Calculation of the hedge ratio:

The hedge ratio at this point can be calculated by using the following formula:

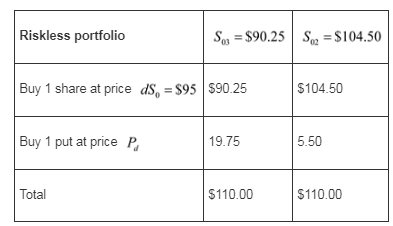

Therefore, the hedge ratio is -1.0

The final stock price of the portfolio that will be worth $110 at expiry is as follows:

The portfolio must have a current market value equal to the present value of $110,which is defined by the following equation:

Hence, the value of put in case stock price decrease is $9.762.

Calculate P using the values of

The put can increase to a value of

Initial value.

The put can fall to a value of

Initial value.

Calculate hedge ratio at this point as follows:

Thus, the payoff,

(C)

To Compute:

Value the put option using the risk-neutral shortcut described in the box. Confirm that your answer matches the value you get using the two-state approach.

Introduction:

Explanation of Solution

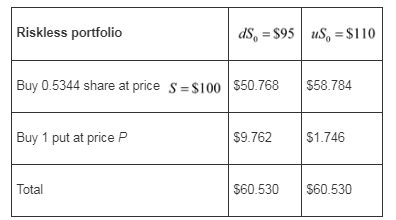

The portfolio will be worth $60.53 at expiry irrespective of the final stock price as follows:

The portfolio must have a market value equal to the present value of $60.53 which is defined by the following equation:

Hence, the value of put option binomial model option pricing is $4.208

Valuation of put option using risk neutral shortcut is described as follows:

Formula for risk neutral probability is as follows:

Here,

u is factor by which stock increases

d is factor by which stock increases

Calculate the risk neutral probability that the stock price will increase as follows:

Calculate the expected cash flows at expiration and discount it by the risk free rate to find

and

Calculate

Calculate

Calculate the expected cash flow in 6 months and discount the E(CF) by the 6 month risk free

Rate as follows:

Hence, the value of put option using risk neutral shortcut is $4.208

Therefore, the value of put option through two state approach and risk neutral shortcut is same, that is, $4.208.

Therefore, the value of put option through two state approach and risk neutral shortcut is same, that is, $4.208.

Want to see more full solutions like this?

Chapter 16 Solutions

Essentials Of Investments

- Beta Company Ltd issued 10% perpetual debt of Rs. 1,00,000. The company's tax rate is 50%. Determine the cost of capital (before tax as well as after tax) assuming the debt is issued at 10 percent premium. helparrow_forwardFinance subject qn solve.arrow_forwardPlease help with questionsarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education