(A)

To Compute:

If the desired put option were traded. How much would it cost to purchase?

Introduction:

The value of put option is calculated using the formula given below.

Explanation of Solution

a) Computation of value of put:

Here, the investor would hold a put position. The current price is $100. This price could either

increase or decrease by 10%

Factor by which stock increases is u

Factor by which stock decreases is d

Calculation of option value

The two possible stock prices are

since, the exercise price is $100, and the corresponding two possible put values are

Calculation of the hedge ratio (H)

The hedge ratio can be calculated by using the following formula:

Here,

The value of the call option in case of in-the-money scenario is

The value of the call option in case of out-of-the-money scenario is

Factor by which stock increases u.

Factor by which stock decreases is d.

Stock price in case stock price increases is

Stock price in case stock price decreases is

Substitute:

Hence, the hedge ratio is -.5

The portfolio combining of two puts and one share brings an assured payoff $ 110 making it a riskless portfolio.

Calculation of the present value of certain stock price of $110 with a one-year interest rate of 5%:

Hence, the present value of certain stock price of $110 with a one-year interest rate of 5% $104.76

Comparing the protective put strategy and present value of stock we get,

One stock and two put options

Solve for the value of put (P):

Hence, the value of put option is $2.38.

Hence, the value of put option is $2.38.

(B)

To Compute:

What would have been the cost of the protective put portfolio? Introduction: The cost of protective put portfolio that comes out is calculated based on the given formula below.

Explanation of Solution

(b) Computation of cost of protective put portfolio:

The cost of the protective put portfolio is the cost of one share plus the cost of one put. It

can be calculated by using the following formula:

Hence, the cost of protective put portfolio comes out to be $102.38.

Hence, the cost of protective put portfolio comes out to be $102.38.

(C)

To Compute:

What portfolio position in stock and T-bills ill ensure you a payoff equal to the payoff that would be provided by a protective put with X-$100? Show that the payoff to this portfolio and

the cost of establishing the portfolio match those of the desired protective put.

Introduction:

The strategy is calculated in the table to determine the pay-off using the below calculation.

Explanation of Solution

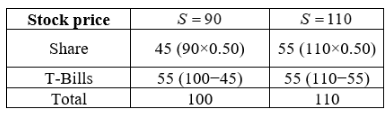

To ensure equal pay-off in stock and T-bills and protective put is as follows

The hedge ratio is 0.50. The investor will invest 0.50 in stocks which costs $50 and

remaining in T-bills to earn 5% interest.

The above strategy will give same pay-off as the protective put option.

The above strategy will give same pay-off as the protective put option.

Want to see more full solutions like this?

Chapter 16 Solutions

ESSEN OF INVESTMENTS CONNECT AC

- critically discuss the hockey stick model of a start-up financing. In your response, explain the model and discibe its three main stages, highlighting the key characteristics of each stage in terms of growth, risk, and funding expectations.arrow_forwardSolve this problem please .arrow_forwardSolve this finance question.arrow_forward

- solve this question.Pat and Chris have identical interest-bearing bank accounts that pay them $15 interest per year. Pat leaves the $15 in the account each year, while Chris takes the $15 home to a jar and never spends any of it. After five years, who has more money?arrow_forwardWhat is corporate finance? explain all thingsarrow_forwardSolve this finance problem.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education