EBK CORNERSTONES OF COST MANAGEMENT

4th Edition

ISBN: 8220103648561

Author: MOWEN

Publisher: Cengage Learning US

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 37P

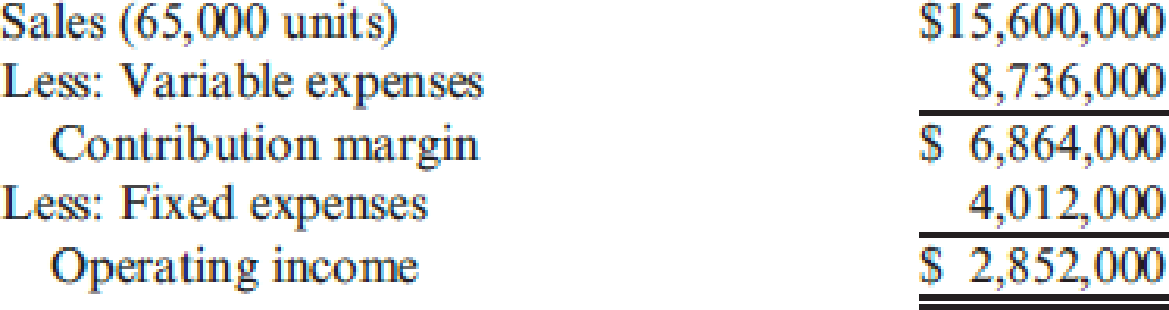

Katayama Company produces a variety of products. One division makes neoprene wetsuits. The division’s

Required:

- 1. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio.

- 2. The divisional manager has decided to increase the advertising budget by $140,000 and cut the average selling price to $200. These actions will increase sales revenues by $1 million. Will this improve the division’s financial situation? Prepare a new income statement to support your answer.

- 3. Suppose sales revenues exceed the estimated amount on the income statement by $612,000. Without preparing a new income statement, determine by how much profits are underestimated.

- 4. How many units must be sold to earn an after-tax profit of $1.254 million? Assume a tax rate of 34 percent. (Round your answer up to the next whole unit.)

- 5. Compute the margin of safety in dollars based on the given income statement.

- 6. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Kindly help me with accounting questions

Need help with this general accounting question

Please give me true answer this financial accounting question

Chapter 16 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

Ch. 16 - Prob. 1DQCh. 16 - Describe the difference between the units-sold...Ch. 16 - Define the term break-even point.Ch. 16 - Explain why contribution margin per unit becomes...Ch. 16 - A restaurant owner who had yet to earn a monthly...Ch. 16 - What is the variable cost ratio? The contribution...Ch. 16 - Prob. 7DQCh. 16 - Suppose a firm with a contribution margin ratio of...Ch. 16 - Prob. 9DQCh. 16 - Explain how CVP analysis developed for single...

Ch. 16 - Prob. 11DQCh. 16 - How do income taxes affect the break-even point...Ch. 16 - Explain how a change in sales mix can change a...Ch. 16 - Explain how a change in sales mix can change a...Ch. 16 - Prob. 15DQCh. 16 - Prob. 1CECh. 16 - Prob. 2CECh. 16 - Health-Temp Company is a placement agency for...Ch. 16 - Olivian Company wants to earn 420,000 in net...Ch. 16 - Vandenberg, Inc., produces and sells two products:...Ch. 16 - Prob. 6CECh. 16 - Prob. 7CECh. 16 - Prob. 8ECh. 16 - Gelbart Company manufactures gas grills. Fixed...Ch. 16 - Schylar Pharmaceuticals, Inc., plans to sell...Ch. 16 - Prob. 11ECh. 16 - Prob. 12ECh. 16 - Big Red Motors, Inc., employs 15 sales personnel...Ch. 16 - Sports-Reps, Inc., represents professional...Ch. 16 - Campbell Company manufactures and sells adjustable...Ch. 16 - Prob. 16ECh. 16 - Sara Pacheco is a sophomore in college and earns a...Ch. 16 - Carmichael Corporation is in the process of...Ch. 16 - Choose the best answer for each of the following...Ch. 16 - Prob. 20ECh. 16 - Income statements for two different companies in...Ch. 16 - Prob. 22ECh. 16 - Prob. 23ECh. 16 - Busy-Bee Baking Company produces a variety of...Ch. 16 - Prob. 25ECh. 16 - Jester Company had unit contribution margin on...Ch. 16 - Loessing Company produced and sold 12,000 units...Ch. 16 - Junior Company has a breakeven point of 34,600...Ch. 16 - Prob. 29ECh. 16 - If a companys variable cost per unit increases,...Ch. 16 - Prob. 31PCh. 16 - More-Power Company has projected sales of 75,000...Ch. 16 - Consider the following information on four...Ch. 16 - Hammond Company runs a driving range and golf...Ch. 16 - Prob. 35PCh. 16 - Faldo Company produces a single product. The...Ch. 16 - Katayama Company produces a variety of products....Ch. 16 - Prob. 38PCh. 16 - Prob. 39PCh. 16 - Prob. 40PCh. 16 - Salem Electronics currently produces two products:...Ch. 16 - Good Scent, Inc., produces two colognes: Rose and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Don't use ai given answer accounting questionsarrow_forwardNovak Company has the following stockholders' equity accounts at December 31, 2025. Common Stock ($100 par value, authorized 7,600 shares) $459,100 Retained Earnings 266,700 a. Prepare entries in journal form to record the following transactions, which took place during 2026 1. 290 shares of outstanding stock were purchased at $97 per share. (These are to be accounted for using the cost method.) 2. A $22 per share cash dividend was declared. 3. The dividend declared in (2) above was paid. 4. The treasury shares purchased in (1) above were resold at $101 per share. 5. 500 shares of outstanding stock were purchased at $103 per share. 6. 380 of the shares purchased in (5) above were resold at $96 per share. b. Prepare the stockholders' equity section of Novak Company's balance sheet after giving effect to these transactions, assuming that the net income for 2026 was $86,300. State law requires restriction of retained earnings for the amount of treasury stock. The answer is not 705,118arrow_forwardHow would Adele’s financial statements have been impacted on the date of the sale of the concert tickets on December 17, 2015? What accounts would be affected? When will adele recognize revenue from the two concerts at the Bridgestone Arena in Nashville, Tennessee? How would Adele’s financial statements be impacted on the dates of these two concerts?arrow_forward

- How are Adele's financial statements impacted when tickets to her North American tour sell out within a few minutes? Adele released her third album, 25, in late 2015, quickly shattering several records. The album 25 was the first album to sell more than three million copies in a week and also racked up the most records sold in a week with 3.38 million records sold that first week. Her single Hello from 25 was the first track to be downloaded more than one million times in one week. 25 was also the best-selling album of 2015. Soon after 25 was released, Adele's North American tour dates were announced. On December 17, 2015, tickets for the dates on this tour went on sale at 11 am EST and sold out within minutes for all of the 56 concerts dates on the tour. A total of 750,000 tickets were available; reportedly over 10 million fans tried to buy tickets through Ticketmaster. (Tickets were also available through Adele's website.) Fans able to obtain tickets paid at the time of purchase. On…arrow_forwardCAL Ltd. sold $6,700,000 of 10% bonds, which were dated March 1, 2023, on June 1, 2023. The bonds paid interest on September 1 and March 1 of each year. The bonds' maturity date was March 1, 2033, and the bonds were issued to yield 12%. CAL's fiscal year-end was February 28, and the company followed IFRS. On June 1, 2024, CAL bought back $2,700,000 worth of bonds for $2,600,000 plus accrued interest. (a) Using 1. a financial calculator, or 2. Excel function PV, calculate the issue price of the bonds and prepare the entry for the issuance of the bonds. Hint: Use the account Interest Expense in your entry). there are 3 entries to be made herearrow_forwardDon't use ai to answer I will report you answerarrow_forward

- 1. Stampede Company has two service departments — purchasing and maintenance, and two production departments — fabrication and assembly. The distribution of each service department's efforts to the other departments is shown below: FROM TO Purchasing Maintenance Fabrication Assembly Purchasing 0% 45% 45% 10% Maintenance 55% 0% 30% 15% The direct operating costs of the departments (including both variable and fixed costs) were as follows: Purchasing $ 138,000 Maintenance 60,000 Fabrication 114,000 Assembly 90,000 The total cost accumulated in the fabrication department using the direct method is: The answer is not 194100 2. Bifurcator Company produces three products — X, Y, and Z — from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were…arrow_forwardGeneral accounting question please solvearrow_forwardDue Jan 26 11:59pm Module 2 Discussion Provide and discuss an example of a situation where a company would use a job cost sheet. As part of your analysis, be sure to explain the nature and importance of a job cost sheet. or Discuss the advantages and disadvantages of Job Order Costing. Be sure to include specific examples of the advantages/disadvantages that you discuss. 21 Replies, 18arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY