Concept explainers

A sample containing years to maturity and yield (%) for 40 corporate bonds is contained in the data file named CorporateBonds (Barron’s, April 2, 2012).

- a. Develop a

scatter diagram of the data using x = years to maturity as the independent variable. Does a simple linear regression model appear to be appropriate? - b. Develop an estimated regression equation with x = years to maturity and x2 as the independent variables.

- c. As an alternative to fitting a second-order model, fit a model using the natural logarithm of price as the independent variable; that is, ŷ = b0 + b1ln(x). Does the estimated regression using the natural logarithm of x provide a better fit than the estimated regression developed in part (b)? Explain.

a.

Construct a scatter diagram of the data using

Decide whether a simple linear regression model appears to be appropriate.

Answer to Problem 29SE

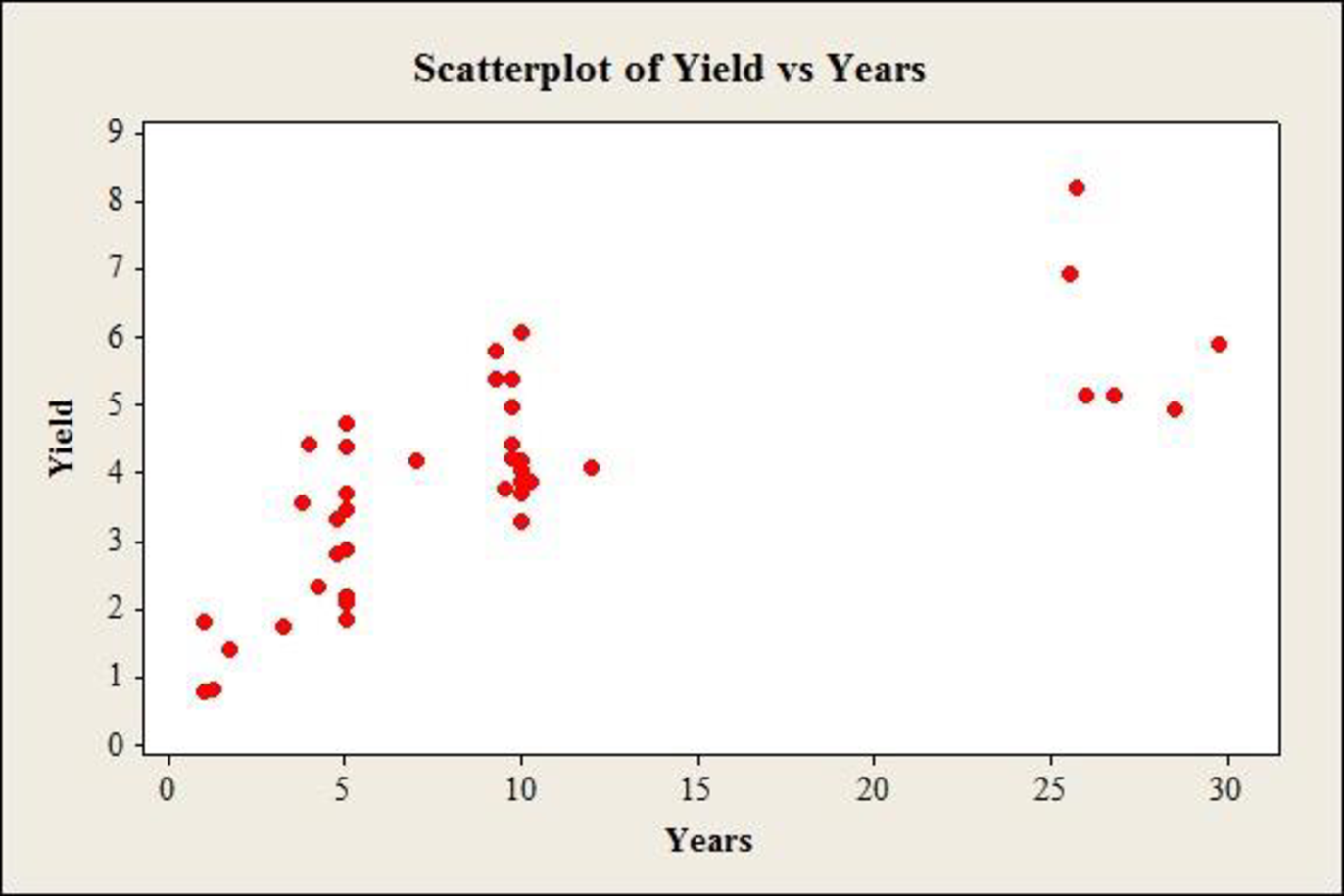

The scatter diagram of the data using

A simple linear regression model does not appear to be appropriate.

Explanation of Solution

Calculation:

The data gives information on yield (%) of 40 corporate bonds and the respective years to maturity.

Scatterplot:

Software procedure:

Step by step procedure to draw scatter diagram using MINITAB software is given below:

- Choose Graph > Scatterplot.

- Choose Simple, and then click OK.

- In Y–variables, enter the column of Yield.

- In X–variables enter the column of Years.

- Click OK.

Observation:

The scatterplot shows a gradual increase in the yield, at a decreasing rate, with increase in years up to 25. After this, there is a reduction in the values of yield. Thus, a simple linear regression model does not appear to be appropriate.

b.

Develop an estimated multiple regression equation with

Answer to Problem 29SE

The estimated multiple regression equation with

Explanation of Solution

Calculation:

Square transformation:

Software procedure:

Step by step procedure to make square transformation using MINITAB software is given as,

- Choose Calc > Calculator.

- In Store result in variable, enter YearsSq.

- In Expression, enter ‘Years’^2.

- Click OK.

The squared variable is stored in the column of ‘YearsSq’.

Regression:

Software procedure:

Step by step procedure to obtain the regression equation using MINITAB software:

- Choose Stat > Regression > General Regression.

- Under Responses, enter the column of Yield.

- Under Model, enter the columns of Years, YearsSq.

- Click OK.

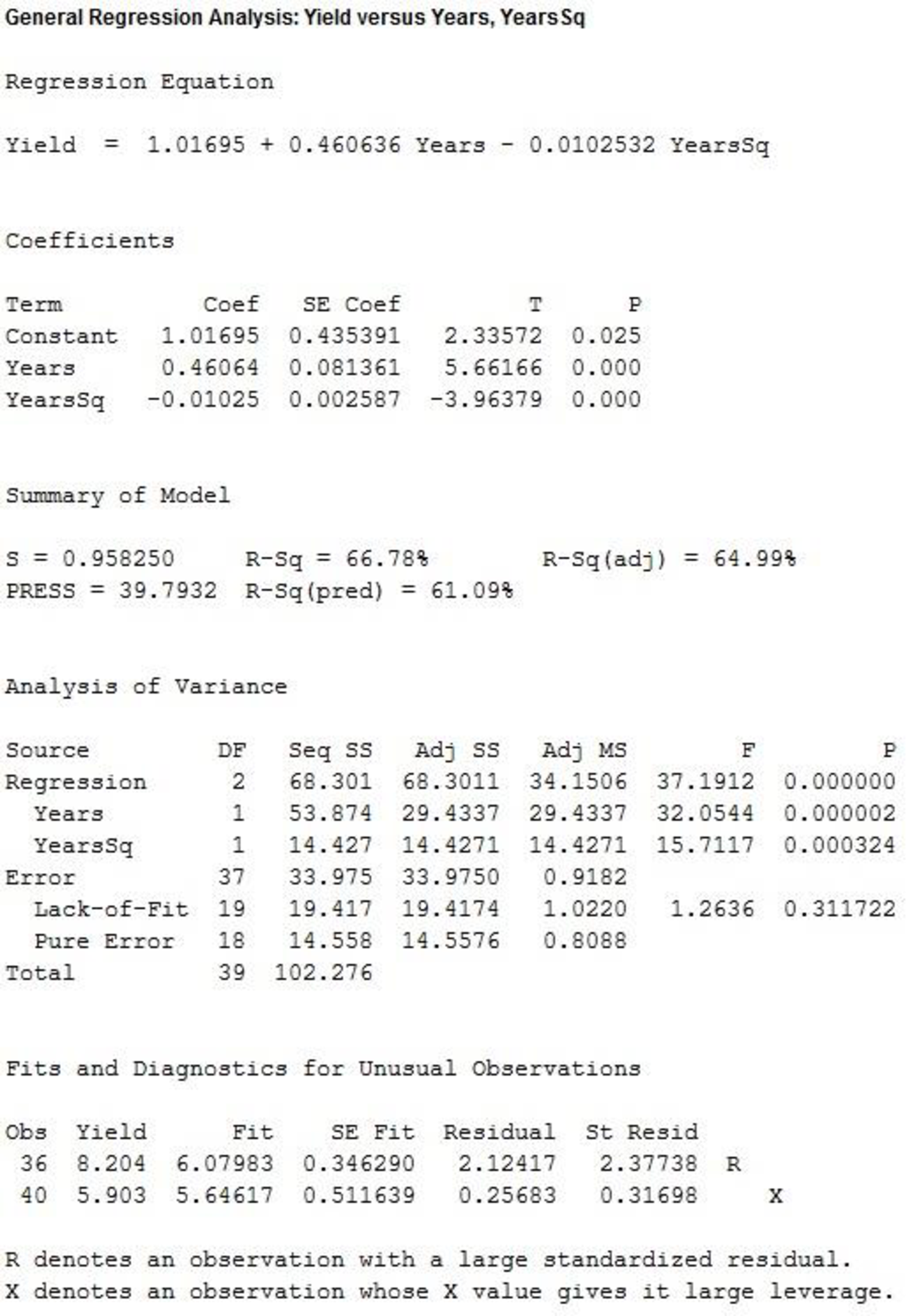

Output using MINITAB software is given below:

From the output, the estimated multiple regression equation with

c.

Develop an estimated multiple regression equation using the natural logarithm of years as the independent variable.

Explain whether the current regression provides a better fit than the estimated regression developed in part b.

Answer to Problem 29SE

The estimated multiple regression equation using the natural logarithm of years as the independent variable is:

The estimated regression using the natural logarithm of x provides a better fit than the estimated regression developed in part b.

Explanation of Solution

Calculation:

Logarithmic transformation:

Software procedure:

Step by step procedure to make logarithmic transformation using MINITAB software is given as,

- Choose Calc > Calculator.

- In Store result in variable, enter Years.

- In Expression, enter ln(‘Years’).

- Click OK.

The logarithm of the variable is stored in the column of ‘ln(‘Years’)’.

Regression:

Software procedure:

Step by step procedure to obtain the regression equation using MINITAB software:

- Choose Stat > Regression > General Regression.

- Under Responses, enter the column of Yield.

- Under Model, enter the columns of ln(Years).

- Click OK.

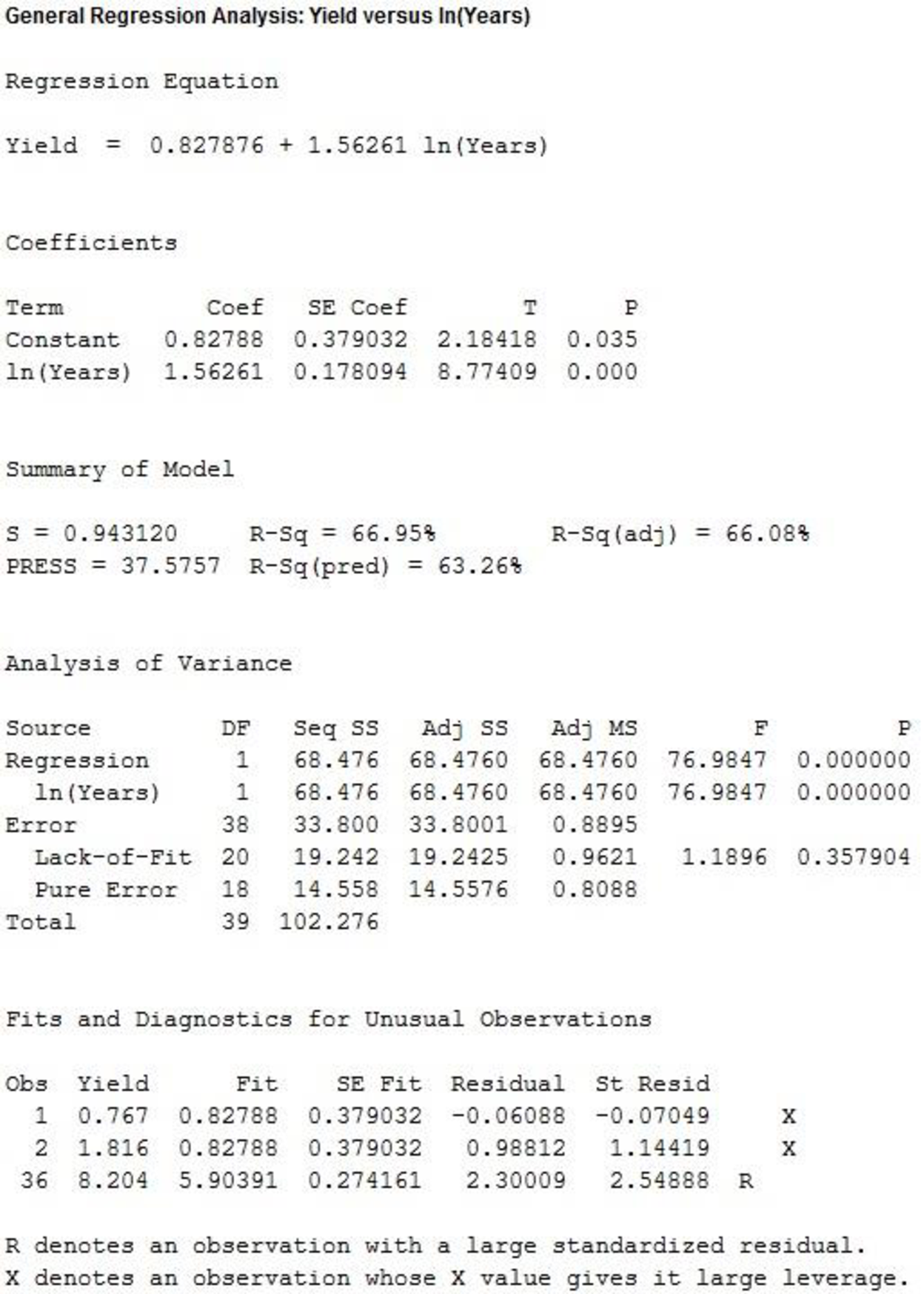

Output using MINITAB software is given below:

From the output, the estimated multiple regression equation using the natural logarithm of years as the independent variable is:

Adjusted-

The adjusted

The value of adjusted

The value of adjusted

Evidently, the current regression equation effectively explains more of the variation the response variable, than the second regression equation.

Thus, the estimated regression using the natural logarithm of x provides a better fit than the estimated regression developed in part b.

Want to see more full solutions like this?

Chapter 16 Solutions

Statistics for Business & Economics (with XLSTAT Education Edition Printed Access Card) (MindTap Course List)

- Introduce yourself and describe a time when you used data in a personal or professional decision. This could be anything from analyzing sales data on the job to making an informed purchasing decision about a home or car. Describe to Susan how to take a sample of the student population that would not represent the population well. Describe to Susan how to take a sample of the student population that would represent the population well. Finally, describe the relationship of a sample to a population and classify your two samples as random, systematic, cluster, stratified, or convenience.arrow_forward1.2.17. (!) Let G,, be the graph whose vertices are the permutations of (1,..., n}, with two permutations a₁, ..., a,, and b₁, ..., b, adjacent if they differ by interchanging a pair of adjacent entries (G3 shown below). Prove that G,, is connected. 132 123 213 312 321 231arrow_forwardYou are planning an experiment to determine the effect of the brand of gasoline and the weight of a car on gas mileage measured in miles per gallon. You will use a single test car, adding weights so that its total weight is 3000, 3500, or 4000 pounds. The car will drive on a test track at each weight using each of Amoco, Marathon, and Speedway gasoline. Which is the best way to organize the study? Start with 3000 pounds and Amoco and run the car on the test track. Then do 3500 and 4000 pounds. Change to Marathon and go through the three weights in order. Then change to Speedway and do the three weights in order once more. Start with 3000 pounds and Amoco and run the car on the test track. Then change to Marathon and then to Speedway without changing the weight. Then add weights to get 3500 pounds and go through the three gasolines in the same order.Then change to 4000 pounds and do the three gasolines in order again. Choose a gasoline at random, and run the car with this gasoline at…arrow_forward

- AP1.2 A child is 40 inches tall, which places her at the 90th percentile of all children of similar age. The heights for children of this age form an approximately Normal distribution with a mean of 38 inches. Based on this information, what is the standard deviation of the heights of all children of this age? 0.20 inches (c) 0.65 inches (e) 1.56 inches 0.31 inches (d) 1.21 inchesarrow_forwardAP1.1 You look at real estate ads for houses in Sarasota, Florida. Many houses range from $200,000 to $400,000 in price. The few houses on the water, however, have prices up to $15 million. Which of the following statements best describes the distribution of home prices in Sarasota? The distribution is most likely skewed to the left, and the mean is greater than the median. The distribution is most likely skewed to the left, and the mean is less than the median. The distribution is roughly symmetric with a few high outliers, and the mean is approximately equal to the median. The distribution is most likely skewed to the right, and the mean is greater than the median. The distribution is most likely skewed to the right, and the mean is less than the median.arrow_forwardDuring busy political seasons, many opinion polls are conducted. In apresidential race, how do you think the participants in polls are generally selected?Discuss any issues regarding simple random, stratified, systematic, cluster, andconvenience sampling in these polls. What about other types of polls, besides political?arrow_forward

- Please could you explain why 0.5 was added to each upper limpit of the intervals.Thanksarrow_forward28. (a) Under what conditions do we say that two random variables X and Y are independent? (b) Demonstrate that if X and Y are independent, then it follows that E(XY) = E(X)E(Y); (e) Show by a counter example that the converse of (ii) is not necessarily true.arrow_forward1. Let X and Y be random variables and suppose that A = F. Prove that Z XI(A)+YI(A) is a random variable.arrow_forward

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt College AlgebraAlgebraISBN:9781305115545Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning

College AlgebraAlgebraISBN:9781305115545Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning Algebra and Trigonometry (MindTap Course List)AlgebraISBN:9781305071742Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning

Algebra and Trigonometry (MindTap Course List)AlgebraISBN:9781305071742Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning