1.

Compute the basic earnings per share for Company M.

1.

Explanation of Solution

Earnings per share (EPS): The amount of net income available to each shareholder per common share outstanding is referred to as earnings per share (EPS).

Compute the basic earnings per share for Company M.

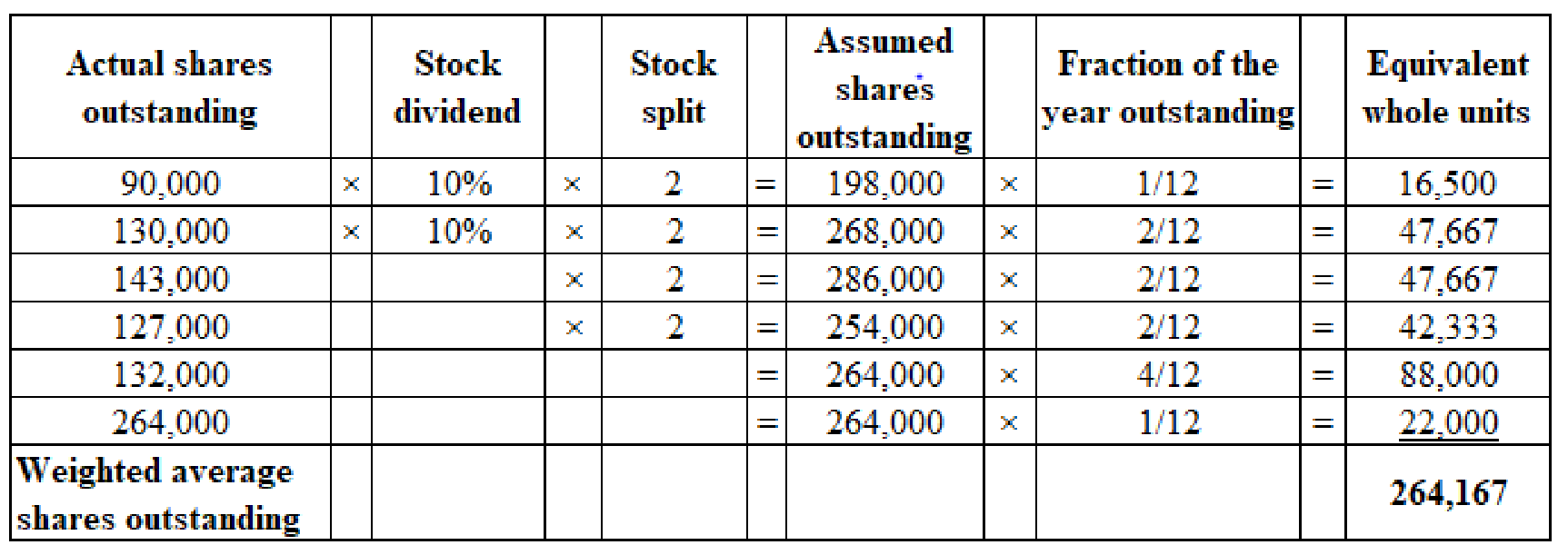

Working note: (1) Calculation of weighted average shares outstanding:

(Table1)

2.

Compute the tentative and incremental dilutive earnings per share for each dilutive security.

2.

Explanation of Solution

Compute tentative diluted EPS for stock options.

Compute the incremental diluted EPS for stock options.

Compute the incremental diluted EPS for convertible bonds.

Compute the incremental diluted EPS of convertible preferred stock.

Compute tentative diluted EPS assuming for 12% convertible preferred stock.

Compute tentative diluted EPS assuming, exercisable options, 9% convertible bonds, and 12% convertible preferred stock.

Working notes (1): Calculate the value of exercisable options:

Working notes (2): Compute the number of shares required:

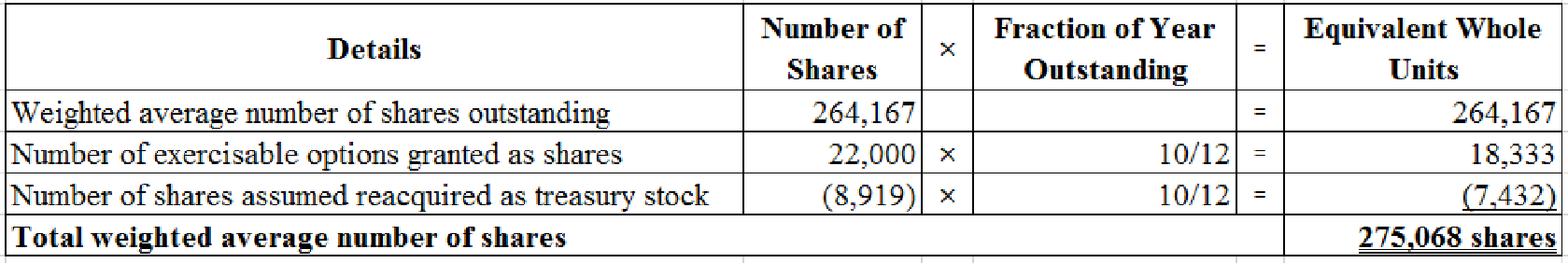

Working notes (3): Compute the total weighted average number of common shares.

(Figure 2)

Working notes (4): Compute the amount of interest expense, net of income tax on 9% bonds.

Working notes (5): Compute the number of common shares due to conversion of 9% bonds.

Working notes (6): Compute the number of common shares due to conversion of preferred shares.

3.

Identify the amount that will be reported as basic and diluted earnings per share for the year 2016.

3.

Explanation of Solution

The Company M must report an amount of $1.95 as basic earnings per share and $1.64 as diluted earnings per share in its 2016 income statement.

Want to see more full solutions like this?

Chapter 16 Solutions

EBK INTERMEDIATE ACCOUNTING: REPORTING

- What is zeniths gross margin as a percentage of sales ? Solve general accounting questionarrow_forwardAccounting answer with solutionarrow_forwardLucas purchased a stock for $55.32 per share and sold it one year later for $57.01 per share. He also received a dividend of $1.45 per share. What was his capital gains yield?arrow_forward

- Pam Pet Foods Co. reported net income of $52,000 for the year ended December 31, 2005. January 1 balances in accounts receivable and accounts payable were $30,000 and $28,000, respectively. Year-end balances in these accounts were $27,000 and $31,000, respectively. Assuming that all relevant information has been presented, Pam's cash flows from operating activities would be__.arrow_forwardPlease provide accurate answerarrow_forwardThe unit product cost of product Q45Y isarrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning