Concept explainers

Roseau Company is preparing its annual earnings per share amounts to be disclosed on its 2019 income statement. It has collected the following information at the end of 2019:

1. Net income: $120,400. Included in the net income is income from continuing operations of $130,400 and a loss from discontinued operations (net of income taxes) of $10,000. Corporate income tax rate: 30%.

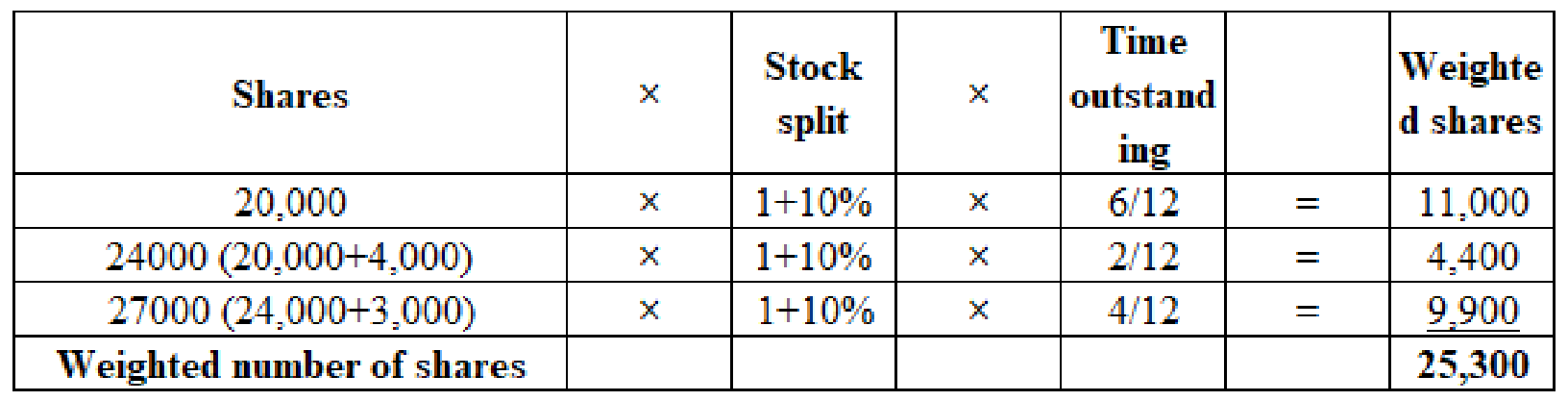

2. Common stock outstanding on January 1, 2019: 20,000 shares.

3. Common stock issuances during 2019: July 6, 4,000 shares; August 24, 3,000 shares.

4. Stock dividend: On October 19, 2019, the company declared a 10% stock dividend that resulted in 2,700 additional outstanding shares of common stock.

5. Common stock prices: 2019 average market price, $30 per share; 2019 ending market price, $27 per share.

6. 7%

7. 8% convertible preferred stock outstanding on January 1, 2019: 800 shares. The stock was issued in 2018 at $130 per share. Each $100 par preferred stock is currently convertible into 1.7 shares of common stock. Current dividends have been paid. To date, no preferred stock has been converted.

8. Bonds payable outstanding on January 1, 2019: $100,000 face value. These bonds were issued several years ago at 97 and pay annual interest of 9.6%. The discount is being amortized in the amount of $300 per year. Each $1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted.

9. Compensatory share options outstanding: Key executives may currently acquire 3,000 shares of common stock at $20 per share. The options were granted in 2018. To date, none have been exercised. The unrecognized compensation cost (net of tax) related to the options is $4 per share.

Required:

1. Compute the basic earnings per share. Show supporting calculations.

2. Compute the diluted earnings per share. Show supporting calculations.

3. Show how Roseau would report these earnings per share figures on its 2019 income statement. Include an explanatory note to the financial statements.

1. and 2.

Calculate the basic earnings per share and diluted earnings per share.

Explanation of Solution

Calculate the basic earnings per share and diluted earnings per share:

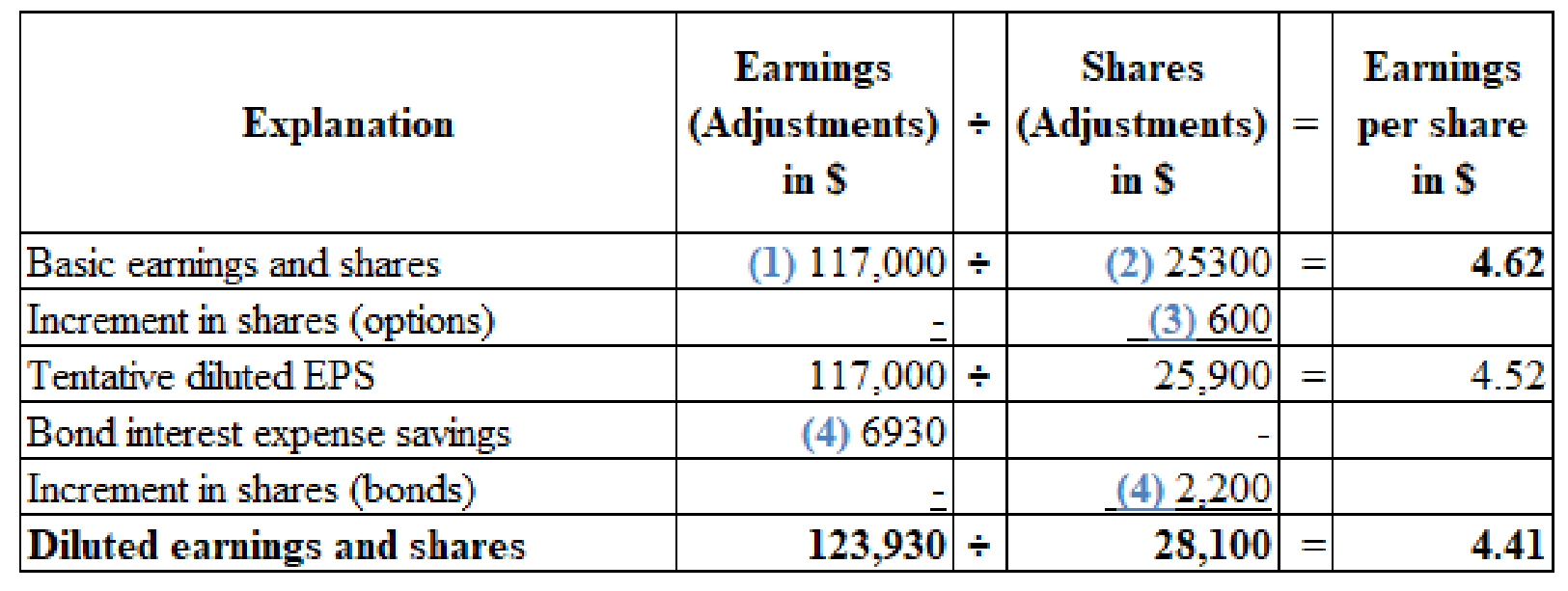

(Figure 1)

Working notes:

(1) Calculate the numerator for the basic earnings per share:

(2) Calculate the number of shares used in computing the basic earnings per share:

(Figure 2)

(3) Calculate the increase in the share options:

(4) Calculate the impact of 8% preferred on diluted earnings per share and ranking:

(5) Calculate the impact of 9.6% bonds on diluted earnings per share and ranking:

Note:

- The Company has occurred loss form the discontinuing operations, the impact of the convertible security is compared with earnings per share that is related to income from continuing operations.

- The percentage of stock dividend that is required to identify the assumed shared outstanding is ascertained using below formula :

3.

Identify whether basic or diluted earnings per share will be reported by the Company R on its 2019 income statement.

Explanation of Solution

The Company R must report an amount of (6) $4.23 as basic earnings per share and (7) $4.05 as diluted earnings per share in its 2019 income statement.

Working notes:

(6) Calculate the basic earnings per share after deducting loss from discontinuing operations:

(7) Calculate the basic earnings per share after deducting loss from discontinuing operations:

Notes to financial statement:

Note 1: Basic earnings per share of the company are based on average common shares outstanding; 7% and 8% preferred dividends are deducted from net income to ascertain the earnings available to common shareholders. Diluted earnings per share are obtained from 600 shares of stock options and 2,200 shares of bonds that are convertible. Diluted earnings available to common shareholders are assumed to have no interest expense of $6,930 on the converted bonds.

Want to see more full solutions like this?

Chapter 16 Solutions

Interm.acct.:reporting.(ll)-w/access

- Coronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi- purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours x (54,000+ 10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related…arrow_forwardThe completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated. Required: Using the payroll registers, complete the General Journal entries as follows: February 10 Journalize the employee pay. February 10 Journalize the employer payroll tax for the February 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. February 14 Issue the employee pay. February 24 Journalize the employee pay. February 24 Journalize the employer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base. February 28 Issue the employee pay. February 28 Issue payment for the payroll liabilities. March 10 Journalize the employee pay. March 10 Journalize the employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base.…arrow_forwardPlease given step by step explanation general accounting questionarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning