To show:

The profit maximizing price, output and economic profit on a graph representing

Explanation of Solution

Given information:

| Price | Quantity | TR | MR |

| 10 | 0 | 0 | - |

| 8 | 2000 | 16000 | 8 |

| 6 | 4000 | 24000 | 4 |

| 4 | 6000 | 24000 | 0 |

| 2 | 8000 | 16000 | -4 |

| 0 | 10000 | 0 | 8 |

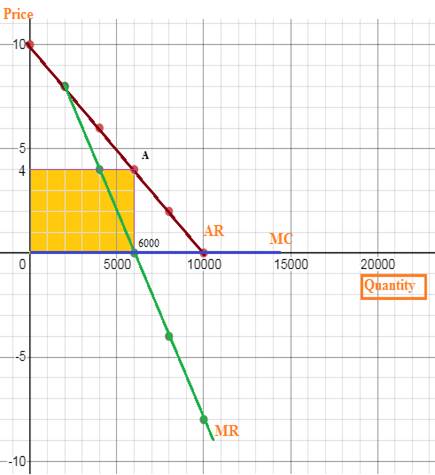

The graph represnting the demand and marginal revenue curve is as shown below:

According to the diagram, the AR represents the demand curve while the marginal revenue curve is represented by the green line. Since the marginal cost is zero, the MC curve overlaps over the horizontal axis (blue color). Marginal revenue curve intersects the marginal cost curve at output level 6000 units (profit maximizing level) and at this point, the profit-maximizing price is 4 dollars. However, the area marked by the yellow color represents the economic profit.

Monopoly market is that market structure where a single firm enjoys the largest market share. The firm sells that commodity which has no close substitute and the entry for new firms in the monopoly market is very difficult.

Want to see more full solutions like this?

Chapter 16 Solutions

EBK FOUNDATIONS OF ECONOMICS

- What are some of the question s that I can ask my economic teacher?arrow_forwardAnswer question 2 only.arrow_forward1. A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate fund, and the third is a (riskless) T-bill money market fund that yields a rate of 8%. The probability distributions of the risky funds have the following characteristics: Standard Deviation (%) Expected return (%) Stock fund (Rs) 20 30 Bond fund (RB) 12 15 The correlation between the fund returns is .10.arrow_forward

- Frederick Jones operates a sole proprietorship business in Trinidad and Tobago. His gross annual revenue in 2023 was $2,000,000. He wants to register for VAT, but he is unsure of what VAT entails, the requirements for registration and what he needs to do to ensure that he is fully compliant with VAT regulations. Make reference to the Vat Act of Trinidad and Tobago and explain to Mr. Jones what VAT entails, the requirements for registration and the requirements to be fully compliant with VAT regulations.arrow_forwardCan you show me the answers for parts a and b? Thanks.arrow_forwardWhat are the answers for parts a and b? Thanksarrow_forward

- What are the answers for a,b,c,d? Are they supposed to be numerical answers or in terms of a variable?arrow_forwardSue is a sole proprietor of her own sewing business. Revenues are $150,000 per year and raw material (cloth, thread) costs are $130,000 per year. Sue pays herself a salary of $60,000 per year but gave up a job with a salary of $80,000 to run the business. ○ A. Her accounting profits are $0. Her economic profits are - $60,000. ○ B. Her accounting profits are $0. Her economic profits are - $40,000. ○ C. Her accounting profits are - $40,000. Her economic profits are - $60,000. ○ D. Her accounting profits are - $60,000. Her economic profits are -$40,000.arrow_forwardSelect a number that describes the type of firm organization indicated. Descriptions of Firm Organizations: 1. has one owner-manager who is personally responsible for all aspects of the business, including its debts 2. one type of partner takes part in managing the firm and is personally liable for the firm's actions and debts, and the other type of partner takes no part in the management of the firm and risks only the money that they have invested 3. owners are not personally responsible for anything that is done in the name of the firm 4. owned by the government but is usually under the direction of a more or less independent, state-appointed board 5. established with the explicit objective of providing goods or services but only in a manner that just covers its costs 6. has two or more joint owners, each of whom is personally responsible for all of the partnership's debts Type of Firm Organization a. limited partnership b. single proprietorship c. corporation Correct Numberarrow_forward

- The table below provides the total revenues and costs for a small landscaping company in a recent year. Total Revenues ($) 250,000 Total Costs ($) - wages and salaries 100,000 -risk-free return of 2% on owner's capital of $25,000 500 -interest on bank loan 1,000 - cost of supplies 27,000 - depreciation of capital equipment 8,000 - additional wages the owner could have earned in next best alternative 30,000 -risk premium of 4% on owner's capital of $25,000 1,000 The economic profits for this firm are ○ A. $83,000. B. $82,500. OC. $114,000. OD. $83,500. ○ E. $112,500.arrow_forwardOutput TFC ($) TVC ($) TC ($) (Q) 2 100 104 204 3 100 203 303 4 100 300 400 5 100 405 505 6 100 512 612 7 100 621 721 Given the information about short-run costs in the table above, we can conclude that the firm will minimize the average total cost of production when Q = (Round your response to the nearest whole number.)arrow_forwardThe following data show the total output for a firm when specified amounts of labour are combined with a fixed amount of capital. Assume that the wage per unit of labour is $20 and the cost of the capital is $100. Labour per unit of time 0 1 Total Output 0 25 T 2 3 4 5 75 137 212 267 The marginal product of labour is at its maximum when the firm changes the amount of labour hired from ○ A. 0 to 1 unit. ○ B. 3 to 4 units. OC. 2 to 3 units. OD. 1 to 2 units. ○ E. 4 to 5 units.arrow_forward

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Microeconomics (MindTap Course List)EconomicsISBN:9781305971493Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Microeconomics (MindTap Course List)EconomicsISBN:9781305971493Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning Principles of MicroeconomicsEconomicsISBN:9781305156050Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of MicroeconomicsEconomicsISBN:9781305156050Author:N. Gregory MankiwPublisher:Cengage Learning