(Optimal Provision of Public Goods) Using at least two individual consumers, show how the market

the market demand curve is to be derived from individual demand curves for a private goods and for a public good and then introduce the market supply curve and show the optimal level of production.

Concept Introduction:

A demand curve is a graph that shows the change in quantity demanded of a good or service with respect to its price. With change in price the demand also change and it carries an inverse relationship with the price. Market demand refers to the demand of a good in a particular market that adds up to a sum of different individual demands.

Explanation of Solution

Individual demand curves adds up to make a market demand curve for a good. It is a broader term that defines demand of a particular good at a much larger scale.

a. For a private good: Private good refers to the good that needs to be purchased from the private individual and its consumption by one individual prevents it to be consumed from the other individuals.

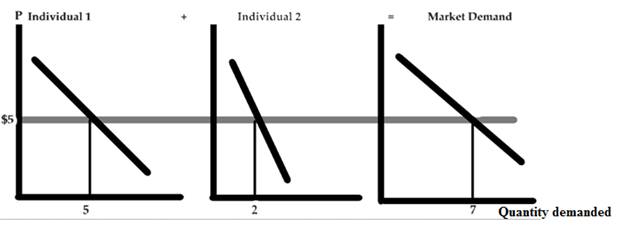

In the above figure there are three curves, where curve 1 is the individual demand curve for a good at price $5 and quantity 5 units. The second curve represents the individual demand curve for the same good at same price but the quantity is 2. The third curve is the market demand curve which is the summation of curve 1 of individual 1 and curve 2 of individual 2 at price $5 same as before. The market demand curve is the summation of curve 1 and curve 2 therefore the quantity for the same is 5 + 2 = 7 units.

b. For public good: A public good is a good which is provided to all the members of the society without profit, it is provided by the government, individual or an organization. The consumption of such good doesn’t affect the consumption for others.

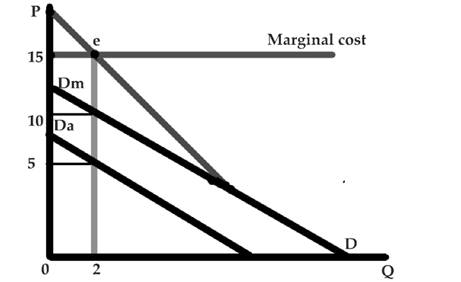

Public good once produced is available to all people and in identical amounts. Hence the demand for the public good is the vertical summation of each individuals demand. The marginal cost here equals the marginal benefits at e where the market demand curve and the marginal cost curve are at equilibrium. The red line on the graph represent the market demand curve and the blue line defines the marginal cost curve. Dm and Da are respectively the two individual demand curves which add up vertically with quantity being constant to make the market demand curve.

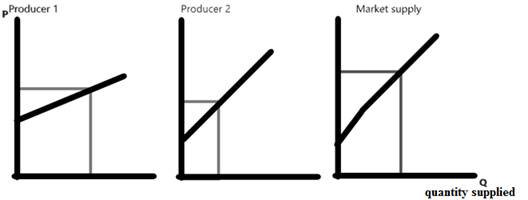

The market supply curve is an upward sloping curve which shows a positive relationship between the price and the quantity supplied. The summation of the individuals producers supply makes the market supply curve.

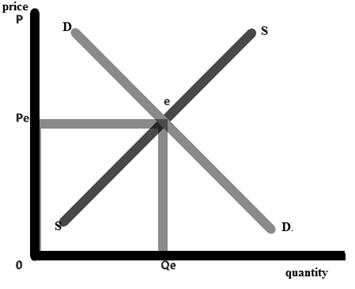

The optimal level of production is the point where the market demand is equal to that of the market supply and that level of intersection is called the market demand.

Want to see more full solutions like this?

- Not use ai pleasearrow_forwardRound Tree Manor is a hotel that provides two types of rooms with three rental classes: Super Saver, Deluxe, and Business. The profit per night for each type of room and rental class is as follows. Rental Class Super Saver Deluxe Business Room Type I Type II $30 $35 $20 $30 $40 Round Tree's management makes a forecast of the demand by rental class for each night in the future. A linear programming model developed to maximize profit is used to determine how many reservations to accept for each rental class. The demand forecast for a particular night is 140 rentals in the Super Saver class, 50 rentals in the Deluxe class, and 40 rentals in the Business class. Round Tree has 100 Type I rooms and 120 Type II rooms. (a) Formulate and solve a linear program to determine how many reservations to accept in each rental class and how the reservations should be allocated to room types. (Assume S₁ is the number of Super Saver rentals allocated to room type I, S₂ is the number of Super Saver…arrow_forwardDon't used hand raitingarrow_forward

- What is the impact of population and demographic trends on our society? How does this continuation of growth impact our project supplies of goods and services? Be specific in your response.arrow_forwardPlease review "Alaska Ranked Choice Voting Implementation" for information to answer , What is the benefit of ranking multiple choices?arrow_forwardDon't used hand raitingarrow_forward

- Please review "Alaska Ranked Coice Voting Implementation" for information to answer, How to win in Round two (and beyond)?arrow_forwardPlease review "Alaska Ranked Coice Voting Implementation" for information to answer, How to win in Round One ?arrow_forwardPlease review "Alaska Ranked Coice Voting Implementation" for infornation to answer, How does Ranked Choice Voting work?arrow_forward

- Please review "Alaska Ranked Coice Voting Implementation" for information to answer question, What is Ranked Choice Voting?arrow_forwardConsider the following demand and supply functions:Qd= 10-PQs=1+2pFind the equilibrium price and quantity, Producers and Consumer surpluses.Consider the tax size 3. What would be new CS and PS, TS and DL? (hint – it would be easierif you draw them)arrow_forwardWHAT IS IS-LM-PCarrow_forward

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Microeconomics (MindTap Course List)EconomicsISBN:9781305971493Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Microeconomics (MindTap Course List)EconomicsISBN:9781305971493Author:N. Gregory MankiwPublisher:Cengage Learning