Survey Of Accounting

5th Edition

ISBN: 9781259631122

Author: Edmonds, Thomas P.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 18P

Problem 10-18A Postaudit evaluation

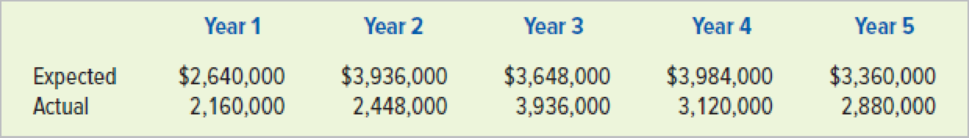

Brett Collins is reviewing his company’s investment in a cement plant. The company paid $12,000,000 five years ago to acquire the plant. Now top management is considering an opportunity to sell it. The president wants to know whether the plant has met original expectations before he decides its fate. The company’s discount rate for present value computations is 8 percent. Expected and actual

Required

Round your computations to the nearest whole dollar.

- a. Compute the

net present value of the expected cash flows as of the beginning of the investment. - b. Compute the net present value of the actual cash flows as of the beginning of the investment.

- c. What do you conclude from this postaudit?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

General Accounting Question

Can you solve this financial accounting question with accurate accounting calculations?

I need help with this financial accounting question using accurate methods and procedures.

Chapter 16 Solutions

Survey Of Accounting

Ch. 16 - Prob. 1QCh. 16 - Prob. 2QCh. 16 - Prob. 3QCh. 16 - 4. Define the term return on investment. How is...Ch. 16 - Prob. 5QCh. 16 - Prob. 6QCh. 16 - Prob. 7QCh. 16 - Prob. 8QCh. 16 - Prob. 9QCh. 16 - Prob. 10Q

Ch. 16 - 11. Maria Espinosa borrowed 15,000 from the bank...Ch. 16 - Prob. 12QCh. 16 - 13. What criteria determine whether a project is...Ch. 16 - Prob. 14QCh. 16 - Prob. 15QCh. 16 - Prob. 16QCh. 16 - 17. What is the relationship between desired rate...Ch. 16 - Prob. 18QCh. 16 - Prob. 19QCh. 16 - Prob. 20QCh. 16 - Prob. 21QCh. 16 - Prob. 22QCh. 16 - Prob. 23QCh. 16 - Exercise 10-1A Identifying cash inflows and...Ch. 16 - Exercise 10-2A Determining the present value of a...Ch. 16 - Prob. 3ECh. 16 - Prob. 4ECh. 16 - Exercise 10-5A Determining net present value...Ch. 16 - Exercise 10-6A Determining net present value Aaron...Ch. 16 - Exercise 10-7A Using the present value index Rolla...Ch. 16 - Exercise 10-8A Determining the cash flow annuity...Ch. 16 - Prob. 9ECh. 16 - Exercise 10-10A Using the internal rate of return...Ch. 16 - Prob. 11ECh. 16 - Prob. 12ECh. 16 - Exercise 10-13A Determining the payback period...Ch. 16 - Prob. 14ECh. 16 - Prob. 15ECh. 16 - Prob. 16PCh. 16 - Prob. 17PCh. 16 - Problem 10-18A Postaudit evaluation Brett Collins...Ch. 16 - Problem 10-19A Using net present value and...Ch. 16 - Problem 10-20A Using the payback period and...Ch. 16 - Problem 10-21A Using net present value and payback...Ch. 16 - Problem 10-22A Effects of straight-line versus...Ch. 16 - Problem 10-23A Comparing internal rate of return...Ch. 16 - Prob. 1ATCCh. 16 - ATC 10-4 Writing Assignment Limitations of capital...Ch. 16 - Prob. 5ATC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Fixed Asset Replacement Decision 1235; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=LJRzn9K8Nwk;License: Standard Youtube License