Concept explainers

Exercise l6..18B

Direct: Preparing statement of

P1 P3 P5

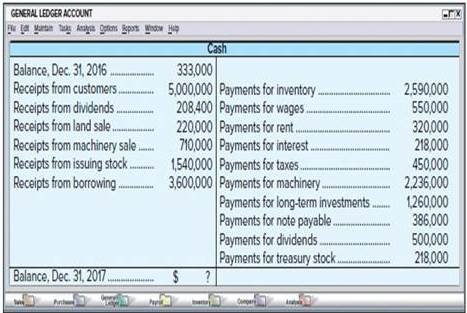

The following summarized Cash T- account reflects the total debits and total credits to the Cash account of Thomas Corporation for calendar-year 2017.

1. Use this information topp a complete statement of cash flows for year 2017. The cash provided or used by operating activities should be reported using the direct method.

2. Refer to the statement of cash flows prepared for part ito answer the following questioi a through d: (a) Which section-operating, investing, or financing-shows the largest cash (1) inflow and (ü) outflow? (b) What is the largest individual item among the investing

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

Connect Access Card for Fundamental Accounting Principles

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

- Please provide the solution to this general accounting question with accurate financial calculations.arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardCurrent Attempt in Progress The following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025. 1. 2. Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business. Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3. 4. 5. 6. In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years. Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. Oriole incurred $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining…arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning