INTEGRATED CASE

NEW WORLD CHEMICALS INC.

FINANCIAL

Assume that you were recently hired as Wilson’s assistant and that your first major task is to help her develop the formal financial forecast. She asks you to begin by answering the following questions.

- a. Assume (1) that NWC was operating at full capacity in 2016 with respect to all assets, (2) that all assets must grow at the same rate as sales, (3) that accounts payable and accrued liabilities also will grow at the same rate as sales, and (4) that the 2016 profit margin and dividend payout will be maintained. Under those conditions, what would the AFN equation predict the company’s financial requirements to be for the coming year?

- b. Consultations with several key managers within NWC, including production, inventory, and receivable managers, have yielded some very useful information.

- 1. NWC’s high DSO is largely due to one significant customer who battled through some hardships the past 2 years but who appears to be financially healthy again and is generating strong cash flow. As a result, NWC’s

accounts receivable manager expects the Firm to lower receivables enough for a calculated DSO of 34 days without adversely affecting sales. - 2. NWC was operating slightly below capacity; but its forecasted growth will require a new facility, which is expected to increase NWC’s net Fixed assets to $700 million.

- 3. A relatively new inventory management system (installed last year) has taken some time to catch on and to operate efficiently. NWC’s inventory turnover improved slightly last year, but this year NWC expects even more improvement as inventories decrease and inventory turnover is expected to rise to 10×.

- 1. NWC’s high DSO is largely due to one significant customer who battled through some hardships the past 2 years but who appears to be financially healthy again and is generating strong cash flow. As a result, NWC’s

Incorporate that information into the 2017 initial forecast results, as these adjustments to the initial forecast represent the final forecast for 2017. (Hint: Total assets do not change from the initial forecast.)

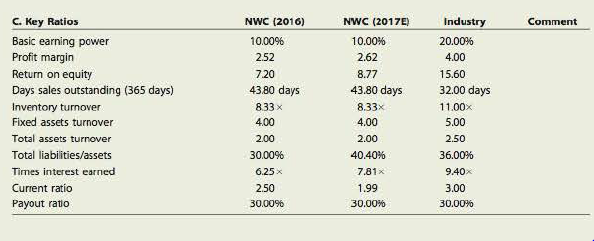

- c. Calculate NWC’s forecasted ratios based on its final forecast and compare them with the company’s 2016 historical ratios, the 2017 initial forecast ratios, and the industry averages. How does NWC compare with the average firm in its industry, and is the company’s financial position expected to improve during the coming year? Explain.

- d. Based on the final forecast, calculate NWC’s

free cash flow for 2017. How does this FCF differ from the FCF forecasted by NWC’s initial “business as usual” forecast? - e. Initially, some NWC managers questioned whether the new facility expansion was necessary, especially as it results in increasing net fixed assets from $500 million to $700 million (a 40% increase). However, after extensive discussions about NWC needing to position itself for future growth and being flexible and competitive in today’s marketplace, NWC’s top managers agreed that the expansion was necessary. Among the issues raised by opponents was that NWC’s fixed assets were being operated at only 85% of capacity. Assuming that its fixed assets were operating at only 85% of capacity, by how much could sales have increased, both in dollar terms and in percentage terms, before NWC reached full capacity?

- f. How would changes in the following items affect the AFN: (1) the dividend payout ratio, (2) the profit margin, (3) the capital intensity ratio, and (4) NWC beginning to buy from its suppliers on terms that permit it to pay after 60 days rather than after 30 days? (Consider each item separately and hold all other things constant.)

TABLE IC 16.1 Financial Statements and Other Data on NWC (Millions of Dollars)

| A. Balance Sheets | 2016 | 2017E |

| Cash and equivalents | $ 20 | $ 25 |

| Accounts receivable | 240 | 300 |

| Inventories | 240 | 300 |

| Total current assets | $ 500 | $ 625 |

| Net fixed assets | 500 | 625 |

| Total assets | $1,000 | $1,250 |

| Accounts payable and accrued liabilities | $ 100 | $ 125 |

| Notes payable | 100 | 190 |

| Total current liabilities | $ 200 | $ 315 |

| Long-term debt | 100 | 190 |

| Common stock | 500 | 500 |

| 200 | 245 | |

| Total liabilities and equity | $1,000 | $1.250 |

| B. Income Statements | 2016 | 2017E |

| Sales | $2,000.00 | $2,500.00 |

| Variable costs | 1,200.00 | 1,500.00 |

| Fixed costs | 700.00 | 875.00 |

| Earnings before interest and taxes (EBIT) | $ 100.00 | $ 125.00 |

| Interest | 16.00 | 16.00 |

| Earnings before taxes (EBT) | $ 84.00 | $ 109.00 |

| Taxes (40%) | 33.60 | 43.60 |

| Net income | $ 50.40 | $ 65.40 |

| Dividends (30%) | $ 15.12 | $ 19.62 |

| Addition to retained earnings | $ 35.28 | $ 45.78 |

a.

To calculate: Company’s financial requirements for 2017.

Additional Fund Needed:

Additional fund needed is also known as external financing needed. It is the state in which a company needed finance to increase its operation. Additional fund needed is a method in which a company raises the funds through external resources to increase its assets, which helps to increase the sales revenue of the company.

But according to additional fund needed method, a company do not change its financial ratio. Liabilities and retained earnings spontaneously increase with the increase in sales and assets.

Explanation of Solution

Computation of AFN equation for the year 2017,

Given,

Projected increase in assets is $250 million (working notes).

Spontaneous increase in liabilities is $25 million (working notes).

Increase in retained earnings is $45 million (working notes).

Formula to calculate the AFN equation,

Substitute $250 million for projected increase in assets, $25 million for spontaneous increase in liabilities and $45 million for increase in retained earnings.

Working notes:

Given,

Forecasted assets for 2017 are $1,250 million.

Assets for 2016 are $1,000 million.

Calculation of projected increase in assets,

Given,

Forecasted accounts payable and accrued liabilities for 2017 are $125 million.

Accounts payable and accrued liabilities for 2016 are $100 million.

Calculation of Spontaneous increase in liabilities,

Given,

Forecasted retained earnings for 2017 are $245 million.

Retained earnings for 2016 are $200 million.

Calculation of increase in retained earnings,

The additional funds needed for 2017 is $175 million.

b.

To determine: The final forecast for 2017 after the adjustment.

Balance Sheet:

Balance sheet is the summarize statement of total assets and total liabilities of a company in an accounting period. It is one of the financial statements.

Explanation of Solution

Final forecast for 2017 after the adjustment has been shown by preparing balance sheet.

| Company NWC | ||

| Balance Sheet | ||

| 2016 | 2017 | |

| Assets |

Amount (Millions of Dollars) |

Amount (Millions of Dollars) |

| Cash and equivalents | 20 | 79.5 |

| Account receivable | 240 | 233 |

| Inventories | 240 | 237.5 |

| Total current assets | 500 | 550 |

| Net fixed assets | 500 | 700 |

| Total assets | 1,000 | 1,250 |

| Liabilities and Owners' Equity | ||

|

Accounts payable and accrued liabilities | 100 | 125 |

| Notes payable | 100 | 190 |

| Total current liabilities | 200 | 315 |

| Long-term debt | 100 | 190 |

| Common stock | 500 | 500 |

| Retained earnings | 200 | 245 |

| Total liabilities and equity | 1,000 | 1,250 |

Table (1)

Working notes:

Calculation of Net fixed assets,

Given,

The company is expected to increase net fixed assets to $700 million.

So, the forecasted fixed assets for the year 2017 are $700 million.

Calculation of forecasted account receivable for the year 2017,

Given,

Total credit sales for 2017 are $2,500 million.

The DSO is 34 days.

Calculation of account receivable,

Calculation of forecasted cost of goods sold for the year 2017,

Given,

Forecasted fixed cost for the year 2017 is $1,500 million.

Forecasted variable cost for the year 2017 is $870 million.

Calculation of cost of goods sold,

Calculation of forecasted inventories for the year 2017 after the adjustment,

Given,

Cost of goods sold is $2,375 million.

The company is expected to raise its inventory turnover to 10 times.

Calculation of inventories,

Calculation of cash and equivalents for the year 2017 after the adjustment,

Given,

Total current assets for the year 2017 after adjustment are$550 million.

Inventory for the year 2017 after adjustment is $237.5 million.

Account receivable for the year 2017 after adjustment is $233 million.

Calculation of cash and cash equivalents,

c.

To calculate: Final forecasted ratio and compare the ratios with the ratios of 2016, initial forecasted ratio of 2017 and with industry ratio.

Current Ratio:

Current ratio is a measurement tool to identify that whether a company has enough current assets to repay its current liabilities or not.

Fixed Asset Turnover:

Fixed asset turnover is a measuring tool to identify that how a company generates its net sales through the efficient use of its fixed assets.

Total Asset Turnover:

Total asset turnover is a measuring tool to identify that how a company generates its net sales through the efficient use of total assets

Profit Margin:

The profit margin is also known as sales margin, as profit margin is the margin or profit calculated on sales revenue and is equal to the excess of sales over cost of goods sold.

Payout Ratio:

Payout ratio indicates the amount of dividend paid to the shareholders of a company from the net income generated by a company over a period of time.

Times Interest Earned Ratio:

It is a ratio that helps in measuring the company’s ability to pay off its interest through the income generated by a company before interest and tax. It tells that how much amount a company has to use to pay off its interest obligation.

Basic Earnings Ratio:

It is a ratio that helps in measuring that what is the company’s earning power before the effect of financial leverage and income tax on business.

Return on Equity:

It is a ratio that tells about the amount of company’s earnings from the amount invested by its shareholder on the equity.

Days Sales Outstanding:

Days sales outstanding mean the ratio to calculate the number of days a company needed to recover the amounts from its debtors.

Explanation of Solution

Calculation of forecasted ratio after adjustment,

Calculation of current ratio,

Given,

Total current assets after adjustment for 2017 are $550 million.

Total current liabilities for 2017 are $315 million.

Formula to calculate current ratio,

Substitute $550 million for current assets and $315 million for current liabilities.

Calculation of fixed assets turnover ratio,

Given,

Net sales for 2017 are $2,500 million.

Fixed assets for 2017 after adjustment are $700 million.

Formula to calculate fixed assets turnover ratio,

Substitute $2,500 million for net sales and $700 for fixed assets.

Comparison of company’s financial ratio

|

Company’s Key Ratios | 2016 |

2017 (initial) | 2017(final) | Industry |

| Basic earning power | 10.00% | 10.00% | 10.00% | 20.00% |

| Profit margin | 2.25 | 2.62 | 2.62 | 4.00 |

| Returns on equity | 7.20 | 8.77 | 8.77 | 15.60 |

| Days sales outstanding | 43.80 days | 43.80 days | 34 days | 32 days |

| Inventory turnover | 8.33

| 8.33

| 10

| 11.00

|

| Fixed assets turnover | 4.00 | 4.00 | 3.57 | 5.00 |

| Total assets turnover | 2.00 | 2.00 | 2.00 | 2.50 |

| Total liabilities/assets | 30.00% | 40.40% | 40.40% | 36.00% |

| Times interest earned | 6.25

| 7.81

| 7.81

| 9.40

|

| Current ratio | 2.50 | 1.99 | 1.75 | 3.00 |

| Payout ratio | 30.00% | 30.00% | 30.00% | 30.00% |

Table (2)

Yes, the financial position of the company is going to be improve in the next coming year. As the company is going to increase its total assets and the sales revenue.

- Basic earnings ratio reflects the company’s earning power before the effect of business income taxes and financial leverage is less than the industry, which is 10% in the year 2016,2017 (initial) and 2017 (final) and the of industry is 20%.

- Profit margin reflects that 2.62 % of company sales are its profit while the average of the industry is 4.00%.

- Returns on equity ratio indicates that in 2016 the company is generating 7.20% earned from the amount invested by shareholders while in 2017 it is 8.77% and the average of the industry it is 15.06%.

- Days sales outstanding ratio reflects the average collection period of the company in 2016 is 43.80 days, in 2017 initially it was 43.80 days while in 2017 after adjustment it is 34 days and the average of the industry is 32 days.

- Inventory turnover represent in 2016 company’s inventory is sold and replaced in 8.33 days, in 2017 initially it was 8.33 days , in 2017 after final adjustment, it is 10 days and the average of the industry it is 11 days.

- Fixed asset turnover ratio reflects the use of fixed assets to generate sales revenue. The high fixed asset turnover indicates the effective use of fixed assets to generate revenue which is 4% in the year 2016 and 2017 in initial and 3.57% in the year 2017 in the final and the average of the industry is 5%.

- Total asset turnover ratio reflects the use of total assets to generate sales revenue. The high total asset turnover indicates the effective use of total assets to generate revenue which is 2% of the company and 2.50% is the average of the industry.

- Total assets/liabilities indicate the amount of total assets provided by debts. The lower the ratio, the lower the debt of a company which is 30% in 2016, 40.40 in 2017 (initial) and 2017(final) and 36% is the average of the industry.

- Times interest earned ratio represents the company’s ability to pay off its interest from its earnings. The higher the ratio the higher the ability of company to pay off its interest by its earnings, which is 6.25 times in the year 2016, 7.81 in the year 2017 and 9.40 is the average of industry.

- Current ratio indicated the company’s ability to pay off its current liabilities by its current assets, which is 2.50 in the year 2016, 1.99 in the initial 2017, 1.75 in the final 2017 and 3.00 is the average of the industry.

- The payout ratio indicates the amount of dividend paidto the shareholders of a company from its earnings, which is 30% of the company as well as 30% is the average of the industry.

The company’s final forecasted current ratio is 1.75, fixed assets turnover ratio is 3.57, the inventory turnover ratio is 10 times and the days sale outstanding are 34 days. And the financial position of the company will improve in the coming year.

d.

To calculate: Final free cash flow for 2017 and compare with the initially forecasted cash flow for 2017.

Cash flow:

The net amount of cash and equivalents moving into and out of a business

Explanation of Solution

Calculation of cash and equivalents for the year 2017 after the adjustment,

Given,

Total current assets for the year 2017 after adjustment are$550 million.

Inventory for the year 2017 after adjustment is $237.5 million.

Account receivable for the year 2017 after adjustment is $233 million.

Formula to calculate cash and cash equivalents,

Substitute $550million for total current assets, $233 million for accounts receivable and $237.5 for inventories.

The initially cash forecasted cash flow for 2017 was $25 million.

Comparison of initial cash flow for 2017 and final cash flow for 2017.

The final cash flow of 2017 has been increase due to days sales outstanding has increase to 34 days, which means that the account receivable has been due and increases the amount of cash flow.

The final cash flow for 2017 is $79.5 million and the final cash flow has been increase as compare to initial cash flow.

e.

To calculate: Increase in sales in terms of dollars and % when fixed assets are operated at 100% capacity.

Explanation of Solution

Calculation of sales if fixed assets are operated at 100% capacity,

Given,

Sales for year 2016 are $2,000 million (Fixed assets are operated at 85% capacity).

Formula to calculate sales if fixed assets are operated at 100% capacity,

Substitute $2,000 million for sales at 85% capacity.

Calculation of % increase in sales,

Given,

Sales for year 2016 at 85% capacity are $2,000 million.

Sales for year 2016 at 100% capacity are $2,353 million.

Formula to calculate % increase in sales,

Substitute $2,353 million for sales at 100% capacity and $2,000 million for sales at 85% capacity.

The 17.65% sales or sales amounted to $2,353 million should be increase if the fixed assets are operated at 100% capacity.

f.

1.

To identify: The effect of dividend payout ratio on AFN.

Answer to Problem 16IC

The AFN will increase as an increase in the dividend payout ratio. If the dividend payout ratio remains constant and if a company wants to decrease its dividend payout ratio then the company does not need the additional funds.

Explanation of Solution

If the company wants to increase in the dividend payout ratio it means the company needs additional profit, which can only generate by increase in sales revenue and sales revenue only increase by the company has additional funds to increase its assets.

The AFN will increase as the dividend payout ratio is increase.

2.

To identify: The effect of profit margin on AFN.

Answer to Problem 16IC

Every company’s main motive is to increase its profit margin. The AFN will increase as increase in profit margin. If the profit margin remains constant,then the company does not need the additional funds.

Explanation of Solution

If the company wants to increase in profit margin it means the company needs additional sales revenue and sales revenue only increase by the company has additional funds to increase its assets.

The AFN will increase as the profit margin is increase.

3.

To identify: The effect of capital intensity ratio on AFN.

Capital Intensity Ratio:

The capital intensity ratio is the ratio to find the amount of capital a company needed to invest in its assets so that company has enough assets to meet its sales target. It helps to find out the amount of capital a company can invest into its assets.

Answer to Problem 16IC

The AFN will increase as the capital intensity ration will increase.

Explanation of Solution

It the company wants to increase its assets it means companiesneed addition capital to invest it inthe assets, so increase in the capital intensity ratio will increase the AFN.

The AFN will increase as increase in capital intensity ratio.

4.

To identify: The effect of suppliers permit to the company to pay after 60 days rather than 30 days.

Answer to Problem 16IC

The company does not need additional fund in this case.

Explanation of Solution

As the company gets extra time period to pay off to its suppliers than there is no requirement of additional fund to pay off the suppliers.

No AFN is required.

Want to see more full solutions like this?

Chapter 16 Solutions

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

- Larry Davis borrows $80,000 at 14 percent interest toward the purchase of a home. His mortgage is for 25 years. a. How much will his annual payments be? (Although home payments are usually on a monthly basis, we shall do our analysis on an annual basis for ease of computation. We will get a reasonably accurate answer.) b. How much interest will he pay over the life of the loan? c. How much should be willing to pay to get out of a 14 percent mortgage and into a 10 percent mortgage with 25 years remaining on the mortgage? Assume current interest rates are 10 percent. Carefully consider the time value of money. Disregard taxes.arrow_forwardYou are chairperson of the investment fund for the local closet. You are asked to set up a fund of semiannual payments to be compounded semiannually to accumulate a sum of $250,000 after nine years at a 10 percent annual rate (18 payments). The first payment into the fund is to take place six months from today, and the last payment is to take place at the end of the ninth year. Determine how much the semiannual payment should be. (a) On the day, after the sixth payment is made (the beginning of the fourth year), the interest rate goes up to a 12 percent annual rate, and you can earn a 12 percent annual rate on funds that have been accumulated as well as all future payments into the funds. Interest is to be compounded semiannually on all funds. Determine how much the revised semiannual payments should be after this rate change (there are 12 payments and compounding dates). The next payment will be in the middle of the fourth year.arrow_forwardIf your Uncle borrows $60,000 from the bank at 10 percent interest over the seven-year life of the loan, what equal annual payments must be made to discharge the loan, plus pay the bank its required rate of interest? How much of his first payment will be applied to interest? To principal? How much of his second payment will be applied to each?arrow_forward

- Q1: You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5.The required rate of return for NEWER stock is 14% compounded annually.What is NEWER’s stock price?The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8.The required rate of return for OLDER stock is 16% compounded annually.What is OLDER’s stock price?Now assume that both stocks have a required…arrow_forwardQ1: Blossom is 30 years old. She plans on retiring in 25 years, at the age of 55. She believes she will live until she is 105. In order to live comfortably, she needs a substantial retirement income. She wants to receive a weekly income of $5,000 during retirement. The payments will be made at the beginning of each week during her retirement. Also, Blossom has pledged to make an annual donation to her favorite charity during her retirement. The payments will be made at the end of each year. There will be a total of 50 annual payments to the charity. The first annual payment will be for $20,000. Blossom wants the annual payments to increase by 3% per year. The payments will end when she dies. In addition, she would like to establish a scholarship at Toronto Metropolitan University. The first payment would be $80,000 and would be made 3 years after she retires. Thereafter, the scholarship payments will be made every year. She wants the payments to continue after her death, therefore…arrow_forwardQ1: Blossom is 30 years old. She plans on retiring in 25 years, at the age of 55. She believes she will live until she is 105. In order to live comfortably, she needs a substantial retirement income. She wants to receive a weekly income of $5,000 during retirement. The payments will be made at the beginning of each week during her retirement. Also, Blossom has pledged to make an annual donation to her favorite charity during her retirement. The payments will be made at the end of each year. There will be a total of 50 annual payments to the charity. The first annual payment will be for $20,000. Blossom wants the annual payments to increase by 3% per year. The payments will end when she dies. In addition, she would like to establish a scholarship at Toronto Metropolitan University. The first payment would be $80,000 and would be made 3 years after she retires. Thereafter, the scholarship payments will be made every year. She wants the payments to continue after her death, therefore…arrow_forward

- Jerome Moore invests in a stock that will pay dividends of $2.00 at the end of the first year; $2.20 at the end of the second year; and $2.40 at the end of the third year. also, he believes that at the end of the third year he will be able to sell the stock for $33. what is the present value of all future benefits if a discount rate of 11 percent is applied?arrow_forwardQ1: You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5.The required rate of return for NEWER stock is 14% compounded annually.What is NEWER’s stock price?The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8.The required rate of return for OLDER stock is 16% compounded annually.What is OLDER’s stock price?Now assume that both stocks have a required…arrow_forwardQ1: You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5.The required rate of return for NEWER stock is 14% compounded annually.What is NEWER’s stock price?The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8.The required rate of return for OLDER stock is 16% compounded annually.What is OLDER’s stock price?Now assume that both stocks have a required…arrow_forward

- Q1: Blossom is 30 years old. She plans on retiring in 25 years, at the age of 55. She believes she will live until she is 105. In order to live comfortably, she needs a substantial retirement income. She wants to receive a weekly income of $5,000 during retirement. The payments will be made at the beginning of each week during her retirement. Also, Blossom has pledged to make an annual donation to her favorite charity during her retirement. The payments will be made at the end of each year. There will be a total of 50 annual payments to the charity. The first annual payment will be for $20,000. Blossom wants the annual payments to increase by 3% per year. The payments will end when she dies. In addition, she would like to establish a scholarship at Toronto Metropolitan University. The first payment would be $80,000 and would be made 3 years after she retires. Thereafter, the scholarship payments will be made every year. She wants the payments to continue after her death, therefore…arrow_forwardTrue and False 1. There are no more than two separate phases to decision making and problem solving. 2. Every manager always has complete control over all inputs and factors. 3. Opportunity cost is only considered by accountants as a way to calculate profits 4. Standard error is always used to evaluate the overall strength of the regression model 5. The t-Stat is used in a similar way as the P-valued is used 6. The P-value is used as R-square is used. 7. R-square is used to evaluate the overall strength of the model. 8. Defining the problem is one of the last things that a manager considers Interpreting Regression Printouts (very brief answers) R² = .859 Intercept T N = 51 Coefficients 13.9 F= 306.5 Standard Error .139 SER=.1036 t Stat P value 99.8 0 .275 .0157 17.5 0 The above table examines the relationship between the nunber, of poor central city households in the U.S. and changes in the costs of college tuition from 1967 to 2019. 9. What is the direction of this relationship? 10.…arrow_forwardCARS Auto Co. Ltd – Alpha Branch Unadjusted Trial Balance December 31, 2024 A/C NAME TRIAL BALANCE DR CR cash 240,000 Accounts receivables 120,000 supplies 41,100 Lease hold improvement 200,000 Accumulated depreciation – Lease hold improvement 80,000 Furniture and fixtures 800,000 Accumulated depreciation - furniture and fixtures 380,000 Accounts payable 30,000 Salary payable Unearned service revenue 44,100 Cars, capital 649,000 Cars, withdrawal 165,100 Service revenue 450,000 Salary expense 48,400 Supplies expense Rent expense Depreciation expense – leasehold improvement Depreciation expense – furniture and fixtures Advertising expense 18,500 1,633,100 1,633,100 Data presented for the adjusting entries include the following: Rent expense of $160,000…arrow_forward

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT