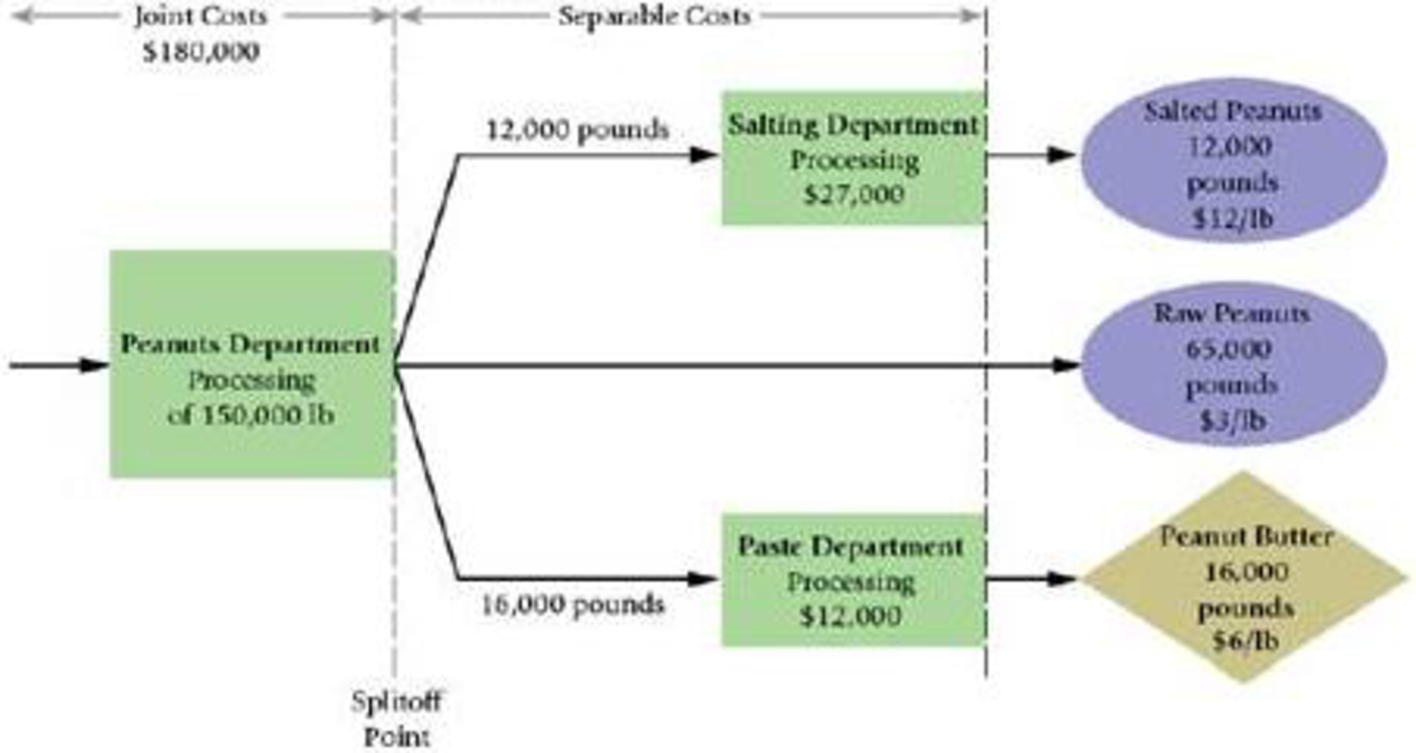

Joint costs and byproducts. (W. Crum adapted) Royston, Inc., is a large food-processing company. It processes 150,000 pounds of peanuts in the peanuts department at a cost of $180,000 to yield 12,000 pounds of product A, 65,000 pounds of product B, and 16,000 pounds of product C.

- Product A is processed further in the salting department at a cost of $27,000. It yields 12,000 pounds of salted peanuts, which are sold for $12 per pound.

- Product B (raw peanuts) is sold without further processing at $3 per pound.

- Product C is considered a byproduct and is processed further in the paste department at a cost of $12,000. It yields 16,000 pounds of peanut butter, which are sold for $6 per pound.

The company wants to make a gross margin of 10% of revenues on product C and needs to allow 20% of revenues for marketing costs on product C. An overview of operations follows:

- 1. Compute unit costs per pound for products A, B, and C, treating C as a byproduct. Use the NRV method for allocating joint costs. Deduct the NRV of the byproduct produced from the joint cost of products A and B.

Required

- 2. Compute unit costs per pound for products A, B, and C, treating all three as joint products and allocating joint costs by the NRV method.

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Chapter 16 Solutions

Cost Accounting

Additional Business Textbook Solutions

Managerial Accounting (5th Edition)

Financial Accounting: Tools for Business Decision Making, 8th Edition

Horngren's Accounting (12th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Fundamentals of Management (10th Edition)

Business Essentials (12th Edition) (What's New in Intro to Business)

- Gary Watson, a graduating business student at a small college, is currently interviewing for a job. Gary was invited by both Tilly Manufacturing Company and Watson Supply Company to travel to a nearby city for an interview. Both companies have offered to pay Gary's expenses. His total expenses for the trip were $96 for mileage on his car and $45 for meals. As he prepares the letters requesting reimbursement, he is considering asking for the total amount of the expenses from both employers. His rationale is that if he had taken separate trips, each employer would have had to pay that amount. Who are the parties that are directly affected by this ethical dilemma? multiple choice 1 Tilly Manufacturing Company Watson Supply Company Both the employers Are the other students at the college potentially affected by Gary's decision? multiple choice 2 Yes No Are the professors at the college potentially affected by Gary's decision? multiple choice 3 Yes No…arrow_forwardSolve with accounting explanationarrow_forwardFinancial Accountingarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,