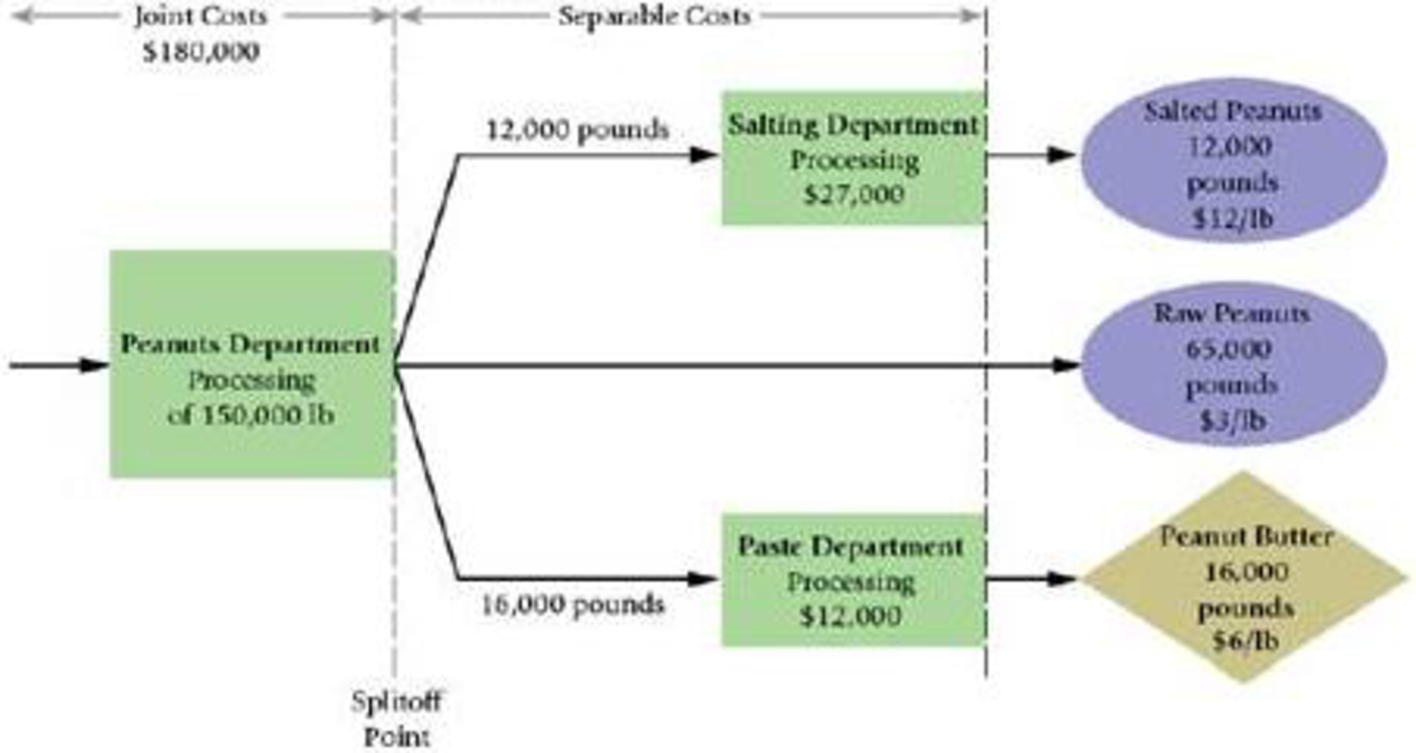

Joint costs and byproducts. (W. Crum adapted) Royston, Inc., is a large food-processing company. It processes 150,000 pounds of peanuts in the peanuts department at a cost of $180,000 to yield 12,000 pounds of product A, 65,000 pounds of product B, and 16,000 pounds of product C.

- Product A is processed further in the salting department at a cost of $27,000. It yields 12,000 pounds of salted peanuts, which are sold for $12 per pound.

- Product B (raw peanuts) is sold without further processing at $3 per pound.

- Product C is considered a byproduct and is processed further in the paste department at a cost of $12,000. It yields 16,000 pounds of peanut butter, which are sold for $6 per pound.

The company wants to make a gross margin of 10% of revenues on product C and needs to allow 20% of revenues for marketing costs on product C. An overview of operations follows:

- 1. Compute unit costs per pound for products A, B, and C, treating C as a byproduct. Use the NRV method for allocating joint costs. Deduct the NRV of the byproduct produced from the joint cost of products A and B.

Required

- 2. Compute unit costs per pound for products A, B, and C, treating all three as joint products and allocating joint costs by the NRV method.

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Chapter 16 Solutions

Cost Accounting (15th Edition)

Additional Business Textbook Solutions

Managerial Accounting (5th Edition)

Financial Accounting: Tools for Business Decision Making, 8th Edition

Horngren's Accounting (12th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Fundamentals of Management (10th Edition)

Business Essentials (12th Edition) (What's New in Intro to Business)

- Please provide the answer to this general accounting question using the right approach.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,