Joint costs and decision making. Jack Bibby is a prospector in the Texas Panhandle. He has also been running a side business for the past couple of years. Based on the popularity of shows such as “Rattlesnake Nation,” there has been a surge of interest from professionals and amateurs to visit the northern counties of Texas to capture snakes in the wild. Jack has set himself up as a purchaser of these captured snakes.

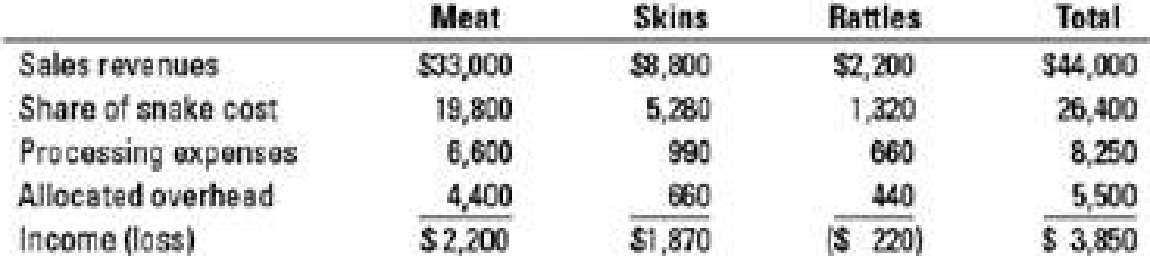

Jack purchases rattlesnakes in good condition from “snake hunters” for an average of $11 per snake. Jack produces canned snake meat, cured skins, and souvenir rattles, although he views snake meat as his primary product. At the end of the recent season, Jack Bibby evaluated his financial results:

The cost of snakes is assigned to each product line using the relative sales value of meat, skins, and rattles (i.e., the percentage of total sales generated by each product). Processing expenses are directly traced to each product line.

Jack has a philosophy of every product line paying for itself and is determined to cut his losses on rattles.

- 1. Should Jack Bibby drop rattles from his product offerings? Support your answer with computations.

Required

- 2. An old miner has offered to buy every rattle “as is” for $0.60 per rattle (note: “as is” refers to the situation where Jack only removes the rattle from the snake and no

processing costs are incurred). Assume that Jack expects to process the same number of snakes each season. Should he sell rattles to the miner? Support your answer with computations.

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

Cost Accounting (15th Edition)

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

- Please provide the answer to this general accounting question with proper steps.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub  Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning