COST ACCOUNTING

16th Edition

ISBN: 9781323694008

Author: Horngren

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 16.23E

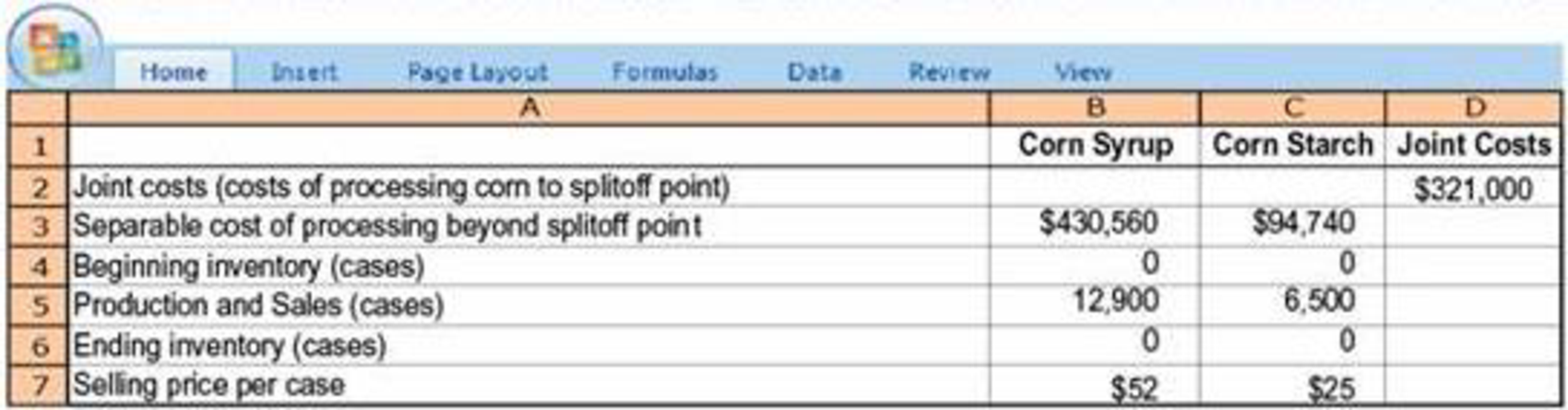

Net realizable value method. Sweeney Company is one of the world’s leading corn refiners. It produces two joint products—corn syrup and corn starch—using a common production process. In July 2017, Sweeney reported the following production and selling-price information:

Allocate the $321,000 joint costs using the NRV method.

Required

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Step by step answer general Accounting question

What is dol

give answer

Chapter 16 Solutions

COST ACCOUNTING

Ch. 16 - Give two examples of industries in which joint...Ch. 16 - What is a joint cost? What is a separable cost?Ch. 16 - Distinguish between a joint product and a...Ch. 16 - Why might the number of products in a joint-cost...Ch. 16 - Provide three reasons for allocating joint costs...Ch. 16 - Why does the sales value at splitoff method use...Ch. 16 - Prob. 16.7QCh. 16 - Distinguish between the sales value at splitoff...Ch. 16 - Give two limitations of the physical-measure...Ch. 16 - How might a company simplify its use of the NRV...

Ch. 16 - Why is the constant gross-margin percentage NRV...Ch. 16 - Managers must decide whether a product should be...Ch. 16 - Prob. 16.13QCh. 16 - Describe two major methods to account for...Ch. 16 - Why might managers seeking a monthly bonus based...Ch. 16 - Prob. 16.16MCQCh. 16 - Joint costs of 8,000 are incurred to process X and...Ch. 16 - Houston Corporation has two products, Astros and...Ch. 16 - Dallas Company produces joint products, TomL and...Ch. 16 - Earls Hurricane Lamp Oil Company produces both A-1...Ch. 16 - Joint-cost allocation, insurance settlement....Ch. 16 - Joint products and byproducts (continuation of...Ch. 16 - Net realizable value method. Sweeney Company is...Ch. 16 - Alternative joint-cost-allocation methods,...Ch. 16 - Alternative methods of joint-cost allocation,...Ch. 16 - Prob. 16.26ECh. 16 - Joint-cost allocation, sales value, physical...Ch. 16 - Joint-cost allocation: Sell immediately or process...Ch. 16 - Accounting for a main product and a byproduct....Ch. 16 - Joint costs and decision making. Jack Bibby is a...Ch. 16 - Joint costs and byproducts. (W. Crum adapted)...Ch. 16 - Methods of joint-cost allocation, ending...Ch. 16 - Alternative methods of joint-cost allocation,...Ch. 16 - Comparison of alternative joint-cost-allocation...Ch. 16 - Joint-cost allocation, process further or sell....Ch. 16 - Joint-cost allocation. SW Flour Company buys 1...Ch. 16 - Further processing decision (continuation of...Ch. 16 - Joint-cost allocation with a byproduct. The...Ch. 16 - Byproduct-costing journal entries (continuation of...Ch. 16 - Joint-cost allocation, process further or sell....Ch. 16 - Prob. 16.41PCh. 16 - Prob. 16.42PCh. 16 - Methods of joint-cost allocation, comprehensive....

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License