In 2018, a city opens a municipal landfill, which it will account for in an enterprise fund. It estimates capacity to be 6 million cubic feet and usable life to be 20 years. To close the landfill, the municipality expects to incur labor, material, and equipment costs of $4 million. Thereafter, it expects to incur an additional $6 million of cost to monitor and maintain the site. 1. In 2018, the city uses 300,000 cubic feet of the landfill. Prepare the journal entry to record the expense for closure and post-closure care. 2. In 2019, it again uses 300,000 cubic feet of the landfill. It revises its estimate of available volume to 5.8 million cubic feet and closure and post-closure costs to $10.2 million. Prepare the journal entry to record the expense for closure and post-closure care. 3. Suppose the city accounts for the landfill in the general fund. How would the above entries for 2018 and 2019 differ?

In 2018, a city opens a municipal landfill, which it will account for in an enterprise fund. It estimates capacity to be 6 million cubic feet and usable life to be 20 years. To close the landfill, the municipality expects to incur labor, material, and equipment costs of $4 million. Thereafter, it expects to incur an additional $6 million of cost to monitor and maintain the site.

1. In 2018, the city uses 300,000 cubic feet of the landfill. Prepare the

2. In 2019, it again uses 300,000 cubic feet of the landfill. It revises its estimate of available volume to 5.8 million cubic feet and closure and post-closure costs to $10.2 million. Prepare the journal entry to record the expense for closure and post-closure care.

3. Suppose the city accounts for the landfill in the general fund. How would the above entries for 2018 and 2019 differ?

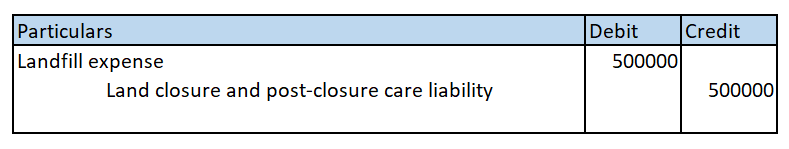

Journal Entry:

Journal entry has two effects for every transaction. The journal entry is passed by first finding the type of account and the applying the golden rules of that type of account. Real account’s golden rules are Debit what comes in Credit what goes out. Personal accounts golden rule is Debit the receiver Credit the Giver. Nominal account rule is Debit all Expenses and losses Credit all Incomes and gains.

1.

In 2018, the city uses 300,000 cubic feet of the landfill. Journal entry to record the expense for closure and post-closure care is as follows:

Step by step

Solved in 4 steps with 2 images