FUND.OF FINANCIAL MGMT:CONCISE-MINDTAP

10th Edition

ISBN: 9781337910972

Author: Brigham

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 14P

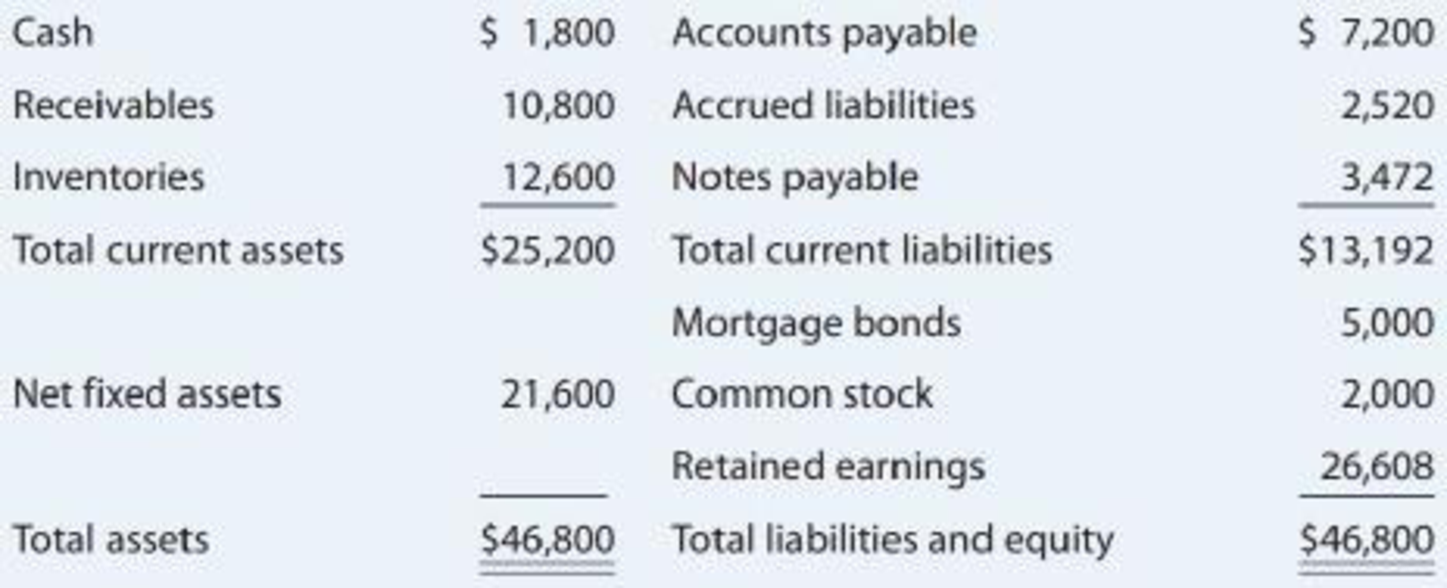

EXCESS CAPACITY Krogh Lumber’s 2019 financial statements are shown here.

Krogh Lumber:

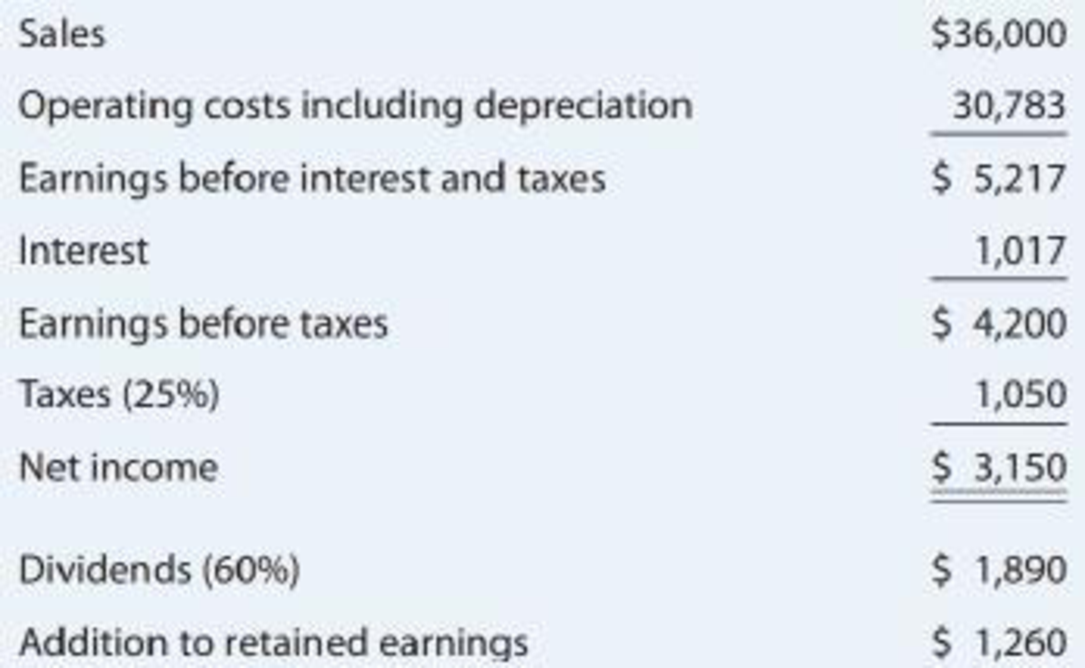

Krogh Lumber: Income Statement for December 31, 2019 (thousands of dollars)

- a. Assume that the company was operating at full capacity in 2019 with regard to all items except fixed assets; fixed assets in 2019 were being utilized to only 75% of capacity. By what percentage could 2020 sales increase over 2019 sales without the need for an increase in fixed assets?

- b. Now suppose 2020 sales increase by 25% over 2019 sales. Assume that Krogh cannot sell any fixed assets. All assets other than fixed assets will grow at the same rate as sales; however, after reviewing industry averages, the firm would like to reduce its operating costs/sales ratio to 82% and increase its total liabilities-to-assets ratio to 42%. The firm will maintain its 60% dividend payout ratio, and it currently has 1 million shares outstanding. The firm plans to raise 35% of its 2020 forecasted interest-bearing debt as notes payable, and it will issue bonds for the remainder. The firm

forecasts that its before-tax cost of debt (which includes both short- and long-term debt) is 11%. Any stock issuances or repurchases will be made at the firm’s current stock price of $40. Develop Krogh’s projected financial statements like those shown in Table 16.2. What are the balances of notes payable, bonds, common stock, andretained earnings ?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Gray

Media would let you make quarterly payments of $1,430 for 7 years at an interest rate of 1.59 percent per quarter. Your first payment to

Gray Media would be today. River Media would let you make monthly payments of $X for 8 years at an interest rate of 1.46 percent per

month. Your first payment to River Media would be in 1 month. What is X?

Input instructions: Round your answer to the nearest dollar.

59

You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Gray

Media would let you make quarterly payments of $14,000 for 6 years at an interest rate of 1.50 percent per quarter. Your first payment

to Gray Media would be in 3 months. Island Media would let you make monthly payments of $X for 4 years at an interest rate of

1.35 percent per month. Your first payment to Island Media would be today. What is X?

Input instructions: Round your answer to the nearest dollar.

99

You plan to retire in 7 years with $X. You plan to withdraw $54,100 per year for 15 years. The expected return is 13.19 percent per year

and the first regular withdrawal is expected in 7 years. What is X?

Input instructions: Round your answer to the nearest dollar.

SA

Chapter 16 Solutions

FUND.OF FINANCIAL MGMT:CONCISE-MINDTAP

Ch. 16 - Prob. 1QCh. 16 - Assume that an average firm in the office supply...Ch. 16 - Would you agree that computerized corporate...Ch. 16 - Certain liability and net worth items generally...Ch. 16 - Suppose a firm makes the following policy changes....Ch. 16 - AFN EQUATION Carlsbad Corporations sales are...Ch. 16 - AFN EQUATION Refer to Problem 16-1. What...Ch. 16 - AFN EQUATION Refer to Problem 16-1 and assume that...Ch. 16 - PRO FORMA INCOME STATEMENT Austin Grocers recently...Ch. 16 - EXCESS CAPACITY Williamson Industries has 7...

Ch. 16 - Prob. 6PCh. 16 - PRO FORMA INCOME STATEMENT At the end of last...Ch. 16 - LONG-TERM FINANCING NEEDED At year-end 2019, total...Ch. 16 - SALES INCREASE Paladin Furnishings generated 4...Ch. 16 - REGRESSION AND RECEIVABLES Edwards Industries has...Ch. 16 - REGRESSION AND INVENTORIES Charlies Cycles Inc....Ch. 16 - Prob. 12PCh. 16 - ADDITIONAL FUNDS NEEDED Morrissey Technologies...Ch. 16 - EXCESS CAPACITY Krogh Lumbers 2019 financial...Ch. 16 - Prob. 1TCLCh. 16 - FORECASTING THE FUTURE PERFORMANCE OF ABERCROMBIE ...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You plan to retire in 3 years with $911,880. You plan to withdraw $X per year for 18 years. The expected return is 18.56 percent per year and the first regular withdrawal is expected in 3 years. What is X? Input instructions: Round your answer to the nearest dollar. $ 59arrow_forwardYou just borrowed $203,584. You plan to repay this loan by making regular quarterly payments of X for 69 quarters and a special payment of $56,000 in 7 quarters. The interest rate on the loan is 1.94 percent per quarter and your first regular payment will be made today. What is X? Input instructions: Round your answer to the nearest dollar. $arrow_forwardI got 1.62 but it's wrong why?arrow_forward

- You plan to retire in 8 years with $X. You plan to withdraw $114,200 per year for 21 years. The expected return is 17.92 percent per year and the first regular withdrawal is expected in 9 years. What is X? Input instructions: Round your answer to the nearest dollar. 69 $arrow_forwardHow much do you need in your account today if you expect to make quarterly withdrawals of $6,300 for 7 years and also make a special withdrawal of $25,700 in 7 years. The expected return for the account is 4.56 percent per quarter and the first regular withdrawal will be made today. Input instructions: Round your answer to the nearest dollar. $arrow_forwardFor EnPro, Please find the following values using the pdf (value line) provided . Please no excle. On Value Line: DPO = All Div'ds to Net Profit On Value Line: ROE = Return on Shr. Equity On Value Line: P/E = Avg Ann'l P/E ratio* r= _ Average DPO= _ Growth rate= _ Average P/E= _ 2026 EPS= _ 2027 EPS= _ 2028 EPS= _ 2026 dividend= _ 2027 dividend= _ 2028 dividend= _ 2028 price= _ 2028 total cash flow Intrinsic value= _arrow_forward

- Don't used hand raitingarrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Gray Media would let you make quarterly payments of $14,000 for 6 years at an interest rate of 1.50 percent per quarter. Your first payment to Gray Media would be in 3 months. Island Media would let you make monthly payments of $X for 4 years at an interest rate of 1.35 percent per month. Your first payment to Island Media would be today. What is X? Input instructions: Round your answer to the nearest dollar. SA $arrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Gray Media would let you make quarterly payments of $1,430 for 7 years at an interest rate of 1.59 percent per quarter. Your first payment to Gray Media would be today. River Media would let you make monthly payments of $X for 8 years at an interest rate of 1.46 percent per month. Your first payment to River Media would be in 1 month. What is X? Input instructions: Round your answer to the nearest dollar. $arrow_forward

- You just borrowed $203,584. You plan to repay this loan by making regular quarterly payments of X for 69 quarters and a special payment of $56,000 in 7 quarters. The interest rate on the loan is 1.94 percent per quarter and your first regular payment will be made today. What is X? Input instructions: Round your answer to the nearest dollar. 59arrow_forwardYou plan to retire in 4 years with $698,670. You plan to withdraw $X per year for 17 years. The expected return is 17.95 percent per year and the first regular withdrawal is expected in 5 years. What is X? Input instructions: Round your answer to the nearest dollar. $arrow_forwardYou just borrowed $111,682. You plan to repay this loan by making X regular annual payments of $15,500 and a special payment of $44,900 in 10 years. The interest rate on the loan is 13.33 percent per year and your first regular payment will be made in 1 year. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Financial Projections for Startups Basic Walkthrough; Author: Mike Lingle;https://www.youtube.com/watch?v=7avegQF4dxI;License: Standard youtube license