MANAGING CURRENT ASSETS Dan Barnes,

EVA = EBIT(1 – T) − Annual dollar cost of capital

= EBIT(1 – T) – (WACC Capital employed

If EVA is positive, the firm is creating value. On the other hand, if EVA is negative, the firm is not covering its cost of capital and stockholders’ value is being eroded. Koren rewards managers handsomely if they create value, but those whose operations produce negative EVAs are soon looking for work. Koren frequently points out that if a company can generate its current level of sales with fewer assets, it will need less capital. That would, other things held constant, lower capital costs and increase EVA.

Shortly after he took control, Koren met with SKI’s senior executives to tell them his plans for the company. First, he presented some EVA data that convinced everyone that SKI had not been creating value in recent years. He then stated, in no uncertain terms, that this situation must change. He noted that SKI’s designs of skis, boots, and clothing are acclaimed throughout the industry but that other aspects of the company must be seriously amiss. Either costs are too high, prices are too low, or the company employs too much capital; and he expects SKI’s managers to identify and correct the problem.

Barnes has long believed that SKI’s working capital situation should be studied—the company may have the optimal amounts of cash, securities, receivables, and inventories, but it may also have too much or too little of these items. In the past, the production manager resisted Barnes’s efforts to question his holdings of raw materials inventories; the marketing manager resisted questions about finished goods; the sales staff resisted questions about credit policy (which affects accounts receivable); and the treasurer did not want to talk about her cash and securities balances. Koren’s speech made it clear that such resistance would no longer be tolerated.

Barnes also knows that decisions about working capital cannot be made in a vacuum. For example, if inventories could be lowered without adversely affecting operations, less capital would be required, the dollar cost of capital would decline, and EVA would increase. However, lower raw materials inventories might lead to production slowdowns and higher costs, while lower finished goods inventories might lead to the loss of profitable sales. So before inventories are changed, it will be necessary to study operating as well as financial effects. The situation is the same with regard to cash and receivables.

- a. Barnes plans to use the ratios in Table IC 16.1 as the starting point for discussions with SKI’s operating executives. He wants everyone to think about the pros and cons of changing each type of current asset and the way changes would interact to affect profits and EVA. Based on the data in Table IC 16.1, does SKI seem to be following a relaxed, moderate, or restricted current assets investment policy?

- b. How can we distinguish between a relaxed but rational current assets investment policy and a situation where a firm has a large amount of current assets due to inefficiency? Does SKI’s current assets investment policy seem appropriate? Explain.

- c. SKI tries to match the maturity of its assets and liabilities. Describe how SKI could adopt a more aggressive or a more conservative financing policy.

- d. Assume that SKI’s payables deferral period is 30 days. Now calculate the firm’s cash conversion cycle estimating the inventory conversion period as 365/Inventory turnover.

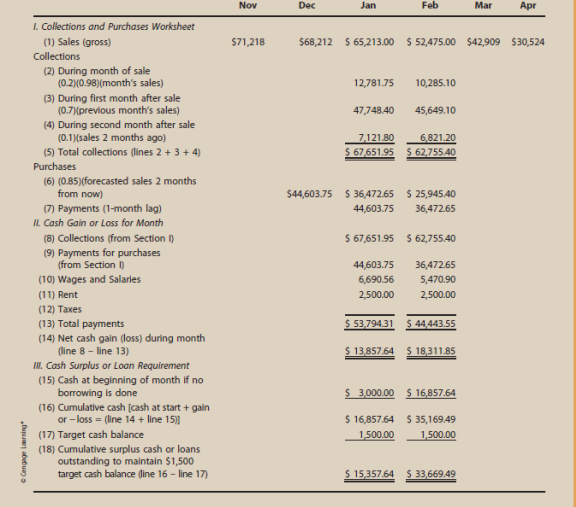

- e. What might SKI do to reduce its cash and securities without harming operations? In an attempt to better understand SKI’s cash position, Barnes developed a cash budget. Data for the first 2 months of the year are shown in Table IC 16.2. (Note that Barnes’s preliminary cash budget does not account for interest income or interest expense.) He has the figures for the other months, but they are not shown in Table IC 16.2.

- f. In his preliminary cash budget, Barnes has assumed that all sales are collected and thus that SKI has no

bad debts . Is this realistic? If not, how would bad debts be dealt with in a cash budgeting sense? (Hint: Bad debts affect collections but not purchases.) - g. Barnes’s cash budget for the entire year, although not given here, is based heavily on his

forecast for monthly sales. Sales are expected to be extremely low between May and September but then increase dramatically in the fall and winter. November is typically the firm’s best month, when SKI ships equipment to retailers for the holiday season. Interestingly, Barnes’s forecasted cash budget indicates that the company’s cash holdings will exceed the targeted cash balance every month except October and November, when shipments will be high but collections will not be coming in until later. Based on the ratios in Table IC 16.1, does it appear that SKI’s target cash balance is appropriate? In addition to possibly lowering the target cash balance, what actions might SKI take to better improve its cash management policies and how might that affect its EVA? - h. Is there any reason to think that SKI may be holding too much inventory? If so, how would that affect EVA and ROE?

- i. If the company reduces its inventory without adversely affecting sales, what effect should this have on the company’s cash position (1) in the short run and (2) in the long run? Explain in terms of the cash budget and the balance sheet.

- j. Barnes knows that SKI sells on the same credit terms as other firms in the industry. Use the ratios presented in Table IC 16.1 to explain whether SKI’s customers pay more or less promptly than those of its competitors. If there are differences, does that suggest that SKI should restrict or relax its credit policy? What four variables make up a firm’s credit policy, and in what direction should each be changed by SKI?

- k. Does SKI face any risks if it restricts its credit policy? Explain.

- l. If the company reduces its DSO without seriously affecting sales, what effect will this have on its cash position (1) in the short run and (2) in the long run? Answer in terms of the cash budget and the balance sheet. What effect should this have on EVA in the long run?

- m. Assume that SKI buys on terms of 1 10, net 30, but that it can get away with paying on the 40th day if it chooses not to take discounts. Also, assume that it purchases $3 million of components per year, net of discounts. How much free trade credit can the company get, how much costly trade credit can it get, and what is the percentage cost of the costly credit? Should SKI take discounts? Why or why not?

- n. Suppose SKI decided to raise an additional $100,000 as a 1-year loan from its bank, for which it was quoted a rate of 8%. What is the effective annual cost rate assuming simple interest and add-on interest on a 12-month installment loan?

Table IC 16.1 Selected Ratios: SKI and Industry Average

| SKI | Industry | |

| Current | 1.75 | 2.25 |

| Debt/Assets | 58.76% | 50.00% |

| Turnover of cash and securities | 16.67 | 22.22 |

| Days sales outstanding (365-day basis) | 45.63 | 32.00 |

| Inventory turnover | 4.82 | 7.00 |

| Fixed assets turnover | 11.35 | 12.00 |

| Total assets turnover | 2.08 | 3.00 |

| Profit margin | 2.07% | 3.50% |

| 10.45% | 21.00% |

TABLE IC 16.2 Ski’s Cash Budget for January and February

a.

To determine: The investment policy followed by Company S.

Introduction:

Economic Value Added:

The economic value added is a tool to measure the financial performance of a company. This value estimates the economic profit of a company. The economic value added is determined by deducting the cost of capital from the operating profit.

Explanation of Solution

Given information:

The current ratio is 1.75.

The quick ratio is 0.83.

The turnover of cash and securities is 16.67.

The policy followed by the company is relaxed working capital policy. This is clear from the following points:

- The working capital policy is analyzed through the firm’s short-term liquidity ratios like current ratio, quick ratio, turnover of cash, and securities and days of outstanding sales.

- These ratios indicate that the company has a large amount of working capital as compared to the level of sales.

- The working capital policies are of three types relaxed, restricted, and moderate policy.

- When the working capital is high than the sales level, this means that the company is following the relaxed policy.

- When the working capital is less then the sales level, this means that the policy followed by the company is the restricted policy.

- The policy, which is in between of these two extreme policies is the moderate policy.

- So, the company is following a relaxed working capital policy.

Therefore, the working capital policy followed by the company is the relaxed working capital policy.

b.

To explain: The way to distinguish between the relaxed current assets investment policy and a situation of a firm having a largeamount of current assets due to inefficiency and whether the current assets investment policy is appropriate or not.

Explanation of Solution

There is the difference between rational but relaxed current assets investment policy and the situation of having a largeamount of current assets due to inefficiency. This is explained as:

- A relaxed net operating working capital is thepolicy under which the comparatively large amount of cash, securities, and inventories are carried and sales are stirred by a liberal strategy.

- This policy results in higher level of receivables, so the company is not able to take benefits of the credit offered by theaccounts payable and accruals.

- The situation where a firm had a largeamount of current assets due to inefficiency is another situation. This means that the firm is not able to convert the assets into cash fast.

- The type of policy which is adopted is suitable if it minimizes risk more than increasing the profitability.

- The relaxed but rational net operating working capital refers to the policy in which the working capital is higher than the level of the sales.

- This kind of policy is effective in reducing risk.

- If a company is having a large amount of current assets, this means that the company is not in a profitable situation.

Therefore, there is difference between the current assets investment policy and a situation of having a largeamount of current assets due to inefficiency and the current assets investment policy which is adopted is appropriate.

c.

To explain: The way in which the Company can adopt a more aggressive or traditionalfinancial policy.

Explanation of Solution

The company wants to match the maturity of its assets and liabilities. The company can adopt a moderate policy to match it. However, the way in which company can adopt a more aggressive or conservative policy is as follows:

- In this case, the company should follow the moderate policy, as it is also called as the maturity method.

- It falls between the aggressive policy and the conservative policy and it is best to be chosen when the firm has to match the maturity.

- If the company wants to adopt a more aggressive policy, the greatest amount of short-term debt will be used.

- If the company wants to adopt a conservative policy, the least amount of short-term debt will be used.

There are three kinds of policies, which are the alternative current asset financing policies. These are as follows:

- Aggressive short-term financing policy:This is a policy in which the companyagrees to finance a fraction of the permanent working capital by temporary sources. This policy looks to reduce the liquidity while meeting the short-term necessities. The organization accepts a higher risk ofliquidation to save the rate of long-term financing and to obtain a higher return.

- Moderate short-term financing policy: This is also called as a maturity method policy. In this policy, the life period of current assets is matched tothe maturity period of the sources of funds. This is the reason the fixed assets are financed by long-term sources and the short-term funds are financed by the short-term sources.

- Conservative short-term financing policy: In this policy the management does not take the risk. This is why the working capital needs are financed by the long-term sources. The short-term sources are restricted to the unexpected and emergency situation only.

Therefore, the moderate financing policy should be used if the company wants to match the maturity of assets and liabilities. To adopt a more aggressive or conservative policy, the company should do as mentioned above.

d.

To determine: The cash conversion cycle.

Introduction:

Cash Conversion Cycle:

The cash conversion cycle refers to the time period, which starts from the production and ends when the receipt of sale is produced for a product. This cycle measures the effectiveness of the management of a company.

Answer to Problem 12IC

The cash conversion cycle is 92 days.

Explanation of Solution

Given information:

The payment deferral period is 30 days.

The inventory conversion period is 365/Inventory turnover.

The inventory turnover is 4.82.

The day's sales outstanding is 45.6 or 46 days.

Calculation of the cash conversion cycle:

The formula to calculate the cash conversion cycle is,

Substitute 76 days for the inventory conversion period (refer working note), 46 days for receivables collection period and 30 days for the payables deferral period in the above formula.

Therefore the cash conversion cycle is 92 days.

Working note:

Calculation of the inventory conversion period:

Therefore the inventory conversion period is 76 days.

e.

To explain: The action of the company to reduce the cash and securities with harming operations.

Explanation of Solution

The company can take following actions to reduce the cash and securities without harming operations:

- Use of lockbox system: In this system, the customers can make the payments to the lockboxes, which are provided in the post office near to them.

- Concentration banking: Under this system, the collection centers should be opened near to the debtors.

- Controlling outflow: The firm should try to slow down the payments to some extent. However, this should not affect the goodwill and credit rating of the firm.

The cash and securities are those financial assets, which are used for balancing the effective needs of a company. The company wants to reduce the cash and securities but without harming the operations. For this, those ways are used where the company can collect the cash in some other manner from the customers. The company needs to manage the inflows and outflows for this purpose.

Therefore, the company should do the above-mentioned actions to reduce the cash and marketable securities without harming the operations.

f.

To explain: The assumption of no bad debts is realistic or not and the way in which bad debts be dealt in a cash budgeting sense.

Explanation of Solution

Following points explain the given situation:

- It is not a realistic approach to assume that there is no bad debt.

- Bad debts are expected when credit is given.

- In a cash budgeting sense, the collections would lower down by the percentage of bad debts.

- The payments would remain unchanged and because of which the loan balances would increase.

- The cash surplus balance would be reduced because of the difference in the amount of collection.

- The bad debts are those amounts owed to the creditor which the creditor is not willing to return.

- In cash budgeting sense, to assume that there are no bad debts is not a real approach.

- When the company gives credit, the chances of having bad debts arealways there.

g.

To determine: The target cash balance is appropriate or not, the actions taken by the company to improve the cash management policies and effect on the economic value added.

Explanation of Solution

The target cash balance is appropriate as the company is holding too much cash.

The actions taken by the company to improve the cash management policies and effect on the economic value added is as follows:

- The company can improve its economic value added either by investing cash in other useful assets or returning to the shareholders.

- If the company utilizes the cash for profitable investments, the costs will remain similar, but the operating income will increase, which results in an increase of the economic value added.

- If the firmdecides to return the capital to the holders, by raising the dividend or reburying the common stock shares, the revenue of the firm will remain the same but the on the whole cost of capital would fall which increases the economic value added.

- The economic value added is a value that is calculated by deducting the cost of capital from the operating profit of the company.

- This value shows the financial performance of the company.

- The company needs to improve the cash management policies if the company sees that the cash budget is not effective.

h.

To explain: The reason, if the company is holding too much inventory and its effect on the Economic value added and return on equity.

Explanation of Solution

The reason for the holding of too much inventory by the company and the effect of it is as follows:

- The inventory turnover of the company is equal to 4.82, which is comparatively lower than the firm’s turnover, which is 7.

- This shows that the firm is holding a high amount of inventory per dollar of sales.

- This reduces the return on equity, as by holding more inventory, the company is increasing the costs.

- The working capital must be financed, so the economic value added will be decreased.

- The return on equity is a financial tool to measure the profitability of a company.

- The return on equity determines that portion of the equity that is distributed to the shareholders.

- The increased inventory in the company shows that the company is not able to sell the goods and therefore it is not a profit-making company.

Therefore, the reason for the company is holding too much inventory is the lowest inventory turnover ratio and the effect of it on the return on equity and economic value added are that both get reduced.

i.

To explain: The effect on the company’s cash position in the shorter run and the longer run.

Explanation of Solution

The effect on the company’s cash position is as follows:

- If the firm minimizes the inventory amount it holds, the carrying expenses will be reduced.

- The ordering costs of inventory increases, as the company will set up the production runs more often.

- If the company reduces the inventory investment, the chances of running short in cash increases and this would result in a loss of sale and the goodwill of customers.

- The company’s cash position will not be affectedin the short run.

- The cash position will be affected in the long run.

The inventory costs are of three types and the effect of it is as follows:

- Carrying cost: The cost, which is incurred in keeping or maintaining the raw material inventory or work in progress or finished goods is the carrying cost.

- Ordering cost: This includes the cost of acquisition of inventory. This is calculated by multiplying the cost per order by the number of orders placed in a year.

- Cost of stock outs: This refers to the costs of the stock which are out in the sense when the firm has faced a situation of loss in sales and back orders. This is also known as hidden costs.

Therefore, the company’s cash position will be effected upto some extent in short run and a lot in the long run.

j.

To explain: Whether the customers of the company should pay less or more than those of its competition and the suggestion that company should restrict or relax its policy, the four variables that make the credit policy and the direction in which it should be changed by the company.

Explanation of Solution

- The company’s days of sales outstanding are 45.63 days and the average days of sales outstanding in the industry are 32 days. This means that the customers of this company are paying less than the competitors.

- As the days of sales outstanding aregreater than the average of the industry, the firm should tighten the credit policy.

The credit policy is the policy, which is made so that the company can control the level of total investment in the receivables. The decision is made regarding receivables and credit to be extended is determined.

The four elements in the credit policy are as follows:

- Credit period: The credit period refers to the length of time over which the customers are allowed to delay the payment.

- Cash discounts: The discounts are offered for a different period. The discounts are offered mostly to induce customers to make prompt payments.

- Credit standards: The firm takes a risk about the paying capacity of a company when the firm sells anything on credit. So, the company sets a credit standard that is applied in selecting the customers for credit sales.

- Collection policy: The firm should also have the policy to deal with the slow paying customers. The slow paying customers increase the interest cost and more cash is tied up in receivables. The overall collection policy should neither be too strict nor be too loose.

The direction in which it should be changed by the company are as follows:

- The days of sales outstanding refers to the days in which the company is able to sell the inventories.

- The credit policy is a kind of rule, which is made to decide the amount of credit that should be extended to the customers.

- The parameters and the principles, which govern the extension of credit to the customers are defined or are set by the credit policy.

- The credit policy has four important elements and those are the credit period, cash discounts, credit standards and the collection policy.

Therefore, the customers are paying lesser than the competitors, the firm should tighten the credit policy and the elements of the credit policy are credit period, cash discounts, credit standards and the collection policies.

k.

To explain: The risks company faces if it restricts the credit policy.

Explanation of Solution

The risks company has to face if it restricts its credit policy are as follows:

- The tightening of the credit policy by the company decreases the sales of the company.

- The customers will not stay with the company, if they have the pressure to pay their bills sooner.

- The strict credit policy can affect the goodwill and hence it will damage the growth prospects of sales for the company.

- The credit policy is a kind of parameter, which is set by a company to decide the amount of credit to be extended to the customers.

- If the company restricts the policy, this means the company would set more limits for providing the credit.

- In that case, the company has risks and these risks will makean adverseconsequence on the sales of the company and the customers.

l.

To determine: The effect of the days of sales outstanding on the sales and effect on the cash position in the short run and long run, the effect on this on economic value added in the longer run.

Explanation of Solution

The effect of the days of sales outstanding on the sales and effect on the cash position is as follows:

- In the short run: The effect of the days of sales outstanding in the short run is that it will increase the cash balance of the company as the customers will pay before the no discounted period.

- In the long run: The effect of the days of sales outstanding in the long run is that the target cash balance needed decreases with time and so the amount of financing also decreases. This wouldreduce the economic value added in the long run.

The effects on this on economic value added in the longer run are as follows:

- The days of sales outstanding refers to those days in which the company will be able to sell its inventories.

- If the days of sales outstanding reduce,the company is able to sell the inventories fast and so the cash balance with the company increases fast.

- The company with time, will use this cash in more productive assets or pay this cash to the shareholders.

- Thisin turn, will increase the economic value added of the company.

Therefore, the days of sales outstanding will increase the cash balance and reduce the economic value added and decreases the target cash balance for the long run and decreases the economic value added.

m.

To determine: The amount of trade credit the company can get, the cost of trade credit and the percentage cost of costly credit, should the company can get discounts and the reason for getting it.

Answer to Problem 12IC

The effective annual cost of trade credit is 13.01% and the cost of trade credit is 12.28%.

Explanation of Solution

Given information:

The terms are of 1/30, net 30.

The company is paying on the 40th day.

The amount of purchase is $3 million.

Calculation of the amount of trade credit the company should get if it takes the discount:

The formula to calculate the total trade credit is,

Substitute $8,219 for the credit purchases each day and 10 days for the credit period (working note) in the above formula.

Therefore total trade credit if the company takes a discount is $82,190.

Calculation of the trade credit if the discount is not taken:

The formula to calculate the trade credit is,

Substitute $8,219 for the credit purchases of each day and 40 days for the credit period (working note) in the above formula.

Therefore trade credit if the company does not takes a discount is $328,760.

Calculation of the costly trade credit:

The formula to calculate the costly trade credit is,

Substitute $328,760 for trade credit if discounts are not taken and $82,190 if discounts are taken in the above formula.

Therefore costly trade credit is $246,570.

Calculation of the percentage of the costly trade credit:

The formula to calculate the percentage of the costly trade credit is,

Substitute 0.0101 for period rate and 12.167 for period/year (working note) in the above formula.

Therefore percentage of costly trade credit or the nominal cost of trade credit is 12.28%.

Calculation of effective annual cost of trade credit:

The formula to calculate the effective annual cost of trade credit is,

Substitute 0.0101 for periodic rate and 12.167 for the period/year (working note) in the above formula.

Therefore effective annual cost of trade credit is 13.01%.

As the effective annual cost of trade credit is more than the nominal cost of trade credit, the company should take the discounts.

Working note:

Calculation of the credit purchases if the firm takes discount,

Therefore credit purchase for each day is $8,219.

Calculation of the credit period if the discount is taken:

Given terms are 1/30, net 30 which means that the firm gives a discount of 1% if the customers pay within 10 days of the invoice date.

This means the credit period is of 10 days.

Calculation of the credit period if the discount is not taken:

Given terms are 1/10, net 30 which means that the firm gives a discount of 1% if the customers pay within 30 days of the invoice date.

This means the credit period is of 40 days.

Calculation of the periodic rate,

Therefore the periodic rate is 0.0101.

Calculation of the period/year,

Therefore the period/year is 12.167.

The amount of trade credit the company can get is$82,190 if it takes a discount, $328,760 if it does not takes a discount, the costly trade credit is $246,570, the percentage cost of costly credit is 12.28% and the company should take discounts.

n.

To determine: The effective annual cost rate.

Answer to Problem 12IC

The effective annual cost rate is 15.45%.

Explanation of Solution

Given information:

The additional amount to be raised is $100,000.

This is as a 1-year loan from the bank.

The rate for this loan is 8%.

Assume the simple interest and add-on interest on a 12-month installment loan.

Calculation of the effective annual cost rate:

The formula to calculate the effective annual cost rate is,

Substitute 0.012043 for the monthly rate (refer working note) and 12 for the number of months in the above formula.

Therefore the effective annual cost rate is 15.45%.

Working note:

Calculation of the total amount to be repaid,

Therefore the total amount to be repaid is $108,000.

Calculation of the monthly payments,

Therefore the monthly payments are $9,000.

Calculation of the monthly rate,

By the help of a financial calculator, the monthly rate is 1.2043%.

Want to see more full solutions like this?

Chapter 16 Solutions

Fundamentals of Financial Management (MindTap Course List)

- Larry Davis borrows $80,000 at 14 percent interest toward the purchase of a home. His mortgage is for 25 years. a. How much will his annual payments be? (Although home payments are usually on a monthly basis, we shall do our analysis on an annual basis for ease of computation. We will get a reasonably accurate answer.) b. How much interest will he pay over the life of the loan? c. How much should be willing to pay to get out of a 14 percent mortgage and into a 10 percent mortgage with 25 years remaining on the mortgage? Assume current interest rates are 10 percent. Carefully consider the time value of money. Disregard taxes.arrow_forwardYou are chairperson of the investment fund for the local closet. You are asked to set up a fund of semiannual payments to be compounded semiannually to accumulate a sum of $250,000 after nine years at a 10 percent annual rate (18 payments). The first payment into the fund is to take place six months from today, and the last payment is to take place at the end of the ninth year. Determine how much the semiannual payment should be. (a) On the day, after the sixth payment is made (the beginning of the fourth year), the interest rate goes up to a 12 percent annual rate, and you can earn a 12 percent annual rate on funds that have been accumulated as well as all future payments into the funds. Interest is to be compounded semiannually on all funds. Determine how much the revised semiannual payments should be after this rate change (there are 12 payments and compounding dates). The next payment will be in the middle of the fourth year.arrow_forwardIf your Uncle borrows $60,000 from the bank at 10 percent interest over the seven-year life of the loan, what equal annual payments must be made to discharge the loan, plus pay the bank its required rate of interest? How much of his first payment will be applied to interest? To principal? How much of his second payment will be applied to each?arrow_forward

- Q1: You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5.The required rate of return for NEWER stock is 14% compounded annually.What is NEWER’s stock price?The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8.The required rate of return for OLDER stock is 16% compounded annually.What is OLDER’s stock price?Now assume that both stocks have a required…arrow_forwardQ1: Blossom is 30 years old. She plans on retiring in 25 years, at the age of 55. She believes she will live until she is 105. In order to live comfortably, she needs a substantial retirement income. She wants to receive a weekly income of $5,000 during retirement. The payments will be made at the beginning of each week during her retirement. Also, Blossom has pledged to make an annual donation to her favorite charity during her retirement. The payments will be made at the end of each year. There will be a total of 50 annual payments to the charity. The first annual payment will be for $20,000. Blossom wants the annual payments to increase by 3% per year. The payments will end when she dies. In addition, she would like to establish a scholarship at Toronto Metropolitan University. The first payment would be $80,000 and would be made 3 years after she retires. Thereafter, the scholarship payments will be made every year. She wants the payments to continue after her death, therefore…arrow_forwardQ1: Blossom is 30 years old. She plans on retiring in 25 years, at the age of 55. She believes she will live until she is 105. In order to live comfortably, she needs a substantial retirement income. She wants to receive a weekly income of $5,000 during retirement. The payments will be made at the beginning of each week during her retirement. Also, Blossom has pledged to make an annual donation to her favorite charity during her retirement. The payments will be made at the end of each year. There will be a total of 50 annual payments to the charity. The first annual payment will be for $20,000. Blossom wants the annual payments to increase by 3% per year. The payments will end when she dies. In addition, she would like to establish a scholarship at Toronto Metropolitan University. The first payment would be $80,000 and would be made 3 years after she retires. Thereafter, the scholarship payments will be made every year. She wants the payments to continue after her death, therefore…arrow_forward

- Jerome Moore invests in a stock that will pay dividends of $2.00 at the end of the first year; $2.20 at the end of the second year; and $2.40 at the end of the third year. also, he believes that at the end of the third year he will be able to sell the stock for $33. what is the present value of all future benefits if a discount rate of 11 percent is applied?arrow_forwardQ1: You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5.The required rate of return for NEWER stock is 14% compounded annually.What is NEWER’s stock price?The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8.The required rate of return for OLDER stock is 16% compounded annually.What is OLDER’s stock price?Now assume that both stocks have a required…arrow_forwardQ1: You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5.The required rate of return for NEWER stock is 14% compounded annually.What is NEWER’s stock price?The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8.The required rate of return for OLDER stock is 16% compounded annually.What is OLDER’s stock price?Now assume that both stocks have a required…arrow_forward

- Q1: Blossom is 30 years old. She plans on retiring in 25 years, at the age of 55. She believes she will live until she is 105. In order to live comfortably, she needs a substantial retirement income. She wants to receive a weekly income of $5,000 during retirement. The payments will be made at the beginning of each week during her retirement. Also, Blossom has pledged to make an annual donation to her favorite charity during her retirement. The payments will be made at the end of each year. There will be a total of 50 annual payments to the charity. The first annual payment will be for $20,000. Blossom wants the annual payments to increase by 3% per year. The payments will end when she dies. In addition, she would like to establish a scholarship at Toronto Metropolitan University. The first payment would be $80,000 and would be made 3 years after she retires. Thereafter, the scholarship payments will be made every year. She wants the payments to continue after her death, therefore…arrow_forwardTrue and False 1. There are no more than two separate phases to decision making and problem solving. 2. Every manager always has complete control over all inputs and factors. 3. Opportunity cost is only considered by accountants as a way to calculate profits 4. Standard error is always used to evaluate the overall strength of the regression model 5. The t-Stat is used in a similar way as the P-valued is used 6. The P-value is used as R-square is used. 7. R-square is used to evaluate the overall strength of the model. 8. Defining the problem is one of the last things that a manager considers Interpreting Regression Printouts (very brief answers) R² = .859 Intercept T N = 51 Coefficients 13.9 F= 306.5 Standard Error .139 SER=.1036 t Stat P value 99.8 0 .275 .0157 17.5 0 The above table examines the relationship between the nunber, of poor central city households in the U.S. and changes in the costs of college tuition from 1967 to 2019. 9. What is the direction of this relationship? 10.…arrow_forwardCARS Auto Co. Ltd – Alpha Branch Unadjusted Trial Balance December 31, 2024 A/C NAME TRIAL BALANCE DR CR cash 240,000 Accounts receivables 120,000 supplies 41,100 Lease hold improvement 200,000 Accumulated depreciation – Lease hold improvement 80,000 Furniture and fixtures 800,000 Accumulated depreciation - furniture and fixtures 380,000 Accounts payable 30,000 Salary payable Unearned service revenue 44,100 Cars, capital 649,000 Cars, withdrawal 165,100 Service revenue 450,000 Salary expense 48,400 Supplies expense Rent expense Depreciation expense – leasehold improvement Depreciation expense – furniture and fixtures Advertising expense 18,500 1,633,100 1,633,100 Data presented for the adjusting entries include the following: Rent expense of $160,000…arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College