Bundle: College Accounting, Chapters 1-27, Loose-Leaf Version, 22nd + CengageNOWv2, 2 terms Printed Access Card

22nd Edition

ISBN: 9781305930421

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

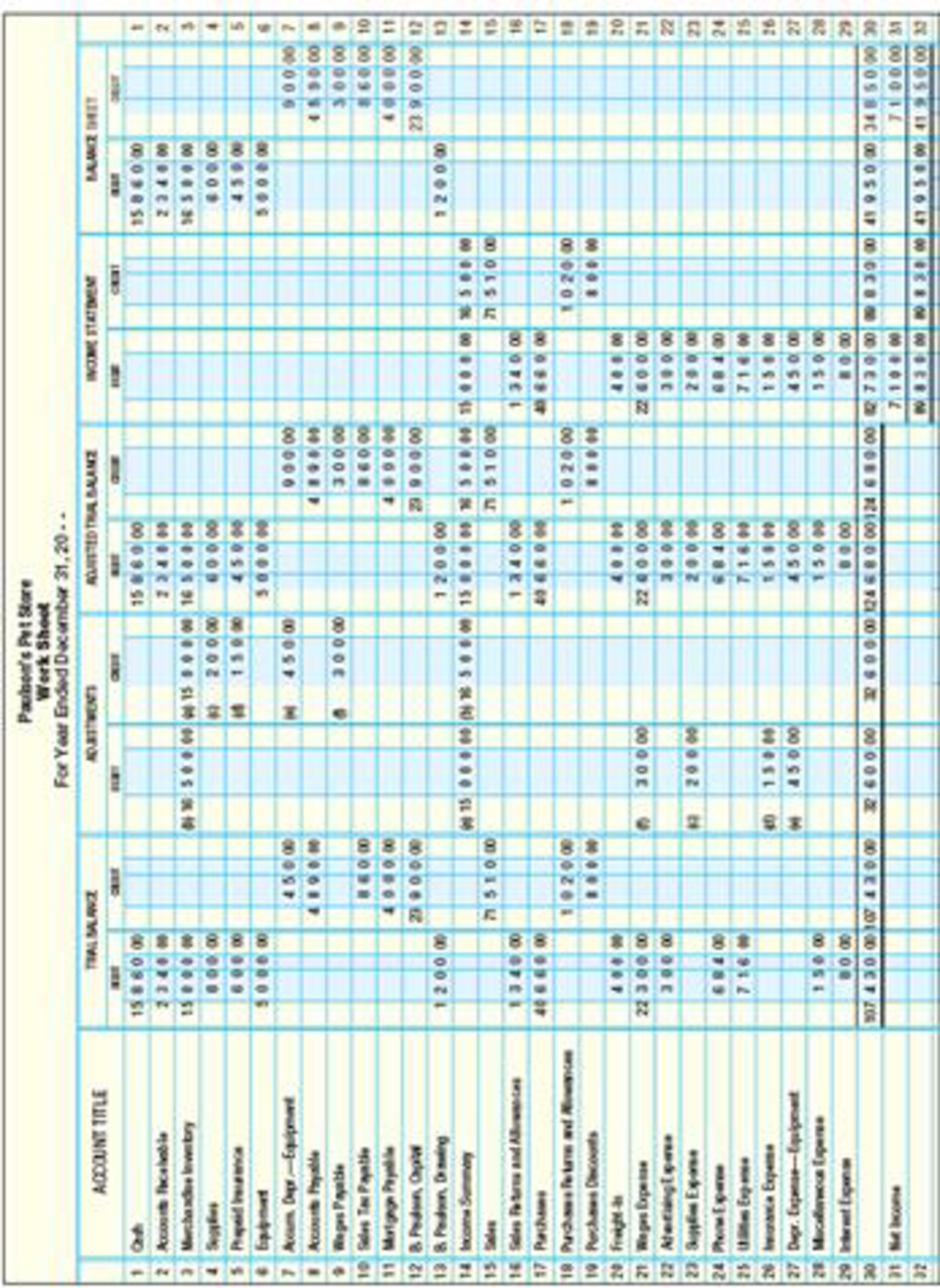

Chapter 15, Problem 8SPA

INCOME STATEMENT. STATEMENT OF OWNER S EQUITY, AND

REQUIRED

- 1. Prepare a multiple-step income statement.

- 2. Prepare a statement of owner’s equity.

- 3. Prepare a balance sheet.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

general accounting

E3-17 (Algo) Calculating Equivalent Units, Unit Costs, and Cost Assigned (Weighted-Average Method)

[LO 3-2]

Vista Vacuum Company has the following production Information for the month of March. All materials are added at the beginning of

the manufacturing process.

Units

.

•

Beginning Inventory of 3,500 units that are 100 percent complete for materials and 28 percent complete for conversion.

14,600 units started during the period.

Ending Inventory of 4,200 units that are 14 percent complete for conversion.

Manufacturing Costs

Beginning Inventory was $20,500 ($10,100 materials and $10,400 conversion costs).

Costs added during the month were $28,400 for materials and $51,500 for conversion ($26.700 labor and $24,800 applied

overhead).

Assume the company uses Weighted-Average Method.

Required:

1. Calculate the number of equivalent units of production for materials and conversion for March.

2. Calculate the cost per equivalent unit for materials and conversion for March.

3. Determine the…

None

Chapter 15 Solutions

Bundle: College Accounting, Chapters 1-27, Loose-Leaf Version, 22nd + CengageNOWv2, 2 terms Printed Access Card

Ch. 15 - LO1 A multiple-step form of income statement...Ch. 15 - Prob. 2TFCh. 15 - Prob. 3TFCh. 15 - Prob. 4TFCh. 15 - LO4 Accounts receivable turnover is the number of...Ch. 15 - Prob. 1MCCh. 15 - Prob. 2MCCh. 15 - Prob. 3MCCh. 15 - Prob. 4MCCh. 15 - Prob. 5MC

Ch. 15 - Prob. 1CECh. 15 - Prob. 2CECh. 15 - 1. L01 Prepare a multiple-step income statement...Ch. 15 - Prob. 4CECh. 15 - Prob. 5CECh. 15 - Prob. 6CECh. 15 - Prob. 1RQCh. 15 - Prob. 2RQCh. 15 - Describe how to calculate the following ratios (a)...Ch. 15 - Where is the information obtained that is needed...Ch. 15 - Explain the function of each of the four closing...Ch. 15 - What is the purpose of a post-closing trial...Ch. 15 - What is the primary purpose of reversing entries?Ch. 15 - What is the customary date for reversing entries?Ch. 15 - What adjusting entries should be reversed?Ch. 15 - REVENUE SECTION. MULTIPLE-STEP INCOME STATEMENT...Ch. 15 - COST OF GOODS SOLD SECTION, MULTIPLE-STEP INCOME...Ch. 15 - MULTIPLE-STEP INCOME STATEMENT Use the following...Ch. 15 - FINANCIAL RATIOS Based on the financial statements...Ch. 15 - CLOSING ENTRIES From the work sheet on page 600,...Ch. 15 - REVERSING ENTRIES From the work sheet used in...Ch. 15 - Prob. 7SEACh. 15 - INCOME STATEMENT. STATEMENT OF OWNER S EQUITY, AND...Ch. 15 - FINANCIAL RATIOS Use the work sheet and financial...Ch. 15 - WORK SHEET, ADJUSTING, CLOSING, AND REVERSING...Ch. 15 - REVENUE SECTION, MULTIPLE-STEP INCOME STATEMENT...Ch. 15 - COST OF GOODS SOLD SECTION, MULTIPLE-STEP INCOME...Ch. 15 - MULTIPLE-STEP INCOME STATEMENT Use the following...Ch. 15 - FINANCIAL RATIOS Based on the financial...Ch. 15 - CLOSING ENTRIES From the work sheet on page 607...Ch. 15 - Prob. 6SEBCh. 15 - ADJUSTING, CLOSING, AND REVERSING ENTRIES Prepare...Ch. 15 - INCOME STATEMENT, STATEMENT OF OWNERS EQUITY, AND...Ch. 15 - FINANCIAL RATIOS Use the work sheet and financial...Ch. 15 - Prob. 10SPBCh. 15 - Prob. 1MYWCh. 15 - Dominique Fouque owns and operates Dominiques Doll...Ch. 15 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning - Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY