FINANCIAL ACCOUNTING

15th Edition

ISBN: 9781337885928

Author: WARREN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 15, Problem 8E

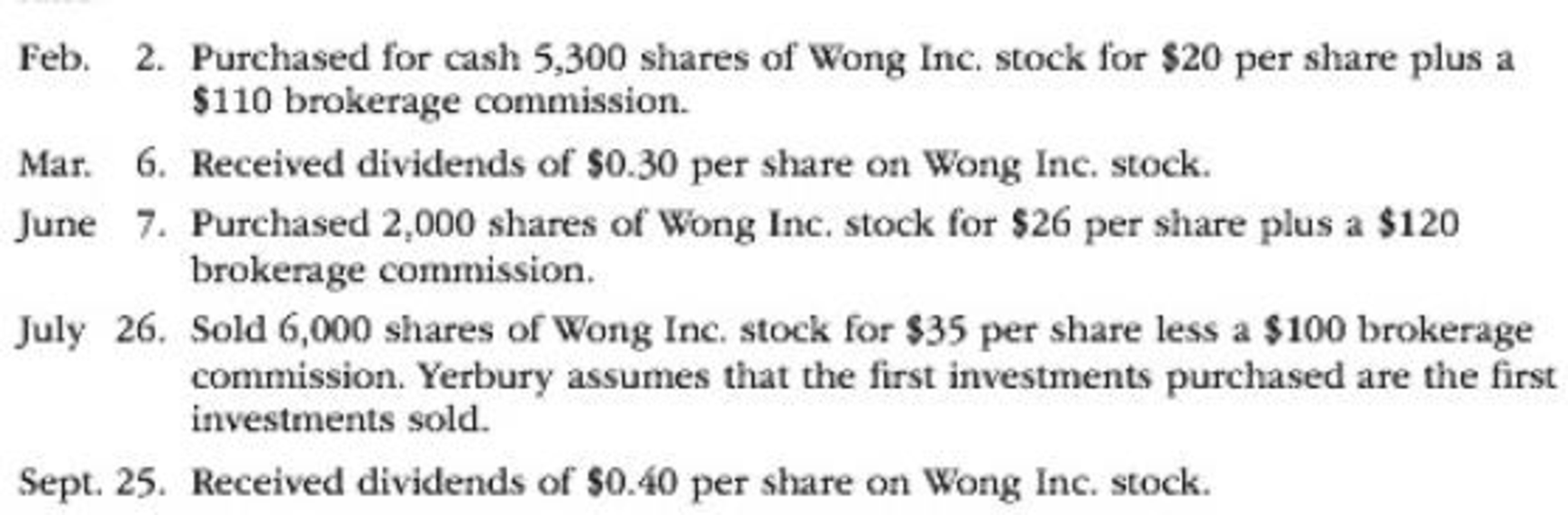

Yerbury Corp. manufactures construction equipment.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Help me Accounting

Please provide the accurate answer to this general accounting problem using appropriate methods.

Please explain the solution to this general accounting problem with accurate explanations.

Chapter 15 Solutions

FINANCIAL ACCOUNTING

Ch. 15 - Why might a business invest cash in temporary...Ch. 15 - What causes a gain or loss on the sale of a bond...Ch. 15 - When is the equity method the appropriate...Ch. 15 - Prob. 4DQCh. 15 - Prob. 5DQCh. 15 - Prob. 6DQCh. 15 - Prob. 7DQCh. 15 - Prob. 8DQCh. 15 - Prob. 9DQCh. 15 - Prob. 10DQ

Ch. 15 - Prob. 1PEACh. 15 - Prob. 1PEBCh. 15 - Prob. 2PEACh. 15 - Prob. 2PEBCh. 15 - Prob. 3PEACh. 15 - Prob. 3PEBCh. 15 - On January 1, Valuation Allowance for Trading...Ch. 15 - On January 1, Valuation Allowance for Trading...Ch. 15 - On January 1, Valuation Allowance for...Ch. 15 - On January 1, Valuation Allowance for...Ch. 15 - On June 30, Setzer Corporation had a market price...Ch. 15 - Prob. 6PEBCh. 15 - Prob. 1ECh. 15 - Prob. 2ECh. 15 - Bocelli Co. purchased 120,000 of 6%, 20-year Sanz...Ch. 15 - Prob. 4ECh. 15 - Prob. 5ECh. 15 - On February 22, Stewart Corporation acquired...Ch. 15 - The following equity investment transactions were...Ch. 15 - Yerbury Corp. manufactures construction equipment....Ch. 15 - Seamus Industries Inc. buys and sells investments...Ch. 15 - Prob. 10ECh. 15 - Prob. 11ECh. 15 - On January 6, Year 1, Bulldog Co. purchased 34% of...Ch. 15 - Hawkeye Companys balance sheet reported, under the...Ch. 15 - JED Capital Inc. makes investments in trading...Ch. 15 - The investments of Charger Inc. include a single...Ch. 15 - Gruden Bancorp Inc. purchased a portfolio of...Ch. 15 - Last Unguaranteed Financial Inc. purchased the...Ch. 15 - The income statement for Delta-tec Inc. for the...Ch. 15 - Highland Industries Inc. makes investments in...Ch. 15 - The investments of Steelers Inc. include a single...Ch. 15 - Prob. 21ECh. 15 - Storm, Inc. purchased the following...Ch. 15 - During Year 1, its first year of operations,...Ch. 15 - During Year 2, Copernicus Corporation held a...Ch. 15 - Prob. 25ECh. 15 - The market price for Microsoft Corporation closed...Ch. 15 - Prob. 27ECh. 15 - Prob. 28ECh. 15 - Prob. 29ECh. 15 - Soto Industries Inc. is an athletic footware...Ch. 15 - Rios Financial Co. is a regional insurance company...Ch. 15 - Forte Inc. produces and sells theater set designs...Ch. 15 - Prob. 4PACh. 15 - Rekya Mart Inc. is a general merchandise retail...Ch. 15 - Prob. 2PBCh. 15 - Glacier Products Inc. is a wholesaler of rock...Ch. 15 - Teasdale Inc. manufactures and sells commercial...Ch. 15 - Selected transactions completed by Equinox...Ch. 15 - Prob. 1CPCh. 15 - Prob. 2CPCh. 15 - Berkshire Hathaway, the investment holding company...Ch. 15 - On July 16, 20Y1, Wyatt Corp. purchased 40 acres...Ch. 15 - International Financial Reporting Standard No. 16...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need guidance with this general accounting problem using the right accounting principles.arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forward

- Can you solve this general accounting problem using accurate calculation methods?arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardPlease help me solve this general accounting problem with the correct financial process.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Stockholders Equity: How to Calculate?; Author: Accounting University;https://www.youtube.com/watch?v=2jZk1T5GIlw;License: Standard Youtube License