Concept explainers

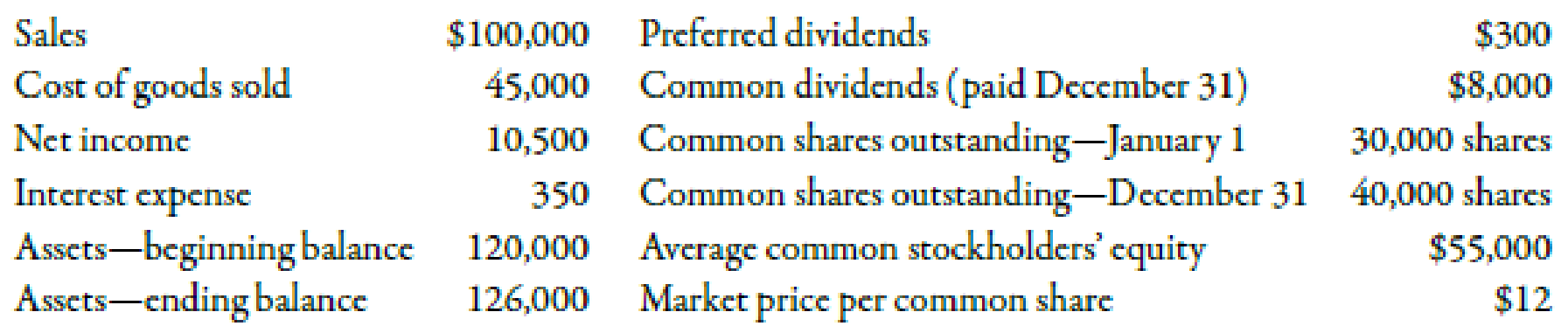

Albion Inc. provided the following information for its most recent year of operations. The tax rate is 40%.

Required:

- 1. Compute the following: (a) return on sales, (b) return on assets, (c) return on stockholders’ equity, (d) earnings per share, (e) price-earnings ratio, (f) dividend yield, and (g) dividend payout ratio.

- 2. CONCEPTUAL CONNECTION If you were considering purchasing stock in Albion, which of the above ratios would be of most interest to you? Explain.

1.

Calculate the return on sales, return on assets, return on stockholders’ equity, and earnings per share, price earnings ratio, and dividend yield and dividend payout ratio.

Explanation of Solution

Profitability Ratio:

These ratios evaluate a firm’s ability to earn profits. They help the stakeholders of the company to measure the degree to which funds invested by them are efficiently used. Some of the ratios calculated return on sales, total assets and stockholder’s equity.

(a)

Use the following formula to calculate the value of return on sales:

Substitute $10,500 for net income and $100,000 for sales in the above formula.

Therefore, the value of return on sales is 0.105 or 10.5%.

(b)

Use the following formula to calculate the value of return on assets:

Substitute $10,550 for net income, $350 for interest expense, 40% for tax rate and $123,000 for average total assets in the above formula.

Therefore, the value of return on assets is 0.087 or 8.7%.

(c)

Use the following formula to calculate the value of return on stockholder’s equity of this year:

Substitute $10,500 for net income, $300 for preference dividend and $55,000 for average common stockholder’s equity in the above formula.

Therefore, the value of return on stockholder’s equity is 0.185 or 18.5%.

(d)

Use the following formula to calculate the value of earnings per share:

Substitute $10,500 for net income, $300 for preference dividend and 35,000 for average common shares in the above formula.

Therefore, the value of earnings per share is $0.29 per share.

(e)

Use the following formula to calculate the price-earnings ratio:

Substitute $12.00 for market price per share and $0.29 (this value is calculated in part d) for earnings per share in the above formula.

Therefore, the value of price-earnings ratio is 41.38.

(f)

Use the following formula to calculate the value of dividend yield:

Substitute $0.20 for dividend per common shares, and $12.00 for market price per common share in the above formula.

Therefore, the value of dividend yield is 0.017 or 1.7%.

(g)

Use the following formula to calculate the value of dividend payout ratio:

Substitute $8,000 for common dividend, $10,500 for net income and $300 for preference dividend in the above formula.

Therefore, the value of dividend payout ratio is 0.7843.

Working Note:

1. Calculation of average total assets:

2. Calculation of average common stockholder’s equity:

3. Calculation of dividends common shares:

2.

Identify the ratio which would interest an investor while considering to purchase stock.

Explanation of Solution

The ratios computed are profitability ratios, and they are equally important for the investors. Therefore, it totally depends on the objectives of the investors which ratio is would be of more interest. For example: if an investor is thinking of having income after retirement by investing in stock of a company, then the investor would be interested in analyzing dividend payout ratio of the company.

Want to see more full solutions like this?

Chapter 15 Solutions

EBK MANAGERIAL ACCOUNTING: THE CORNERST

- For the purposes of the 20x0 annual financial statements, how would the additional shares of Series A preferred stock issued from Company Y to Company Y's original investor on November 1 20X0 affect the measurment of the company Y's series A preferred stock purchased on may 1, 20x0?arrow_forwardGeneral Accountingarrow_forwardFinancial Accounting Questionarrow_forward

- What is the investment turnover for this financial accounting question?arrow_forwardSuppose you take out a five-year car loan for $14000, paying an annual interest rate of 4%. You make monthly payments of $258 for this loan. Complete the table below as you pay off the loan. Months Amount still owed 4% Interest on amount still owed (Remember to divide by 12 for monthly interest) Amount of monthly payment that goes toward paying off the loan (after paying interest) 0 14000 1 2 3 + LO 5 6 7 8 9 10 10 11 12 What is the total amount paid in interest over this first year of the loan?arrow_forwardSuppose you take out a five-year car loan for $12000, paying an annual interest rate of 3%. You make monthly payments of $216 for this loan. mocars Getting started (month 0): Here is how the process works. When you buy the car, right at month 0, you owe the full $12000. Applying the 3% interest to this (3% is "3 per $100" or "0.03 per $1"), you would owe 0.03*$12000 = $360 for the year. Since this is a monthly loan, we divide this by 12 to find the interest payment of $30 for the month. You pay $216 for the month, so $30 of your payment goes toward interest (and is never seen again...), and (216-30) = $186 pays down your loan. (Month 1): You just paid down $186 off your loan, so you now owe $11814 for the car. Using a similar process, you would owe 0.03* $11814 = $354.42 for the year, so (dividing by 12), you owe $29.54 in interest for the month. This means that of your $216 monthly payment, $29.54 goes toward interest and $186.46 pays down your loan. The values from above are included…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning