Problem 15-5B

Long-term investment transactions; unrealized and realized gains and losses

C2 P3P4

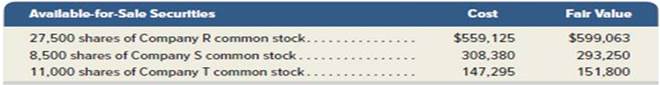

Troyer’s long-term available-for--sale portfolio at December 31, 2016, consists of the following.

Troyer enters into the following long-term investment transactions during year 2017.

Jan. Sold 2,125 shares of Company S stock for $72,250 less a brokerage fee of $1,195.

13

Mar. Purchased 15,500 shares of Company U common stock for $282,875 plus a brokerage fee of $1,980. The shares represent a 62% ownership 24 interest in Company U.

Apr. 5 Purchased 42,500 shares of Company V common stock for $133,875 plus a brokerage fee of $1,125. The shares represent a 10% ownership in Company V.

Sep. 2 Sold 11,000 shares of Company T common stock for $156,750 less a brokerage fee of $2,700.

Sep. Purchased 2,500 shares of Company W common stock for $50,500 plus a brokerage fee of $i,o5o. The shares represent a 25% ownership

27 interest in Company W.

Oct. Purchased 5,000 shares of Company X common stock for $48,750 plus a brokerage fee of $1,170. The shares represent a 13% ownership interest

30 in Company X.

The fair values of its investments at December 31, 2017, are: R, $568,125; S, $210,375; U, $272,800; V, $134,938; W, $54,689; and X, $45,625.

Required

1. Determine the amount Troyer should report on its December 31, 2017,

2. Prepare any necessary December 31, 2017,

securities.

3. What amount of gains or losses on transactions relating to long-term investments in available-for-sale securities should Troyer report on its December

31, 2017, income statement?

Check (2) Dr, Unrealized Loss-Equity, $16.267: Cr. Fair Value Adjustment-AFS (IJ), $46.580

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Loose Leaf for Fundamental Accounting Principles

- I want to this question answer general accountingarrow_forwardProvide Answerarrow_forwardTremont Global, Inc. produces and sells a single product. The product sells for $175.00 per unit, and its variable expense is $52.50 per unit. The company's monthly fixed expense is $245,600. What is the monthly break-even in total dollar sales?arrow_forward

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning