Managerial Accounting

7th Edition

ISBN: 9781337116008

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: South Western Educational Publishing

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 57P

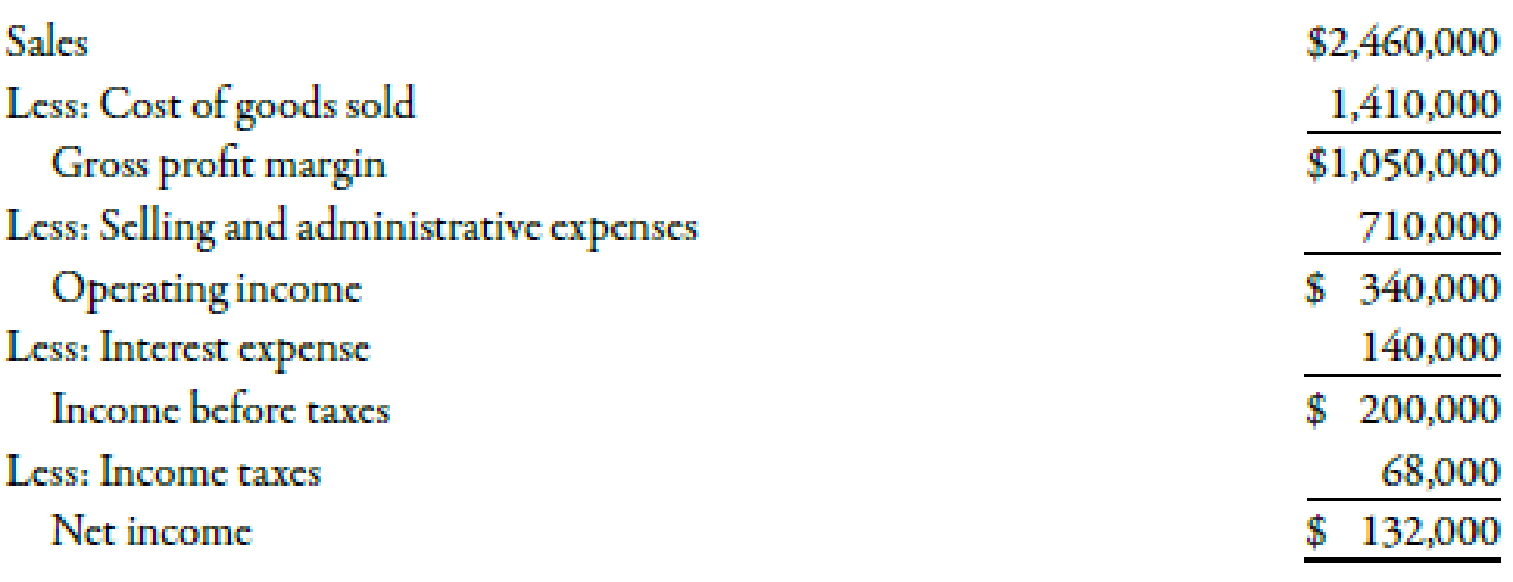

Grammatico Company has just completed its third year of operations. The income statement is as follows:

Selected information from the balance sheet is as follows:

Required:

Note: Round answers to two decimal places.

- 1. Compute the times-interest-earned ratio.

- 2. Compute the debt ratio.

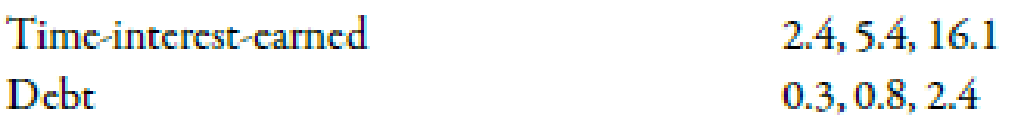

- 3. CONCEPTUAL CONNECTION Assume that the lower quartile, median, and upper quartile values for debt and times-interest-earned ratios in Grammatico’s industry are as follows:

How does Grammatico compare with the industrial norms? Does it have too much debt?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What adjusting entry should be recorded on December 31 ?

hello tutor please help me accounting questions

TechCo uses the straight-line method for depreciation. Assets purchased between the 1st and 15th of the month are depreciated for the entire month; assets purchased after the 15th are treated as though they were acquired the following month. On June 18, 20X2, TechCo purchases a machine for $15,000 that it expects to last for 6 years; TechCo expects the machine to have a residual value of $3,000. What is the 20X2 depreciation expense for the machine?help

Chapter 15 Solutions

Managerial Accounting

Ch. 15 - Name the two major types of financial statement...Ch. 15 - Prob. 2DQCh. 15 - Explain how creditors, investors, and managers can...Ch. 15 - What are liquidity ratios? Leverage ratios?...Ch. 15 - Prob. 5DQCh. 15 - Prob. 6DQCh. 15 - Prob. 7DQCh. 15 - A high inventory turnover ratio provides evidence...Ch. 15 - A loan agreement between a bank and a customer...Ch. 15 - Prob. 10DQ

Ch. 15 - Explain why an investor would be interested in a...Ch. 15 - Prob. 12DQCh. 15 - Prob. 13DQCh. 15 - When a company participates in a stock buyback...Ch. 15 - Explain the significance of the inventory turnover...Ch. 15 - In a JIT manufacturing environment, the current...Ch. 15 - Prob. 1MCQCh. 15 - Prob. 2MCQCh. 15 - Fractions or percentages computed by dividing one...Ch. 15 - Prob. 4MCQCh. 15 - Pedee Companys inventory turnover in days is 80...Ch. 15 - Prob. 6MCQCh. 15 - Prob. 7MCQCh. 15 - Prob. 8MCQCh. 15 - A small pizza restaurant, founded and owned by the...Ch. 15 - Prob. 10MCQCh. 15 - Prob. 11BEACh. 15 - Scherer Company provided the following income...Ch. 15 - Chen Company has current assets equal to...Ch. 15 - Last year, Nikkola Company had net sales of...Ch. 15 - Last year, Nikkola Company had net sales of...Ch. 15 - Paxton Company provided the following income...Ch. 15 - Ernst Companys balance sheet shows total...Ch. 15 - Prob. 18BEACh. 15 - Prob. 19BEACh. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - Jasmine Company provided the following income...Ch. 15 - Jasmine Company provided the following income...Ch. 15 - LoLo Lemon Company has current assets equal to...Ch. 15 - Last year, Tobys Hats had net sales of 45,000,000...Ch. 15 - Last year, Tobys Hats had net sales of 45,000,000...Ch. 15 - Alessandra Makeup Manufactures provided the...Ch. 15 - Klynveld Companys balance sheet shows total...Ch. 15 - Prob. 31BEBCh. 15 - Prob. 32BEBCh. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - Sundahl Companys income statements for the past 2...Ch. 15 - Sundahl Companys income statements for the past 2...Ch. 15 - Cuneo Companys income statements for the last 3...Ch. 15 - Cuneo Companys income statements for the last 3...Ch. 15 - Prob. 41ECh. 15 - Upton Company has current assets equal to...Ch. 15 - Montalcino Company had net sales of 54,000,000....Ch. 15 - Whalen Company had net sales of 125,500,250,000....Ch. 15 - Prob. 45ECh. 15 - Prob. 46ECh. 15 - Bryce Company manufactures pet supplies. However,...Ch. 15 - Prob. 48ECh. 15 - Prob. 49ECh. 15 - Juroe Company provided the following income...Ch. 15 - Juroe Company provided the following income...Ch. 15 - Juroe Company provided the following income...Ch. 15 - Rebert Inc. showed the following balances for last...Ch. 15 - Rebert Inc. showed the following balances for last...Ch. 15 - Rebert Inc. showed the following balances for last...Ch. 15 - The following selected information is taken from...Ch. 15 - Grammatico Company has just completed its third...Ch. 15 - The following information has been gathered for...Ch. 15 - Mike Sanders is considering the purchase of Kepler...Ch. 15 - Prob. 60PCh. 15 - Mike Sanders is considering the purchase of Kepler...Ch. 15 - Mike Sanders is considering the purchase of Kepler...Ch. 15 - Mike Sanders is considering the purchase of Kepler...Ch. 15 - Albion Inc. provided the following information for...Ch. 15 - Prob. 65PCh. 15 - Prob. 66PCh. 15 - Prob. 67C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- TechCo uses the straight-line method for depreciation. Assets purchased between the 1st and 15th of the month are depreciated for the entire month; assets purchased after the 15th are treated as though they were acquired the following month. On June 18, 20X2, TechCo purchases a machine for $15,000 that it expects to last for 6 years; TechCo expects the machine to have a residual value of $3,000. What is the 20X2 depreciation expense for the machine?arrow_forwardBayview Resort has sales of $850,000 and a profit margin of 8%. The annual depreciation expense is $95,000. What is the amount of the operating cash flow if the company has no long-term debt?arrow_forwardDon't use ai given answer accounting questionsarrow_forward

- Provide cash balance?arrow_forwardCdfvvggvvvvvvarrow_forwardOn January 1, 20X2, Mace, which uses the straight-line method, purchases a machine for $72,000 that it expects to last for 8 years; Mace expects the machine to have a residual value of $10,000. What is the machine's book value at the end of 20X4? i. $48,750 ii. $42,010 iii. $35,550 iv. $50,400 I want answerarrow_forward

- Jenson Ltd. recently reported a net income of $5,320 and depreciation of $970. How much was its net cash flow, assuming it had no amortization expense and sold none of its fixed assets?arrow_forwardAbcarrow_forwardOn January 1, 20X2, Mace, which uses the straight-line method, purchases a machine for $72,000 that it expects to last for 8 years; Mace expects the machine to have a residual value of $10,000. What is the machine's book value at the end of 20X4? i. $48,750 ii. $42,010 iii. $35,550 iv. $50,400 Tutor need your helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License