Concept explainers

A portion of a data set containing information for 45 mutual funds that are part of the Morningstar Funds 500 follows. The complete data set is available in the file named MutualFunds. The data set includes the following five variables:

Fund Type: The type of fund, labeled DE (Domestic Equity), IE (International Equity), and FI (Fixed Income).

Net Asset Value ($): The closing price per share on December 31, 2007.

5-Year Average Return (%): The average annual return for the fund over the past five years. Expense Ratio (%): The percentage of assets deducted each fiscal year for fund expenses. Morningstar Rank: The risk adjusted star rating for each fund; Morningstar ranks go from a low of 1-Star to a high of 5-Stars.

| Fund Name | Fund Type | Net Asset Value ($) | 5-Year Average Return (%) | Expense Ratio (%) | Morningstar Rank |

| Amer Cent Inc & Growth Inv | DE | 28.88 | 12.39 | .67 | 2-Star |

| American Century Intl. Disc | IE | 14.37 | 30.53 | 1.41 | 3-Star |

| American Century Tax-Free Bond | FI | 10.73 | 3.34 | .49 | 4-Star |

| American Century Ultra | DE | 24.94 | 10.88 | .99 | 3-Star |

| Ariel | DE | 46.39 | 11.32 | 1.03 | 2-Star |

| Artisan Intl Val | IE | 25.52 | 24.95 | 1.23 | 3-Star |

| Artisan Small Cap | DE | 16.92 | 15.67 | 1.18 | 3-Star |

| Baron Asset | DE | 50.67 | 16.77 | 1.31 | 5-Star |

| Brandywine | DE | 36.58 | 18.14 | 1.08 | 4-Star |

| . | . | . | . | . | . |

| . | . | . | . | . | . |

| . | . | . | . | . | . |

- a. Develop an estimated regression equation that can be used to predict the 5-year average return given the type of fund. At the .05 level of significance, test for a significant relationship.

- b. Did the estimated regression equation developed in part (a) provide a good fit to the data? Explain.

- c. Develop the estimated regression equation that can be used to predict the 5-year average return given the type of fund, the net asset value, and the expense ratio. At the .05 level of significance, test for a significant relationship. Do you think any variables should be deleted from the estimated regression equation? Explain.

- d. Morningstar Rank is a categorical variable. Because the data set contains only funds with four ranks (2-Star through 5-Star), use the following dummy variables: 3Star-Rank = 1 for a 3-Star fund, 0 otherwise; 4StarRank = 1 for a 4-Star fund, 0 otherwise; and 5StarRank = 1 for a 5-Star fund, 0 otherwise. Develop an estimated regression equation that can be used to predict the 5-year average return given the type of fund, the expense ratio, and the Morningstar Rank. Using a = .05, remove any independent variables that are not significant.

- e. Use the estimated regression equation developed in part (d) to predict the 5-year average return for a domestic equity fund with an expense ratio of 1.05% and a 3-Star Morningstar Rank.

a.

Find an estimated regression equation that could be used to predict the 5-year average return given the type of fund.

Perform a test to check the significant relationship between variables at

Answer to Problem 56SE

The estimated regression equation that could be used to predict the 5-year average return given the type of fund is

There is a significant relationship between dependent variable (y) and independent variables FundDE (

Explanation of Solution

Calculation:

The data related to the type of fund, net asset value, 5 year average return, expense ratio and management risk of 45 mutual funds.

Multiple linear regression model:

A multiple linear regression model is given as

The dummy variable FundDE is defined as is,

The dummy variable FundIE is defined as is,

Indicator variable:

Software procedure:

Step by step procedure to create indicator variable using MINITAB software is given as,

- Choose Calc>Make Indicator variables.

- InMake indicator variables for, enterFund Type.

- In Distinct Value, enter 1 for DE and0 for IE, FI.

- Click OK.

The indicator variable is stored in the column of ‘FundDE’.

Software procedure:

Step by step procedure to create indicator variable using MINITAB software is given as,

- Choose Calc>Make Indicator variables.

- InMake indicator variables for, enterDrive.

- In Distinct Value, enter 1 for IE and0 for DE, FI.

- Click OK.

The indicator variable is stored in the column of ‘FundIE’.

In the given problem, five year average return be the dependent variable (y), FundDE be the independent variable (

Regression:

Software procedure:

Step by step procedure to obtain regression equation using MINITAB software is given as,

- Choose Stat > Regression > Regression > Fit Regression Model.

- Under Responses, enter the column of y.

- Under Continuous predictors, enter the columns ofFundDE, FundIE.

- Click OK.

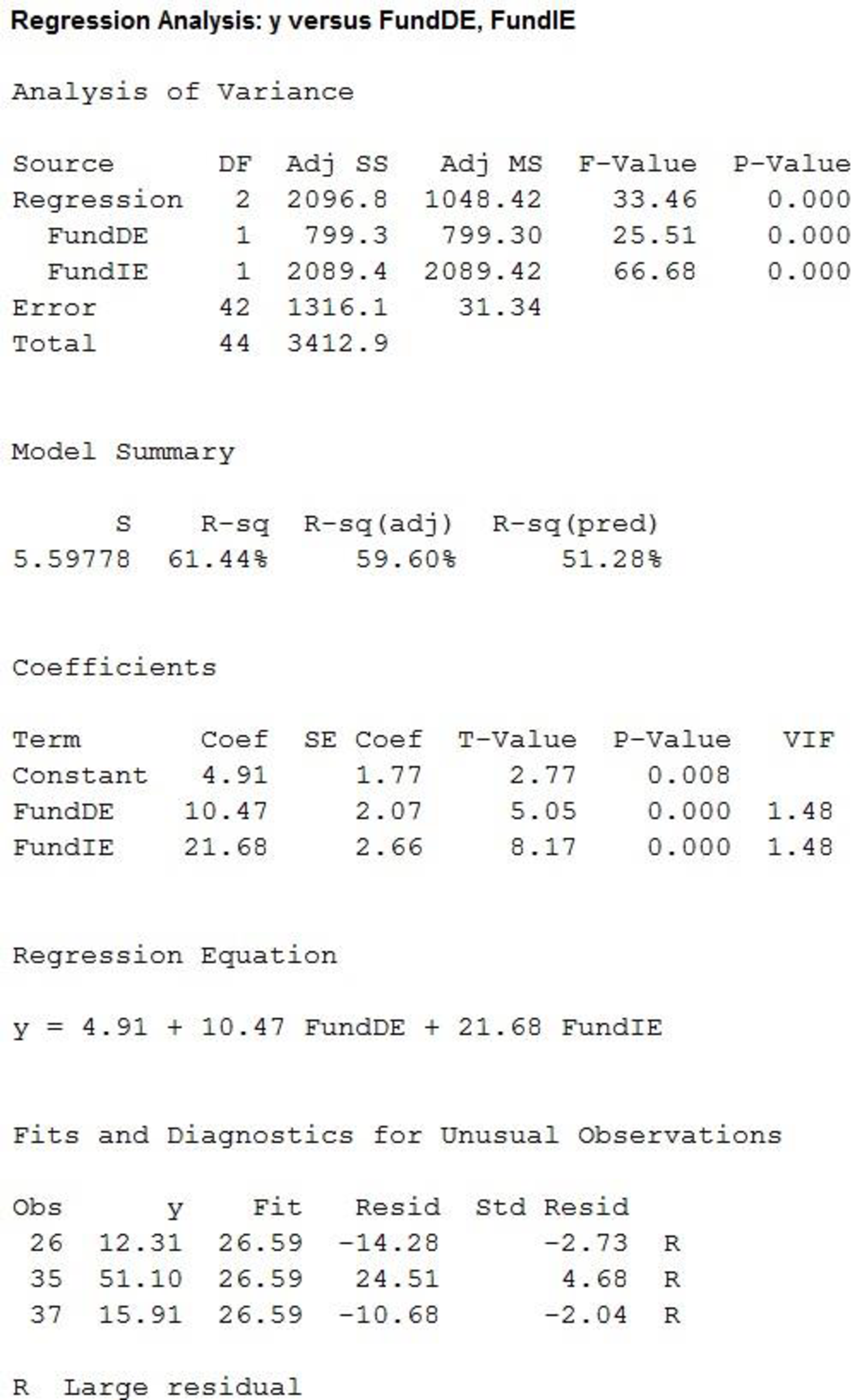

Output using MINITAB software is given below:

Thus, the estimated regression equation that could be used to predict the 5-year average return given the type of fund is

State the test hypotheses.

Null hypothesis:

That is, there is not a significant relationship between dependent variable (y) and independent variables FundDE (

Alternative hypothesis:

That is, there is a significant relationship between dependent variable (y) and independent variables FundDE (

According the output, it is found that the F statistic with numerator df of 1 and denominator df of 42, corresponding to regression is 33.4584 and the p value for F statistic corresponding to regression is 0.000.

Level of significance:

The given level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that there is a significant relationship between dependent variable (y) and independent variables FundDE (

b.

Whether the estimated regression equation in part (a) provides a good fit.

Explanation of Solution

The coefficient of determination (

In the given output,

Thus, the percentage of variation in the observed values of dependent variable that is explained by the regression is 61.44%, which indicates that 61.44% of the variability in dependent variable is explained by the variability in independent variables using the linear regression model.

Thus, the model provides a good fit.

c.

Find an estimated regression equation that could be used to predict the 5-year average return given the type of fund, the net asset value and the expense ratio.

Perform a test to check the significant relationship between variables at

Explain whether any variable should be deleted from the estimated regression equation.

Answer to Problem 56SE

The estimated regression equation that could be used to predict the 5-year average return given the type of fund, the net asset value and the expense ratio is

There is a significant relationship between dependent variable (y) and independent variables FundDE (

The Net Asset value should be deleted from the estimated regression equation.

Explanation of Solution

Calculation:

Here, five year average return be the dependent variable (y), FundDE (

Regression:

Software procedure:

Step by step procedure to obtain regression equation using MINITAB software is given as,

- Choose Stat > Regression > Regression > Fit Regression Model.

- Under Responses, enter the column of y.

- Under Continuous predictors, enter the columns ofFundDE, FundIE, Net Asset Value, and Expense Ratio.

- Click OK.

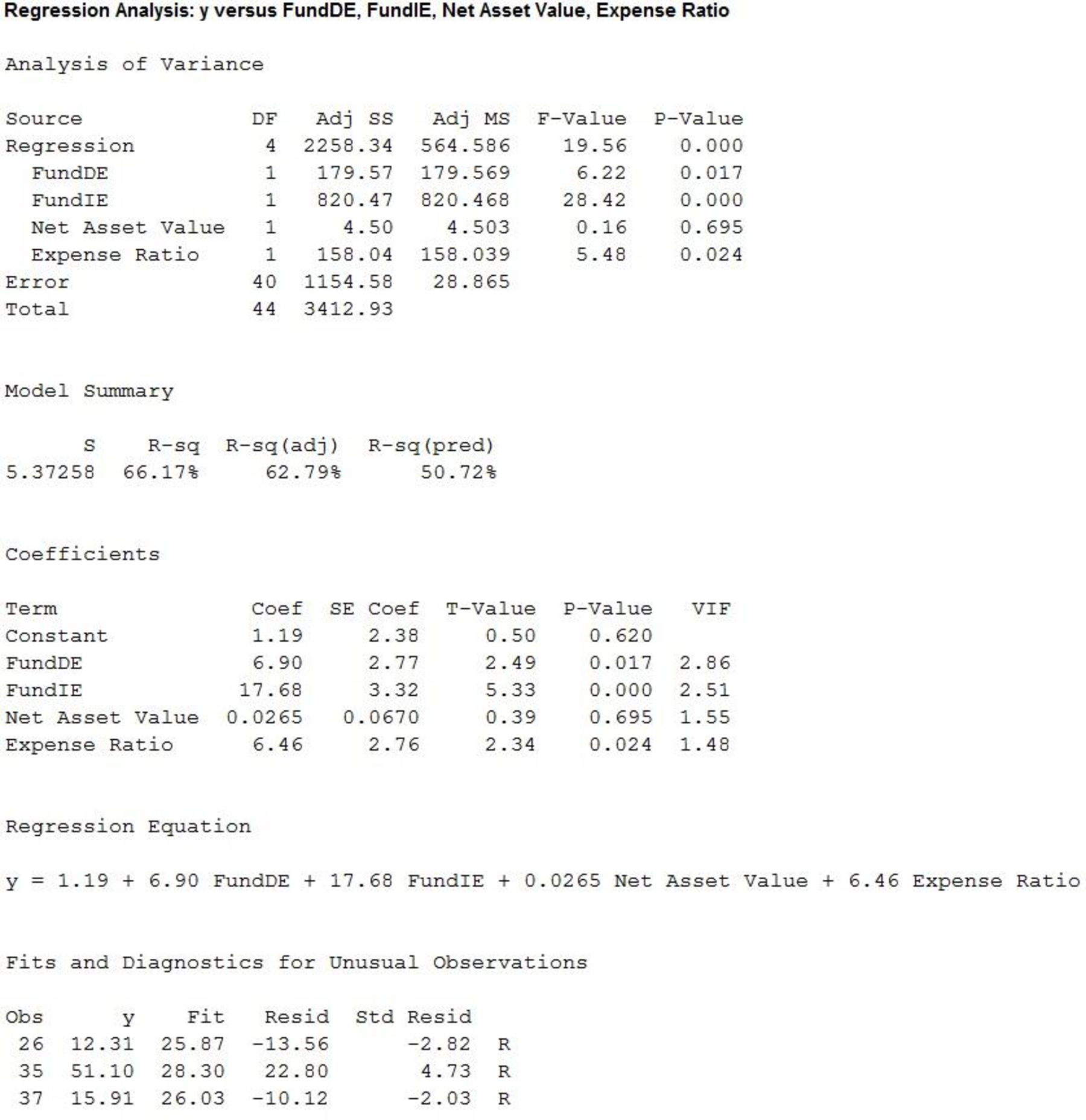

Output using MINITAB software is given below:

Thus,the estimated regression equation that could be used to predict the 5-year average return given the type of fund, the net asset value and the expense ratio is

State the test hypotheses.

Null hypothesis:

That is, there is not a significant relationship between dependent variable (y) and independent variables FundDE (

Alternative hypothesis:

That is, there is a significant relationship between dependent variable (y) and independent variables FundDE (

According the output, it is found that the F statistic with numerator df of 1 and denominator df of 40, corresponding to regression is 19.5598 and the p value for F statistic corresponding to regression is 0.000.

Level of significance:

The given level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that there is a significant relationship between dependent variable (y) and independent variables FundDE (

State the test hypotheses.

Null hypothesis:

That is, the addition of the independent variable FundDE is not significant.

Alternative hypothesis:

That is, the addition of the independent variable FundDE is significant.

From the output, it is found that the t statistic corresponding to FundDE is 2.7651 with df of 40 and the p value is 0.017.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the independent variable FundDE is significant.

State the test hypotheses.

Null hypothesis:

That is, the addition of the FundIE is not significant.

Alternative hypothesis:

That is, the addition of the FundIE is significant.

From the output, it is found that the t statistic corresponding to FundIE is 5.3315 with df of 40 and the p value is 0.000.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the dummy variableFundIE is significant.

State the test hypotheses.

Null hypothesis:

That is, the addition of the Net Asset Value is not significant.

Alternative hypothesis:

That is, the addition of the Net Asset Value is significant.

From the output, it is found that the t statistic corresponding to Net Asset Value is 0.6950 with df of 40 and the p value is 0.695.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is greater than the level of significance.

That is,

Thus, the decision is “fail to reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the Net Asset Value is significant.

State the test hypotheses.

Null hypothesis:

That is, the addition of the Expense Ratio is not significant.

Alternative hypothesis:

That is, the addition of the Expense Ratio is significant.

From the output, it is found that the t statistic corresponding to Expense Ratio is 2.3399 with df of 40 and the p value is 0.024.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the Expense Ratio is significant.

Thus, Net Asset value is not significant and it should be deleted from the estimated regression equation.

d.

Find an estimated regression equation that could be used to predict the 5-year average return given the type of fund, the expense ratio and the Morningstar Rank.

Perform a test at

Answer to Problem 56SE

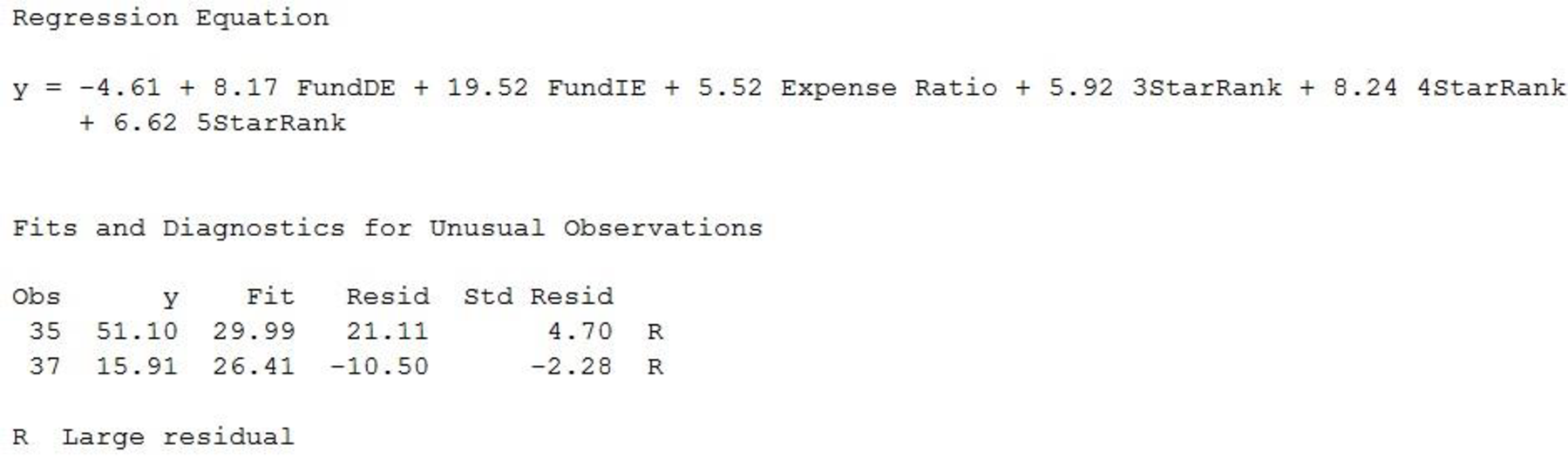

The estimated regression equation that could be used to predict the 5-year average return given the type of fund, the expense ratio and the Morningstar Rank is

None of the independent variables are deleted from the regression equation.

Explanation of Solution

Calculation:

The dummy variable 3StarRank is defined as is,

The dummy variable 4StarRank is defined as is,

The dummy variable 5StarRank is defined as is,

Indicator variable:

Software procedure:

Step by step procedure to create indicator variable using MINITAB software is given as,

- Choose Calc>Make Indicator variables.

- InMake indicator variables for, enterMorningstar Rank.

- In Distinct Value, enter 1 for 3-Star and0 for 2-Star, 4-Star, 5-Star.

- Click OK.

The indicator variable is stored in the column of ‘3StarRank’.

Software procedure:

Step by step procedure to create indicator variable using MINITAB software is given as,

- Choose Calc>Make Indicator variables.

- InMake indicator variables for, enterMorningstar Rank.

- In Distinct Value, enter 1 for 4-Star and0 for 2-Star, 3-Star, 5-Star.

- Click OK.

The indicator variable is stored in the column of ‘4StarRank’.

Software procedure:

Step by step procedure to create indicator variable using MINITAB software is given as,

- Choose Calc>Make Indicator variables.

- InMake indicator variables for, enterMorningstar Rank.

- In Distinct Value, enter 1 for 5-Star and0 for 2-Star, 3-Star, 4-Star.

- Click OK.

The indicator variable is stored in the column of ‘5StarRank’.

Here, five year average return be the dependent variable (y), FundDE (

Regression:

Software procedure:

Step by step procedure to obtain regression equation using MINITAB software is given as,

- Choose Stat > Regression > Regression > Fit Regression Model.

- Under Responses, enter the column of y.

- Under Continuous predictors, enter the columns ofFundDE, FundIE, Expense Ratio,3StarRank, 4StarRank and5StarRank.

- Click OK.

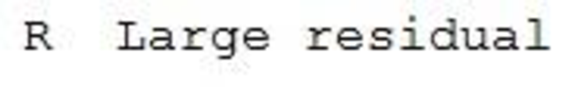

Output using MINITAB software is given below:

Thus, the estimated regression equation that could be used to predict the 5-year average return given the type of fund, the expense ratio and the Morningstar Rank is

State the test hypotheses.

Null hypothesis:

That is, the addition of the independent variable FundDE is not significant.

Alternative hypothesis:

That is, the addition of the independent variable FundDE is significant.

From the output, it is found that the t statistic corresponding to FundDE is 3.59 with df of 38 and the p value is 0.001.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the independentvariable FundDE is significant.

State the test hypotheses.

Null hypothesis:

That is, the addition of the FundIE is not significant.

Alternative hypothesis:

That is, the addition of the FundIE is significant.

From the output, it is found that the t statistic corresponding to FundIE is 7.02 with df of 38 and the p value is 0.000.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the dummy variableFundIE is significant.

State the test hypotheses.

Null hypothesis:

That is, the addition of the Expense Ratio is not significant.

Alternative hypothesis:

That is, the addition of the Expense Ratio is significant.

From the output, it is found that the t statistic corresponding to Expense Ratio is 2.13 with df of 38 and the p value is 0.039.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the Expense Ratio is significant.

State the test hypotheses.

Null hypothesis:

That is, the addition of the 3StarRank is not significant.

Alternative hypothesis:

That is, the addition of the 3StarRank is significant.

From the output, it is found that the t statistic corresponding to 3StarRank is 2.10 with df of 38 and the p value is 0.043.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the 3StarRank is significant.

State the test hypotheses.

Null hypothesis:

That is, the addition of the 4StarRank is not significant.

Alternative hypothesis:

That is, the addition of the 4StarRank is significant.

From the output, it is found that the t statistic corresponding to 4StarRank is 2.89 with df of 38 and the p value is 0.006.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the 4StarRank is significant.

State the test hypotheses.

Null hypothesis:

That is, the addition of the 5StarRank is not significant.

Alternative hypothesis:

That is, the addition of the 5StarRank is significant.

From the output, it is found that the t statistic corresponding to 5StarRank is 2.11 with df of 38 and the p value is 0.042.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the 5StarRank is significant.

Thus, all the independent variables are significant and no independent variables are deleted from the regression equation.

e.

Predict the 5-year average return for a domestic equality fund with an expense ratio of 1.05% and a 3-star Morningstar Rank.

Answer to Problem 56SE

The predicted the 5-year average return for a domestic equality fund with an expense ratio of 1.05% and a 3-star Morningstar Rank is 15.28%.

Explanation of Solution

Calculation:

According to part (d) the estimated regression equation that could be used to predict the 5-year average return given the type of fund, the expense ratio and the Morningstar Rank is

The 5-year average return for a domestic equality fund with an expense ratio of 1.05% and a 3-star Morningstar Rank implies that,

Thus, the predicted the 5-year average return for a domestic equality fund with an expense ratio of 1.05% and a 3-star Morningstar Rank is,

Thus, the predicted the 5-year average return for a domestic equality fund with an expense ratio of 1.05% and a 3-star Morningstar Rank is 15.28%.

Want to see more full solutions like this?

Chapter 15 Solutions

EBK STATISTICS FOR BUSINESS & ECONOMICS

- A college wants to estimate what students typically spend on textbooks. A report fromthe college bookstore observes that textbooks range in price from $22 to $186. Toobtain a 95% confidence level for a confidence interval estimate to plus or minus $10,how many students should the college survey? (We may estimate the populationstandard deviation as (range) ÷ 4.)arrow_forwardIn a study of how students give directions, forty volunteers were given the task ofexplaining to another person how to reach a destination. Researchers measured thefollowing five aspects of the subjects’ direction-giving behavior:• whether a map was available or if directions were given from memory without a map,• the gender of the direction-giver,• the distances given as part of the directions,• the number of times directions such as “north” or “left” were used,• the frequency of errors in directions. Identify each of the variables in this study, and whether each is quantitative orqualitative. For each quantitative variable, state whether it is discrete or continuous. Was this an observational study or an experimental study? Explain your answer.arrow_forwardexplain the difference between the confident interval and the confident level. provide an example to show how to correctly interpret a confidence interval.arrow_forward

- Sketch to scale the orbit of Earth about the sun. Graph Icarus’ orbit on the same set of axesWhile the sun is the center of Earth’s orbit, it is a focus of Icarus’ orbit. There aretwo points of intersection on the graph. Based on the graph, what is the approximate distance between the two points of intersection (in AU)?arrow_forwardThe diameters of ball bearings are distributed normally. The mean diameter is 67 millimeters and the standard deviation is 3 millimeters. Find the probability that the diameter of a selected bearing is greater than 63 millimeters. Round to four decimal places.arrow_forwardSuppose you like to keep a jar of change on your desk. Currently, the jar contains the following: 22 Pennies 27 Dimes 9 Nickels 30 Quarters What is the probability that you reach into the jar and randomly grab a penny and then, without replacement, a dime? Express as a fraction or a decimal number rounded to four decimal places.arrow_forward

- A box contains 14 large marbles and 10 small marbles. Each marble is either green or white. 9 of the large marbles are green, and 4 of the small marbles are white. If a marble is randomly selected from the box, what is the probability that it is small or white? Express as a fraction or a decimal number rounded to four decimal places.arrow_forwardCan I get help with this step please? At a shooting range, instructors can determine if a shooter is consistently missing the target because of the gun sight or because of the shooter's ability. If a gun's sight is off, the variance of the distances between the shots and the center of the shot pattern will be small (even if the shots are not in the center of the target). A student claims that it is the sight that is off, not his aim, and wants the instructor to confirm his claim. If a skilled shooter fires a gun at a target multiple times, the distances between the shots and the center of the shot pattern, measured in centimeters (cm), will have a variance of less than 0.33. After the student shoots 28 shots at the target, the instructor calculates that the distances between his shots and the center of the shot pattern, measured in cm, have a variance of 0.25. Does this evidence support the student's claim that the gun's sight is off? Use a 0.025 level of significance. Assume that the…arrow_forwardThe National Academy of Science reported that 38% of research in mathematics is published by US authors. The mathematics chairperson of a prestigious university wishes to test the claim that this percentage is no longer 38%. He has no indication of whether the percentage has increased or decreased since that time. He surveys a simple random sample of 279 recent articles published by reputable mathematics research journals and finds that 123 of these articles have US authors. Does this evidence support the mathematics chairperson's claim that the percentage is no longer 38 % ? Use a 0.02 level of significance. Compute the value of the test statistic. Round to two decimal places.arrow_forward

- A marketing research company desires to know the mean consumption of milk per week among males over age 32. They believe that the milk consumption has a mean of 4 liters, and want to construct a 98% confidence interval with a maximum error of 0.07 liters. Assuming a variance of 0.64 liters, what is the minimum number of males over age 32 they must include in their sample? Round up to the next integer.arrow_forwardSuppose GRE Verbal scores are normally distributed with a mean of 461 and a standard deviation of 118. A university plans to recruit students whose scores are in the top 4 % . What is the minimum score required for recruitment? Round to the nearest whole number, if necessaryarrow_forwardNeed help with my homework thank you random sample of 6 fields of durum wheat has a mean yield of 45.5 bushels per acre and standard deviation of 7.43 bushels per acre. Determine the 80 % confidence interval for the true mean yield. Assume the population is approximately normal. Step 1: Find the critical value that should be used in constructing the confidence interval. Round to three decimal places. Step 2 of 2: Construct the 80% confidence interval. Round to one decimal place. I got 1.476 as my critical value and 41.0 and 49.9 as my confidence intervalarrow_forward

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill