Concept explainers

A portion of a data set containing information for 45 mutual funds that are part of the Morningstar Funds 500 follows. The complete data set is available in the file named MutualFunds. The data set includes the following five variables:

Fund Type: The type of fund, labeled DE (Domestic Equity), IE (International Equity), and FI (Fixed Income).

Net Asset Value ($): The closing price per share on December 31, 2007.

5-Year Average Return (%): The average annual return for the fund over the past five years. Expense Ratio (%): The percentage of assets deducted each fiscal year for fund expenses. Morningstar Rank: The risk adjusted star rating for each fund; Morningstar ranks go from a low of 1-Star to a high of 5-Stars.

| Fund Name | Fund Type | Net Asset Value ($) | 5-Year Average Return (%) | Expense Ratio (%) | Morningstar Rank |

| Amer Cent Inc & Growth Inv | DE | 28.88 | 12.39 | .67 | 2-Star |

| American Century Intl. Disc | IE | 14.37 | 30.53 | 1.41 | 3-Star |

| American Century Tax-Free Bond | FI | 10.73 | 3.34 | .49 | 4-Star |

| American Century Ultra | DE | 24.94 | 10.88 | .99 | 3-Star |

| Ariel | DE | 46.39 | 11.32 | 1.03 | 2-Star |

| Artisan Intl Val | IE | 25.52 | 24.95 | 1.23 | 3-Star |

| Artisan Small Cap | DE | 16.92 | 15.67 | 1.18 | 3-Star |

| Baron Asset | DE | 50.67 | 16.77 | 1.31 | 5-Star |

| Brandywine | DE | 36.58 | 18.14 | 1.08 | 4-Star |

| . | . | . | . | . | . |

| . | . | . | . | . | . |

| . | . | . | . | . | . |

- a. Develop an estimated regression equation that can be used to predict the 5-year average return given the type of fund. At the .05 level of significance, test for a significant relationship.

- b. Did the estimated regression equation developed in part (a) provide a good fit to the data? Explain.

- c. Develop the estimated regression equation that can be used to predict the 5-year average return given the type of fund, the net asset value, and the expense ratio. At the .05 level of significance, test for a significant relationship. Do you think any variables should be deleted from the estimated regression equation? Explain.

- d. Morningstar Rank is a categorical variable. Because the data set contains only funds with four ranks (2-Star through 5-Star), use the following dummy variables: 3Star-Rank = 1 for a 3-Star fund, 0 otherwise; 4StarRank = 1 for a 4-Star fund, 0 otherwise; and 5StarRank = 1 for a 5-Star fund, 0 otherwise. Develop an estimated regression equation that can be used to predict the 5-year average return given the type of fund, the expense ratio, and the Morningstar Rank. Using a = .05, remove any independent variables that are not significant.

- e. Use the estimated regression equation developed in part (d) to predict the 5-year average return for a domestic equity fund with an expense ratio of 1.05% and a 3-Star Morningstar Rank.

a.

Find an estimated regression equation that could be used to predict the 5-year average return given the type of fund.

Perform a test to check the significant relationship between variables at

Answer to Problem 56SE

The estimated regression equation that could be used to predict the 5-year average return given the type of fund is

There is a significant relationship between dependent variable (y) and independent variables FundDE (

Explanation of Solution

Calculation:

The data related to the type of fund, net asset value, 5 year average return, expense ratio and management risk of 45 mutual funds.

Multiple linear regression model:

A multiple linear regression model is given as

The dummy variable FundDE is defined as is,

The dummy variable FundIE is defined as is,

Indicator variable:

Software procedure:

Step by step procedure to create indicator variable using MINITAB software is given as,

- Choose Calc>Make Indicator variables.

- InMake indicator variables for, enterFund Type.

- In Distinct Value, enter 1 for DE and0 for IE, FI.

- Click OK.

The indicator variable is stored in the column of ‘FundDE’.

Software procedure:

Step by step procedure to create indicator variable using MINITAB software is given as,

- Choose Calc>Make Indicator variables.

- InMake indicator variables for, enterDrive.

- In Distinct Value, enter 1 for IE and0 for DE, FI.

- Click OK.

The indicator variable is stored in the column of ‘FundIE’.

In the given problem, five year average return be the dependent variable (y), FundDE be the independent variable (

Regression:

Software procedure:

Step by step procedure to obtain regression equation using MINITAB software is given as,

- Choose Stat > Regression > Regression > Fit Regression Model.

- Under Responses, enter the column of y.

- Under Continuous predictors, enter the columns ofFundDE, FundIE.

- Click OK.

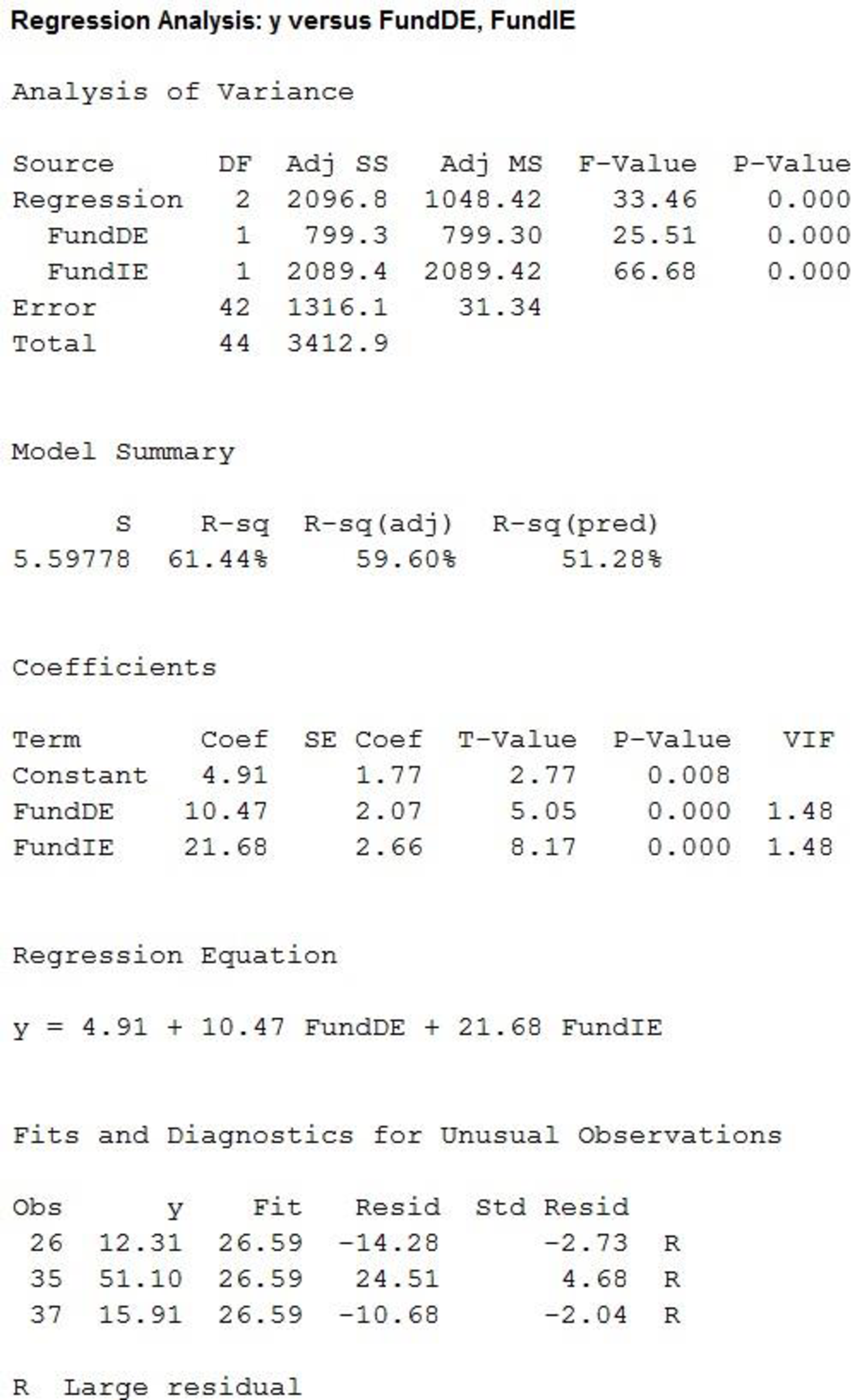

Output using MINITAB software is given below:

Thus, the estimated regression equation that could be used to predict the 5-year average return given the type of fund is

State the test hypotheses.

Null hypothesis:

That is, there is not a significant relationship between dependent variable (y) and independent variables FundDE (

Alternative hypothesis:

That is, there is a significant relationship between dependent variable (y) and independent variables FundDE (

According the output, it is found that the F statistic with numerator df of 1 and denominator df of 42, corresponding to regression is 33.4584 and the p value for F statistic corresponding to regression is 0.000.

Level of significance:

The given level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that there is a significant relationship between dependent variable (y) and independent variables FundDE (

b.

Whether the estimated regression equation in part (a) provides a good fit.

Explanation of Solution

The coefficient of determination (

In the given output,

Thus, the percentage of variation in the observed values of dependent variable that is explained by the regression is 61.44%, which indicates that 61.44% of the variability in dependent variable is explained by the variability in independent variables using the linear regression model.

Thus, the model provides a good fit.

c.

Find an estimated regression equation that could be used to predict the 5-year average return given the type of fund, the net asset value and the expense ratio.

Perform a test to check the significant relationship between variables at

Explain whether any variable should be deleted from the estimated regression equation.

Answer to Problem 56SE

The estimated regression equation that could be used to predict the 5-year average return given the type of fund, the net asset value and the expense ratio is

There is a significant relationship between dependent variable (y) and independent variables FundDE (

The Net Asset value should be deleted from the estimated regression equation.

Explanation of Solution

Calculation:

Here, five year average return be the dependent variable (y), FundDE (

Regression:

Software procedure:

Step by step procedure to obtain regression equation using MINITAB software is given as,

- Choose Stat > Regression > Regression > Fit Regression Model.

- Under Responses, enter the column of y.

- Under Continuous predictors, enter the columns ofFundDE, FundIE, Net Asset Value, and Expense Ratio.

- Click OK.

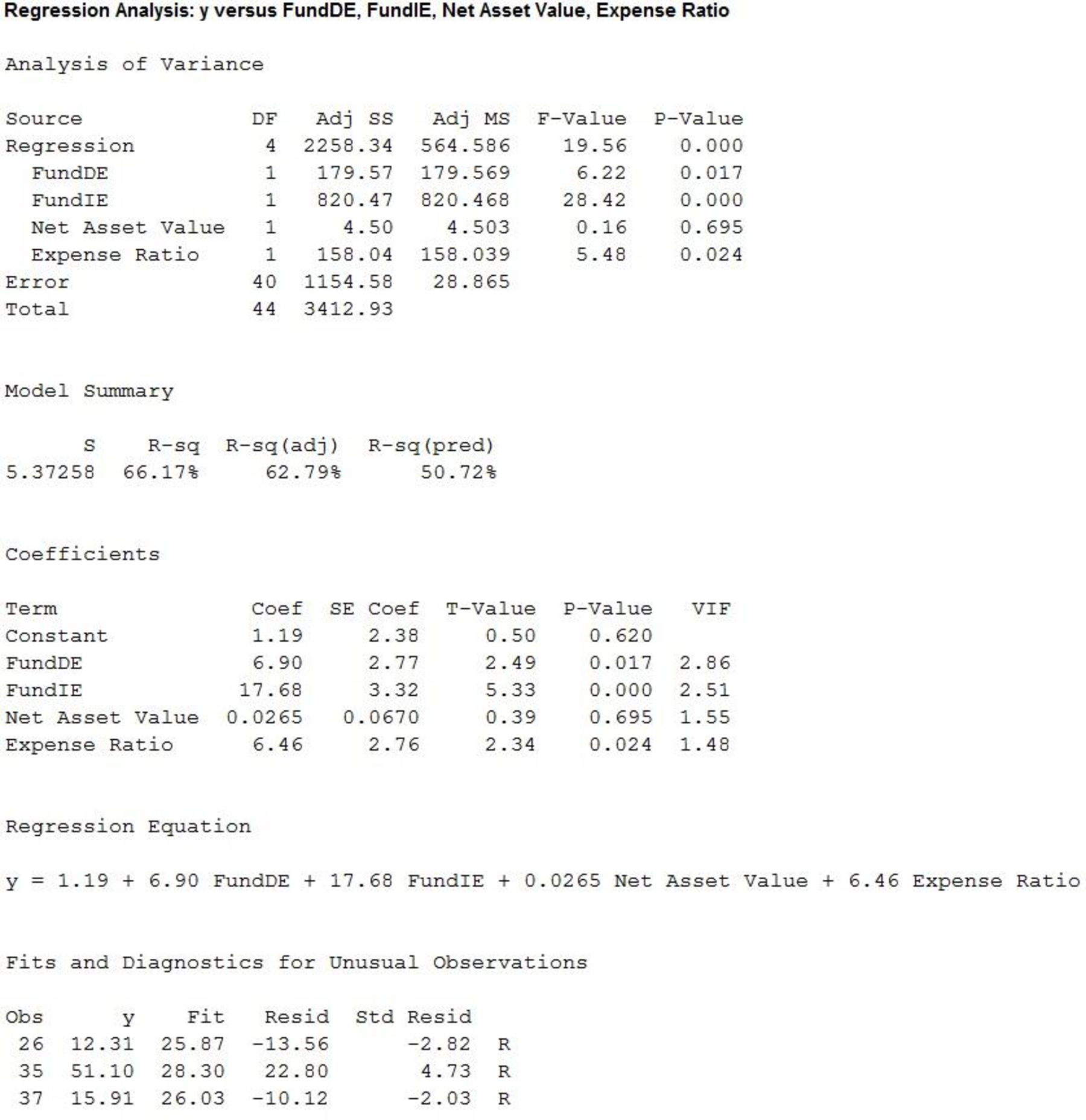

Output using MINITAB software is given below:

Thus,the estimated regression equation that could be used to predict the 5-year average return given the type of fund, the net asset value and the expense ratio is

State the test hypotheses.

Null hypothesis:

That is, there is not a significant relationship between dependent variable (y) and independent variables FundDE (

Alternative hypothesis:

That is, there is a significant relationship between dependent variable (y) and independent variables FundDE (

According the output, it is found that the F statistic with numerator df of 1 and denominator df of 40, corresponding to regression is 19.5598 and the p value for F statistic corresponding to regression is 0.000.

Level of significance:

The given level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that there is a significant relationship between dependent variable (y) and independent variables FundDE (

State the test hypotheses.

Null hypothesis:

That is, the addition of the independent variable FundDE is not significant.

Alternative hypothesis:

That is, the addition of the independent variable FundDE is significant.

From the output, it is found that the t statistic corresponding to FundDE is 2.7651 with df of 40 and the p value is 0.017.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the independent variable FundDE is significant.

State the test hypotheses.

Null hypothesis:

That is, the addition of the FundIE is not significant.

Alternative hypothesis:

That is, the addition of the FundIE is significant.

From the output, it is found that the t statistic corresponding to FundIE is 5.3315 with df of 40 and the p value is 0.000.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the dummy variableFundIE is significant.

State the test hypotheses.

Null hypothesis:

That is, the addition of the Net Asset Value is not significant.

Alternative hypothesis:

That is, the addition of the Net Asset Value is significant.

From the output, it is found that the t statistic corresponding to Net Asset Value is 0.6950 with df of 40 and the p value is 0.695.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is greater than the level of significance.

That is,

Thus, the decision is “fail to reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the Net Asset Value is significant.

State the test hypotheses.

Null hypothesis:

That is, the addition of the Expense Ratio is not significant.

Alternative hypothesis:

That is, the addition of the Expense Ratio is significant.

From the output, it is found that the t statistic corresponding to Expense Ratio is 2.3399 with df of 40 and the p value is 0.024.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the Expense Ratio is significant.

Thus, Net Asset value is not significant and it should be deleted from the estimated regression equation.

d.

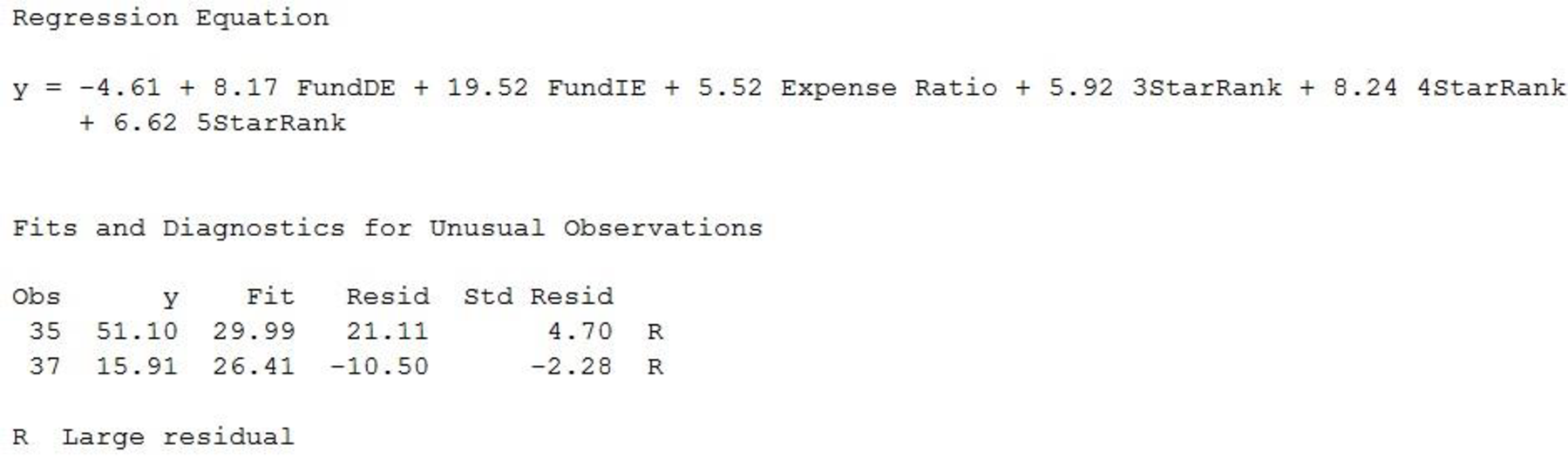

Find an estimated regression equation that could be used to predict the 5-year average return given the type of fund, the expense ratio and the Morningstar Rank.

Perform a test at

Answer to Problem 56SE

The estimated regression equation that could be used to predict the 5-year average return given the type of fund, the expense ratio and the Morningstar Rank is

None of the independent variables are deleted from the regression equation.

Explanation of Solution

Calculation:

The dummy variable 3StarRank is defined as is,

The dummy variable 4StarRank is defined as is,

The dummy variable 5StarRank is defined as is,

Indicator variable:

Software procedure:

Step by step procedure to create indicator variable using MINITAB software is given as,

- Choose Calc>Make Indicator variables.

- InMake indicator variables for, enterMorningstar Rank.

- In Distinct Value, enter 1 for 3-Star and0 for 2-Star, 4-Star, 5-Star.

- Click OK.

The indicator variable is stored in the column of ‘3StarRank’.

Software procedure:

Step by step procedure to create indicator variable using MINITAB software is given as,

- Choose Calc>Make Indicator variables.

- InMake indicator variables for, enterMorningstar Rank.

- In Distinct Value, enter 1 for 4-Star and0 for 2-Star, 3-Star, 5-Star.

- Click OK.

The indicator variable is stored in the column of ‘4StarRank’.

Software procedure:

Step by step procedure to create indicator variable using MINITAB software is given as,

- Choose Calc>Make Indicator variables.

- InMake indicator variables for, enterMorningstar Rank.

- In Distinct Value, enter 1 for 5-Star and0 for 2-Star, 3-Star, 4-Star.

- Click OK.

The indicator variable is stored in the column of ‘5StarRank’.

Here, five year average return be the dependent variable (y), FundDE (

Regression:

Software procedure:

Step by step procedure to obtain regression equation using MINITAB software is given as,

- Choose Stat > Regression > Regression > Fit Regression Model.

- Under Responses, enter the column of y.

- Under Continuous predictors, enter the columns ofFundDE, FundIE, Expense Ratio,3StarRank, 4StarRank and5StarRank.

- Click OK.

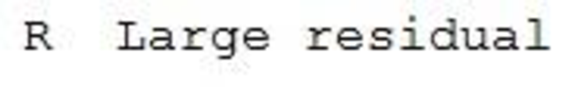

Output using MINITAB software is given below:

Thus, the estimated regression equation that could be used to predict the 5-year average return given the type of fund, the expense ratio and the Morningstar Rank is

State the test hypotheses.

Null hypothesis:

That is, the addition of the independent variable FundDE is not significant.

Alternative hypothesis:

That is, the addition of the independent variable FundDE is significant.

From the output, it is found that the t statistic corresponding to FundDE is 3.59 with df of 38 and the p value is 0.001.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the independentvariable FundDE is significant.

State the test hypotheses.

Null hypothesis:

That is, the addition of the FundIE is not significant.

Alternative hypothesis:

That is, the addition of the FundIE is significant.

From the output, it is found that the t statistic corresponding to FundIE is 7.02 with df of 38 and the p value is 0.000.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the dummy variableFundIE is significant.

State the test hypotheses.

Null hypothesis:

That is, the addition of the Expense Ratio is not significant.

Alternative hypothesis:

That is, the addition of the Expense Ratio is significant.

From the output, it is found that the t statistic corresponding to Expense Ratio is 2.13 with df of 38 and the p value is 0.039.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the Expense Ratio is significant.

State the test hypotheses.

Null hypothesis:

That is, the addition of the 3StarRank is not significant.

Alternative hypothesis:

That is, the addition of the 3StarRank is significant.

From the output, it is found that the t statistic corresponding to 3StarRank is 2.10 with df of 38 and the p value is 0.043.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the 3StarRank is significant.

State the test hypotheses.

Null hypothesis:

That is, the addition of the 4StarRank is not significant.

Alternative hypothesis:

That is, the addition of the 4StarRank is significant.

From the output, it is found that the t statistic corresponding to 4StarRank is 2.89 with df of 38 and the p value is 0.006.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the 4StarRank is significant.

State the test hypotheses.

Null hypothesis:

That is, the addition of the 5StarRank is not significant.

Alternative hypothesis:

That is, the addition of the 5StarRank is significant.

From the output, it is found that the t statistic corresponding to 5StarRank is 2.11 with df of 38 and the p value is 0.042.

Level of significance:

Assume the level of significance is

Rejection rule:

If the

Conclusion:

Here, the p-value is less than the level of significance.

That is,

Thus, the decision is “reject the null hypothesis”.

Therefore, the data provide sufficient evidence to conclude that the addition of the 5StarRank is significant.

Thus, all the independent variables are significant and no independent variables are deleted from the regression equation.

e.

Predict the 5-year average return for a domestic equality fund with an expense ratio of 1.05% and a 3-star Morningstar Rank.

Answer to Problem 56SE

The predicted the 5-year average return for a domestic equality fund with an expense ratio of 1.05% and a 3-star Morningstar Rank is 15.28%.

Explanation of Solution

Calculation:

According to part (d) the estimated regression equation that could be used to predict the 5-year average return given the type of fund, the expense ratio and the Morningstar Rank is

The 5-year average return for a domestic equality fund with an expense ratio of 1.05% and a 3-star Morningstar Rank implies that,

Thus, the predicted the 5-year average return for a domestic equality fund with an expense ratio of 1.05% and a 3-star Morningstar Rank is,

Thus, the predicted the 5-year average return for a domestic equality fund with an expense ratio of 1.05% and a 3-star Morningstar Rank is 15.28%.

Want to see more full solutions like this?

Chapter 15 Solutions

EBK STATISTICS FOR BUSINESS & ECONOMICS

- A recent survey of 400 americans asked whether or not parents do too much for their young adult children. The results of the survey are shown in the data file. a) Construct the frequency and relative frequency distributions. How many respondents felt that parents do too much for their adult children? What proportion of respondents felt that parents do too little for their adult children? b) Construct a pie chart. Summarize the findingsarrow_forwardThe average number of minutes Americans commute to work is 27.7 minutes (Sterling's Best Places, April 13, 2012). The average commute time in minutes for 48 cities are as follows: Click on the datafile logo to reference the data. DATA file Albuquerque 23.3 Jacksonville 26.2 Phoenix 28.3 Atlanta 28.3 Kansas City 23.4 Pittsburgh 25.0 Austin 24.6 Las Vegas 28.4 Portland 26.4 Baltimore 32.1 Little Rock 20.1 Providence 23.6 Boston 31.7 Los Angeles 32.2 Richmond 23.4 Charlotte 25.8 Louisville 21.4 Sacramento 25.8 Chicago 38.1 Memphis 23.8 Salt Lake City 20.2 Cincinnati 24.9 Miami 30.7 San Antonio 26.1 Cleveland 26.8 Milwaukee 24.8 San Diego 24.8 Columbus 23.4 Minneapolis 23.6 San Francisco 32.6 Dallas 28.5 Nashville 25.3 San Jose 28.5 Denver 28.1 New Orleans 31.7 Seattle 27.3 Detroit 29.3 New York 43.8 St. Louis 26.8 El Paso 24.4 Oklahoma City 22.0 Tucson 24.0 Fresno 23.0 Orlando 27.1 Tulsa 20.1 Indianapolis 24.8 Philadelphia 34.2 Washington, D.C. 32.8 a. What is the mean commute time for…arrow_forwardMorningstar tracks the total return for a large number of mutual funds. The following table shows the total return and the number of funds for four categories of mutual funds. Click on the datafile logo to reference the data. DATA file Type of Fund Domestic Equity Number of Funds Total Return (%) 9191 4.65 International Equity 2621 18.15 Hybrid 1419 2900 11.36 6.75 Specialty Stock a. Using the number of funds as weights, compute the weighted average total return for these mutual funds. (to 2 decimals) % b. Is there any difficulty associated with using the "number of funds" as the weights in computing the weighted average total return in part (a)? Discuss. What else might be used for weights? The input in the box below will not be graded, but may be reviewed and considered by your instructor. c. Suppose you invested $10,000 in this group of mutual funds and diversified the investment by placing $2000 in Domestic Equity funds, $4000 in International Equity funds, $3000 in Specialty Stock…arrow_forward

- The days to maturity for a sample of five money market funds are shown here. The dollar amounts invested in the funds are provided. Days to Maturity 20 Dollar Value ($ millions) 20 12 30 7 10 5 6 15 10 Use the weighted mean to determine the mean number of days to maturity for dollars invested in these five money market funds (to 1 decimal). daysarrow_forwardc. What are the first and third quartiles? First Quartiles (to 1 decimals) Third Quartiles (to 4 decimals) × ☑ Which companies spend the most money on advertising? Business Insider maintains a list of the top-spending companies. In 2014, Procter & Gamble spent more than any other company, a whopping $5 billion. In second place was Comcast, which spent $3.08 billion (Business Insider website, December 2014). The top 12 companies and the amount each spent on advertising in billions of dollars are as follows. Click on the datafile logo to reference the data. DATA file Company Procter & Gamble Comcast Advertising ($billions) $5.00 3.08 2.91 Company American Express General Motors Advertising ($billions) $2.19 2.15 ETET AT&T Ford Verizon L'Oreal 2.56 2.44 2.34 Toyota Fiat Chrysler Walt Disney Company J.P Morgan a. What is the mean amount spent on advertising? (to 2 decimals) 2.55 b. What is the median amount spent on advertising? (to 3 decimals) 2.09 1.97 1.96 1.88arrow_forwardMartinez Auto Supplies has retail stores located in eight cities in California. The price they charge for a particular product in each city are vary because of differing competitive conditions. For instance, the price they charge for a case of a popular brand of motor oil in each city follows. Also shown are the number of cases that Martinez Auto sold last quarter in each city. City Price ($) Sales (cases) Bakersfield 34.99 501 Los Angeles 38.99 1425 Modesto 36.00 294 Oakland 33.59 882 Sacramento 40.99 715 San Diego 38.59 1088 San Francisco 39.59 1644 San Jose 37.99 819 Compute the average sales price per case for this product during the last quarter? Round your answer to two decimal places.arrow_forward

- Consider the following data and corresponding weights. xi Weight(wi) 3.2 6 2.0 3 2.5 2 5.0 8 a. Compute the weighted mean (to 2 decimals). b. Compute the sample mean of the four data values without weighting. Note the difference in the results provided by the two computations (to 3 decimals).arrow_forwardExpert only,if you don't know it don't attempt it, no Artificial intelligence or screen shot it solvingarrow_forwardFor context, the image provided below is a quesion from a Sepetember, 2024 past paper in statistical modelingarrow_forward

- For context, the images attached below (the question and the related figure) is from a january 2024 past paperarrow_forwardFor context, the image attached below is a question from a June 2024 past paper in statisical modelingarrow_forwardFor context, the images attached below are a question from a June, 2024 past paper in statistical modelingarrow_forward

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill