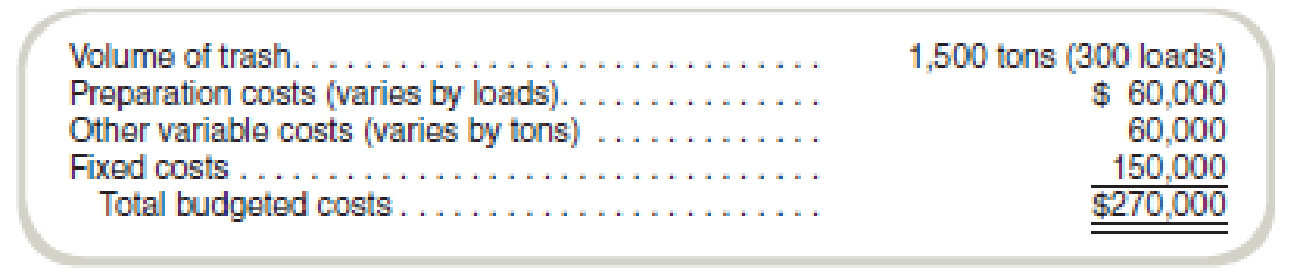

Mathes Corporation manufactures paper products. The company operates a landfill, which it uses to dispose of nonhazardous trash. The trash is hauled from the two nearby manufacturing facilities in trucks that can carry up to five tons of trash in a load. The landfill operation requires certain preparation activities regardless of the amount of trash in a truck (i.e., for each load). The budget for the landfill for next year follows:

Mathes is considering making the landfill a profit center and charging the manufacturing plants for disposal of the trash. The landfill has sufficient capacity to operate for at least the next 20 years. Other landfills are available in the area (both private and municipal), and each plant would be free to decide which landfill to use.

Required

- a. What transfer pricing rule should Mathes implement at the landfill so that its plant managers would independently make decisions regarding landfill use that would be in the company’s best interests?

- b. Illustrate your rule by computing the transfer price that would be applied to a four-ton load of trash from one of the plants.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

FUNDAMENTALS OF...(LL)-W/ACCESS>IP<

- Frisco Company recently purchased 164,000 units of raw material for $642,000. Three units of raw materials are budgeted for use in each finished good manufactured, with the raw material standard set at $23.00 for each completed product. Frisco manufactured 42,305 finished units during the period just ended and used 153,037 units of raw material. If management is concerned about the timely reporting of variances in an effort to improve cost control and bottom-line performance, what would the materials purchase price variance be? Answer?arrow_forwardQuick answer of this accounting questionsarrow_forwardWhich of the following items would not automatically be covered under an HO-3 form? the insured’s driveaway, if damaged by falling object The insured’s pedigreed collie valued at $6000 or $7000 A lawnmower in the insured’s garage personal property of the insured’s daughter who is away from collegearrow_forward

- In an attempt to locate fuser potential coverage needs, a producer interviews a prospective client who owns a home covered by an HO-3 policy. For which of the following items does the client already have coverage? a. the steroids system installed in his automobile b. the ultra-light airplane stored in his garage c. his business property kept in his office that he rents d. the rental value of the room in his home that he rentsarrow_forwardBNM's total equity is?arrow_forwardWhat is Anderson Technologies' TIE ratio on these financial accounting question?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning